This week brings one of the densest clusters of macro data so far this year. Inflation, consumer demand, central bank signals, and global trade will all be tested within a five day window. With markets already sensitive to rate expectations and liquidity conditions, even small surprises have the potential to move bonds, currencies, and risk assets.

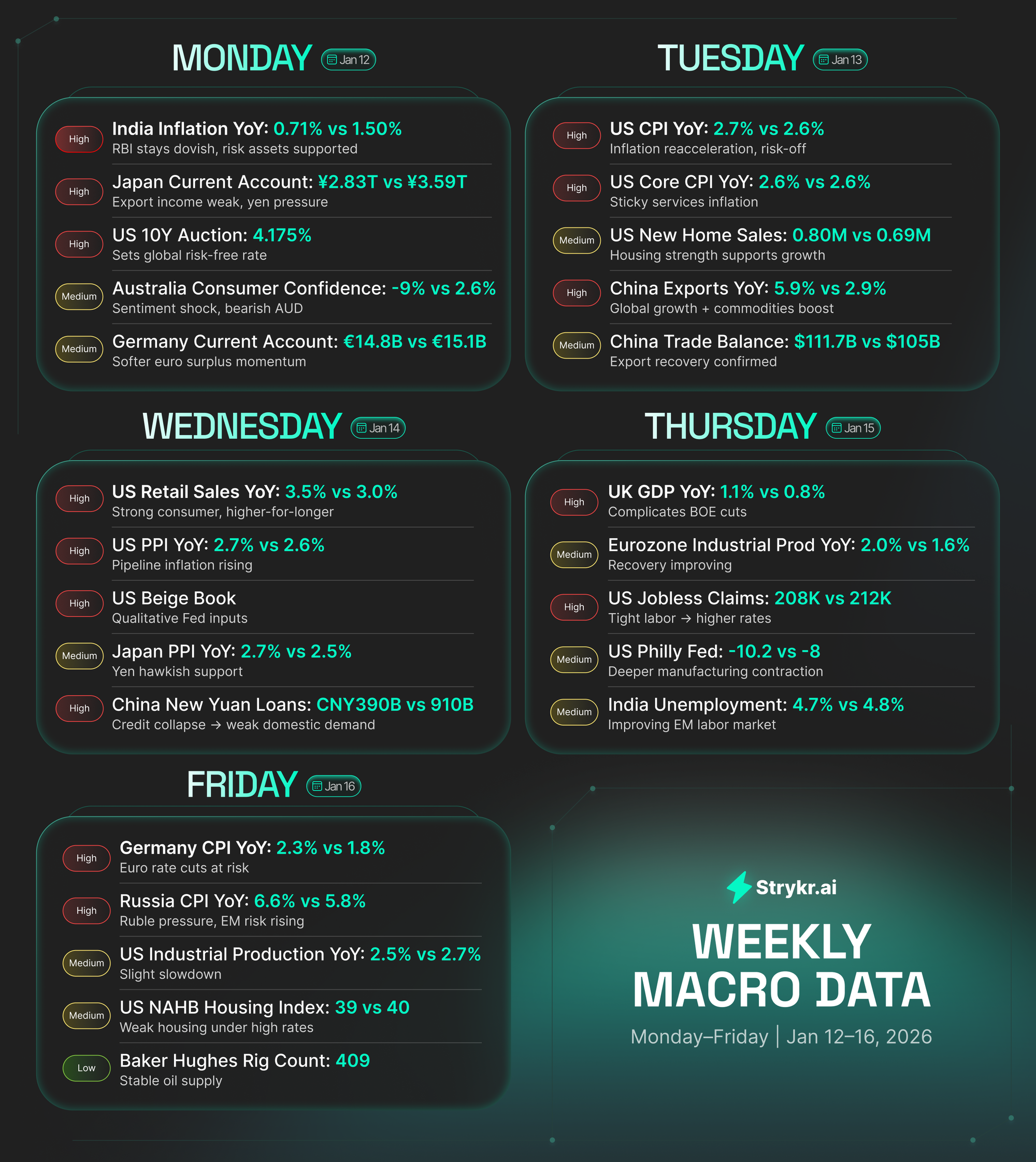

The tone for the week is set early by inflation and rate sensitive data from Asia and Europe. India releases its December inflation numbers on Monday, offering one of the first major reads on price pressures in emerging markets. At the same time, Germany’s current account figures provide insight into the health of Europe’s export engine. These numbers matter more than usual because they influence how global capital flows toward or away from dollar denominated assets.

In the US, Treasury auctions on Monday will quietly test investor appetite for government debt. The ten year note sale is especially important. Strong demand would suggest that investors are comfortable with current rate levels. Weak demand would push yields higher and tighten financial conditions, which tends to weigh on equities and crypto alike.

Tuesday is the centerpiece of the week. US inflation data for December will dominate every market. Headline CPI, core CPI, and the CPI index itself will all hit at once. These prints drive expectations around Federal Reserve policy more than any other data point. A hotter than expected number would reinforce the idea that rates stay higher for longer. A softer print could reopen the door to rate cuts and risk asset rallies.

That same day, China releases its trade data. Exports, imports, and the trade balance provide a window into global demand and manufacturing activity. Because China sits at the center of many supply chains, this data often moves commodities, emerging market currencies, and industrial equities.

Wednesday shifts focus to growth and spending. US retail sales give a direct look at how consumers are behaving after months of inflation and higher borrowing costs. Strong sales suggest the economy is still running hot. Weak sales would raise concerns about a slowdown. Producer price inflation also arrives, showing whether cost pressures are building upstream before they reach consumers.

Energy markets will be watching US crude oil inventory data, which can influence inflation expectations and energy stocks. The Federal Reserve’s Beige Book is also released, offering a qualitative snapshot of economic conditions across the country. Traders use it to gauge whether the economy is accelerating or cooling beneath the surface.

Thursday brings a heavy slate from Europe and the US. UK GDP data will show whether the British economy is gaining traction or slipping back toward stagnation. Eurozone industrial production provides a broader read on manufacturing health across the region. In the US, jobless claims and regional manufacturing surveys give near real time insight into labor market and business conditions. Together, these reports help markets assess whether the economy is bending under tighter financial conditions.

Friday closes the week with US industrial production and capacity utilization. These figures show how much of the economy’s productive potential is being used. When capacity is high, inflation risks rise. When it is low, growth concerns take over. Canada’s housing data adds another piece to the global credit cycle picture, while Russia’s inflation numbers give insight into pressures inside one of the world’s largest energy exporters.

By the end of the week, markets will have a clearer picture of inflation trends, consumer strength, and global trade momentum. With so many moving pieces, volatility is likely to remain elevated, especially around Tuesday’s US inflation release.

This is the kind of week where macro sets the direction for everything else.