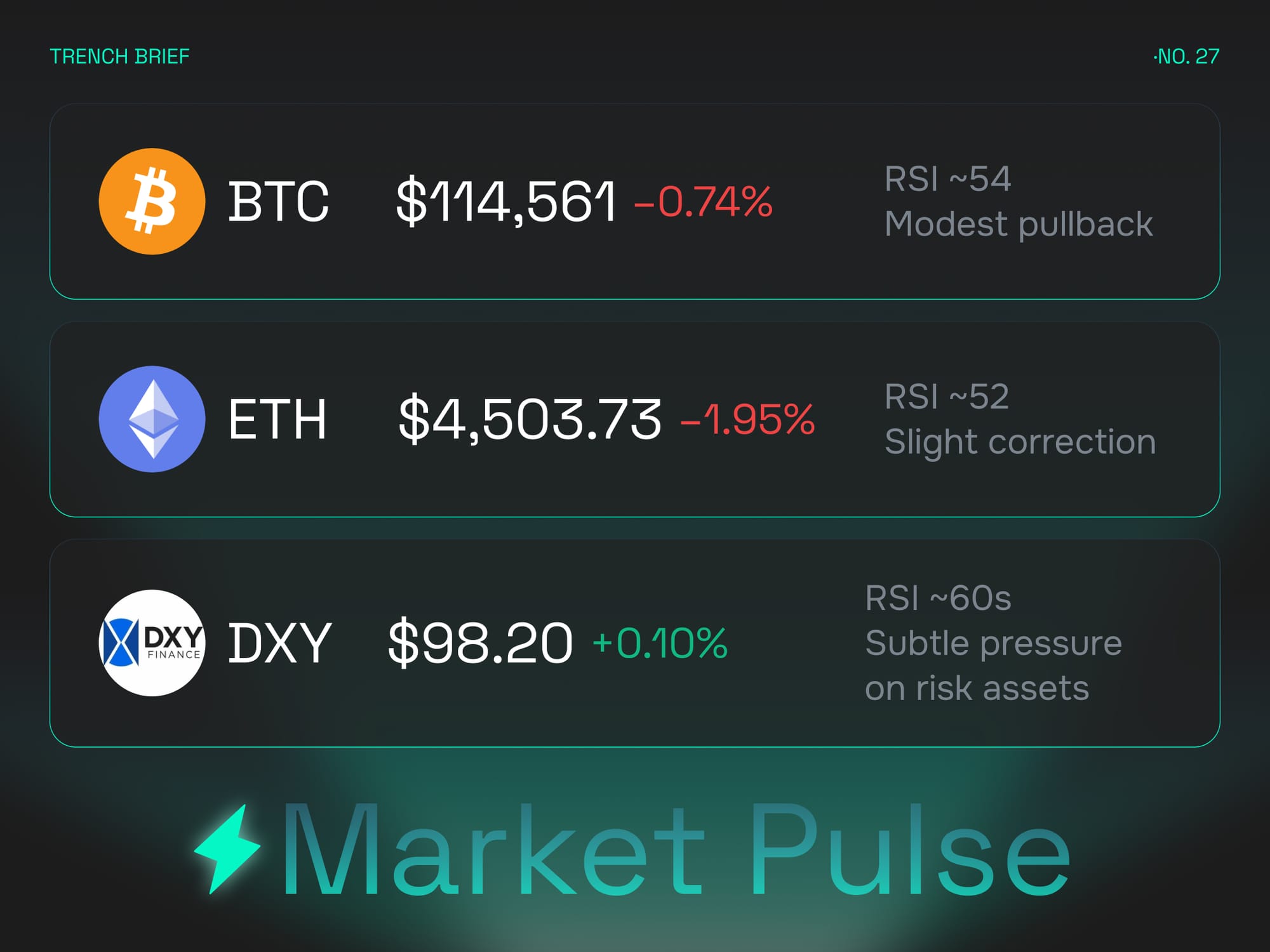

Market Pulse

Markets are opening the week with a slight reset after last week’s rally. Bitcoin slipped back to $114,561 (-0.74%) with RSI near 54, marking a modest pullback rather than a structural shift. ETH tracked lower as well, trading at $4,503 (-1.95%) with RSI at 52, signaling a cooling period but still holding higher ground relative to earlier ranges. The Dollar Index (DXY) edged up to $98.20 (+0.10%) with RSI in the 60s, showing that the dollar remains firm and is applying subtle pressure to risk assets across the board.

For traders, the story is one of digestion. BTC’s defense of the $114K level will be critical. Holding this range suggests that recent gains were not just a one off spike, while a break lower could put $112K back into play. ETH’s correction is notable given its leadership role last week, but so far price action suggests healthy consolidation rather than weakness. Altcoins, which saw strong rotation on the back of ETH’s momentum, will need majors to stabilize before the bid returns in force.

Macro sentiment is still the undercurrent here. With U.S. inflation data and key central bank decisions looming, the market is bracing for volatility. Traders are reluctant to overextend until they see whether dovish signals align across the U.S., UK, and Eurozone. If the dollar continues to firm, BTC may remain pinned in its current range and ETH could be sidelined. If inflation prints softer and central banks lean cautious, the current pullback may prove to be nothing more than a reset before another leg higher.

The takeaway: short term correction, not a reversal. BTC and ETH remain the anchors, while altcoins are waiting in the wings. Momentum has not broken, it has only paused, and the next data releases will decide whether this pause becomes a setup for renewed upside or a stall into late September.

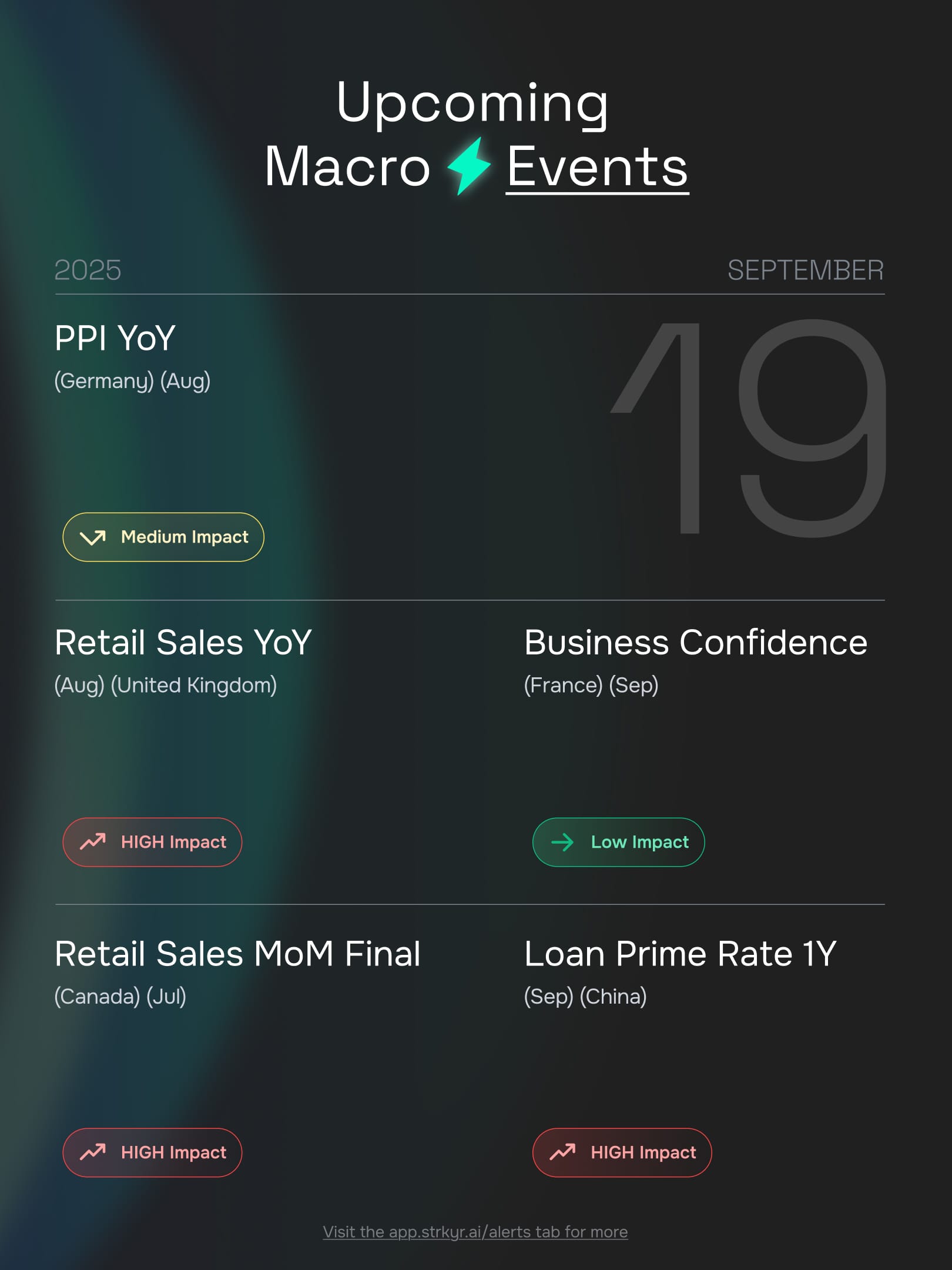

Macro Events

The week ahead is packed with data that could reset expectations around inflation, growth, and central bank policy.

- Monday (Sept 15): Germany’s Wholesale Prices and India’s WPI Inflation will set the early tone. Softer readings would validate last week’s trend of easing price pressures, but any surprise uptick risks reviving hawkish narratives.

- Tuesday (Sept 16): The UK unemployment rate and Eurozone ZEW sentiment survey headline the day. Labor softness in the UK would reinforce dovish BoE expectations, while sentiment data in Europe may reveal whether recent ECB caution is filtering into business outlooks.

- Wednesday (Sept 17): A critical day for inflation watchers. UK and Eurozone CPI prints arrive alongside Canada’s BoC decision. Softer CPI paired with a steady BoC stance would support the case for looser global liquidity, while any stickiness could reintroduce volatility into FX and crypto.

- Thursday (Sept 18): The BoE interest rate decision is the focal point. With growth concerns mounting, markets are watching closely for whether policymakers lean dovish. The outcome will shape both GBP flows and the dollar’s relative strength, indirectly steering risk appetite across crypto.

- Friday (Sept 19): Retail sales from the UK and Canada close out the week, alongside China’s Loan Prime Rate. Stronger consumer data would complicate dovish bets, while easing demand trends would bolster risk assets into the weekend.

Takeaway: This week is less about one data point and more about how the inflation and labor storylines align across major economies. If reports lean dovish, crypto could see renewed rotation into alts. If data comes in hotter, BTC and ETH may stay range-bound as traders hedge into dollar strength.

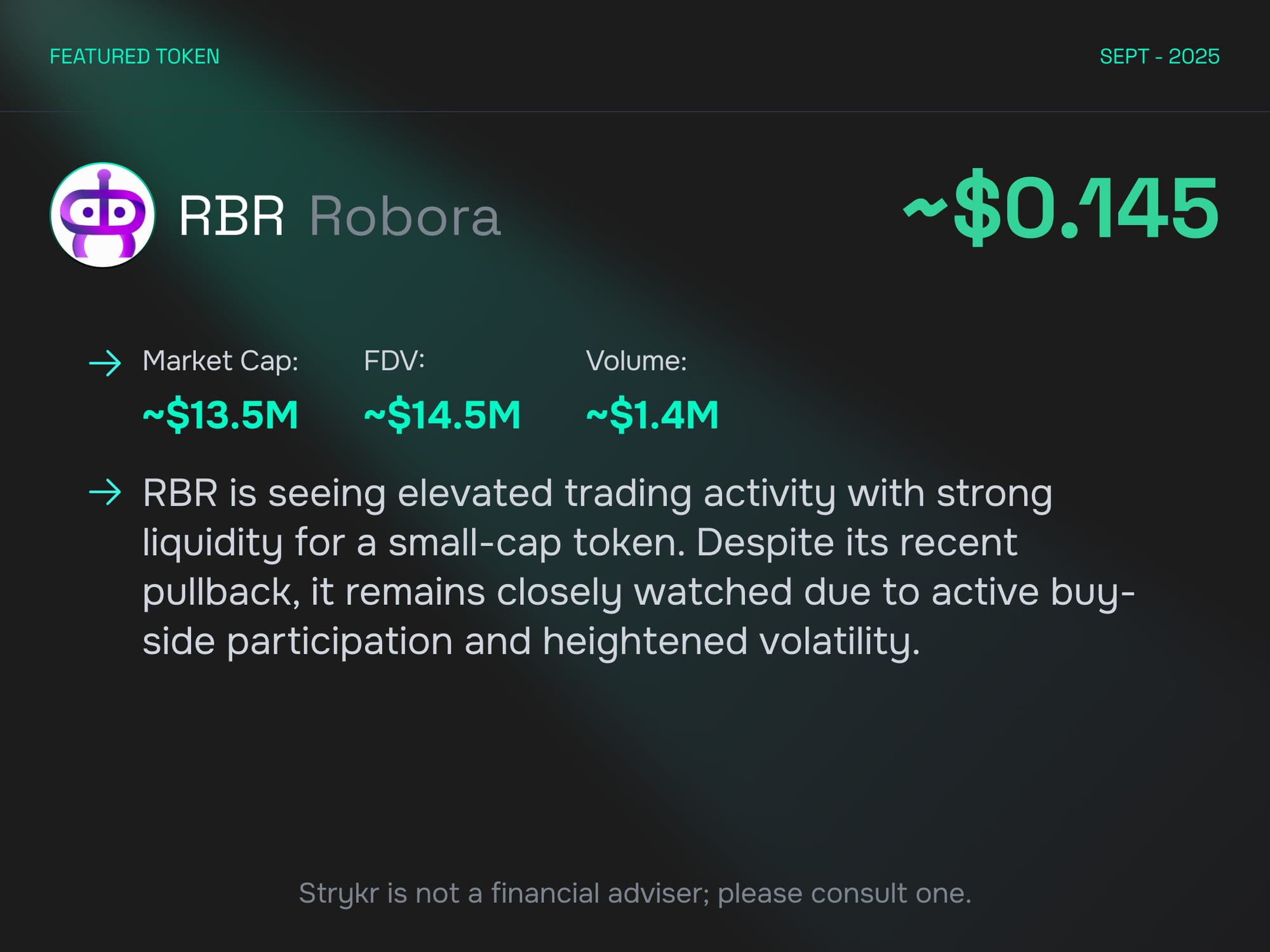

Coin Spotlight

Robora is emerging as one of the more notable small caps in the market, trading near $0.145 with a market cap of $13.5M and volume picking up steadily. Elevated liquidity signals growing buy side participation, keeping RBR active on trader watchlists.

The project aims to build the Web3 hub for Physical AI, combining robotics, IoT, and blockchain into one decentralized ecosystem. Users can design and train robots, contribute real world data, and monetize their work on chain. Early proofs, including a drag and drop 3D builder demo and active GitHub repositories, show progress beyond concept stage.

With a team that includes an ex Google DeepMind engineer, hardware talent from AirCar, and a Shenzhen based R&D unit, Robora brings credible expertise to a growing sector. Its positioning in the blockchain and IoT market gives it a long runway, while short term trading interest keeps volatility high and opportunities active.

Last Week Today

Diving into what happened the previous week.

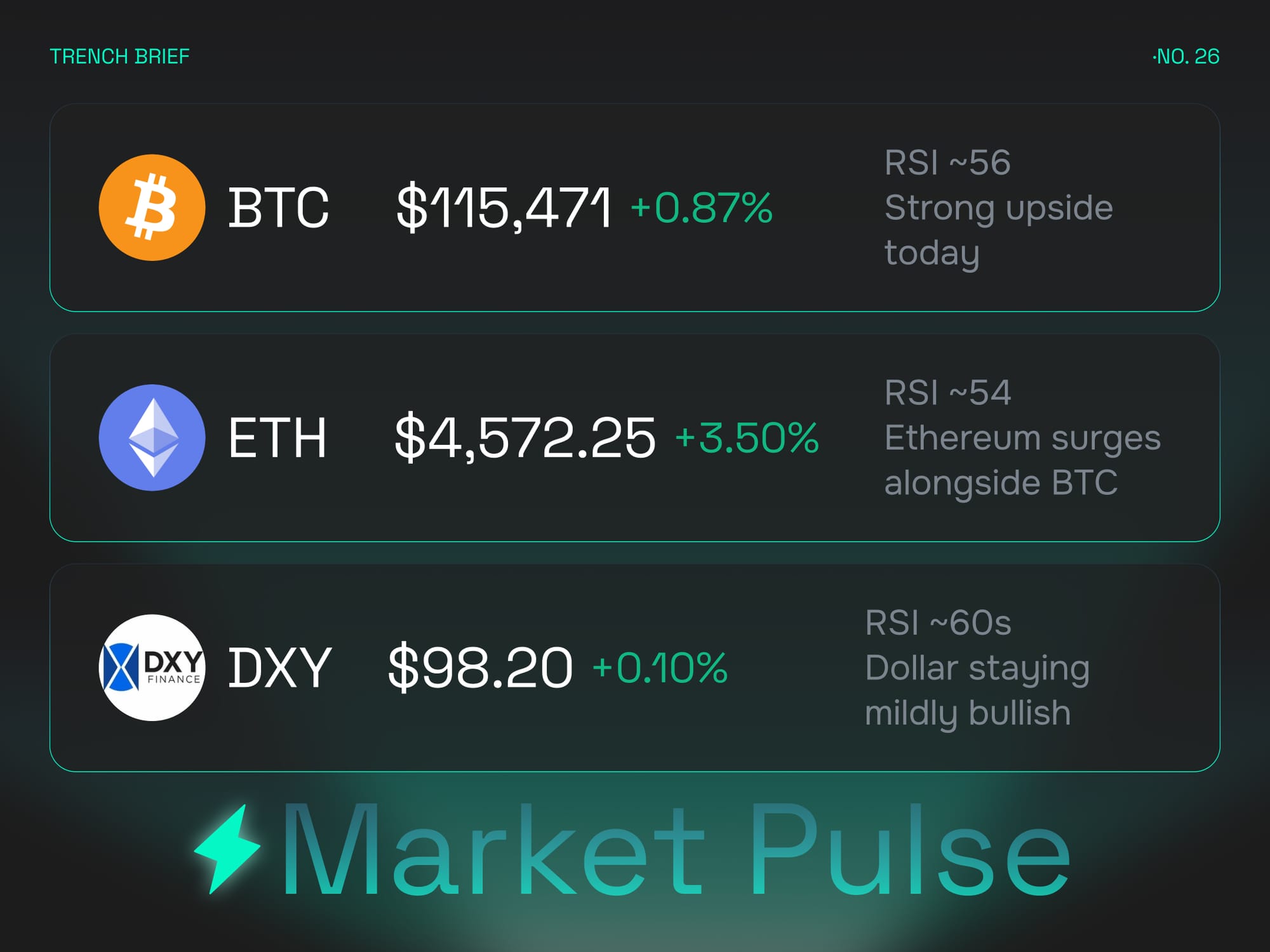

Market Pulse

Markets pushed higher into the close of last week, with Bitcoin advancing to $115,471 (+0.87%) and holding RSI near 56, underscoring steady upside momentum. Ethereum outperformed, climbing to $4,572 (+3.50%) with RSI at 54, reinforcing its role as the market’s leading anchor. The U.S. dollar index (DXY) ticked up slightly to 98.20 with RSI in the 60s, keeping a mildly bullish tone but without disrupting crypto momentum.

The interplay here matters: ETH’s strength signaled a healthy rotation environment, while BTC’s stability provided a base for broader flows. With the dollar showing firmness but not spiking, crypto assets enjoyed space to run. Traders leaned into altcoins, where speculative and structural narratives both drove liquidity.

Looking ahead, the key question is whether ETH can maintain leadership above $4,500 and if BTC can sustain above $115K. If so, the path opens for deeper altcoin rallies, particularly in tokens that already show strong signal activity. Macro data and central bank commentary will again shape short-term volatility, but for now, market tone tilts constructive.

Top 4 Tokens

MYX

MYX continued its commanding run, rebounding sharply after its recent pullback. The strong rally underscores robust demand, positioning MYX as the week’s most active leader. High signal activity reflects both institutional traders recalibrating exposure and retail momentum chasing. The ability to climb back with conviction highlights MYX’s relevance as one of the cycle’s flagship movers. Sustained volume suggests this is more than a one-off rebound, with traders treating MYX as a structural barometer for alt sentiment.

KTA

Keeta held firm near recent highs, reflecting steady confidence from both retail and institutional desks. Signal strength above 100x reinforced its staying power as a mid-cap with real adoption traction. KTA’s momentum is tied not just to speculative activity but also to ongoing liquidity expansion and exchange depth. Its ability to sustain volume while preserving price structure makes it one of the more balanced bullish bets. If broader risk appetite holds, Keeta could cement itself as a recurring core play for active traders.

PUMP

PUMP retained its spot as Solana’s speculative heartbeat. Despite cooling slightly from recent highs, it maintained heavy engagement with 75x signals. This reflects an ongoing appetite for high-beta exposure, where traders seek short bursts of volatility. PUMP’s consistency in topping activity charts highlights its role as a community-driven liquidity magnet. While inherently risky, its traction shows no signs of fading, keeping it central to momentum-based strategies in the near term.

LINK

LINK edged higher, reinforcing its position as one of DeFi’s most resilient tokens. Oracle demand continues to support its long-term structure, making it both a speculative and fundamental play. With 86x signals, activity was widespread, showing persistent institutional usage alongside retail flows. LINK’s ability to weather volatility while holding a growth trajectory strengthens its reputation as an anchor within DeFi. In weeks when traders seek stability without sacrificing upside, LINK remains a top-tier candidate.

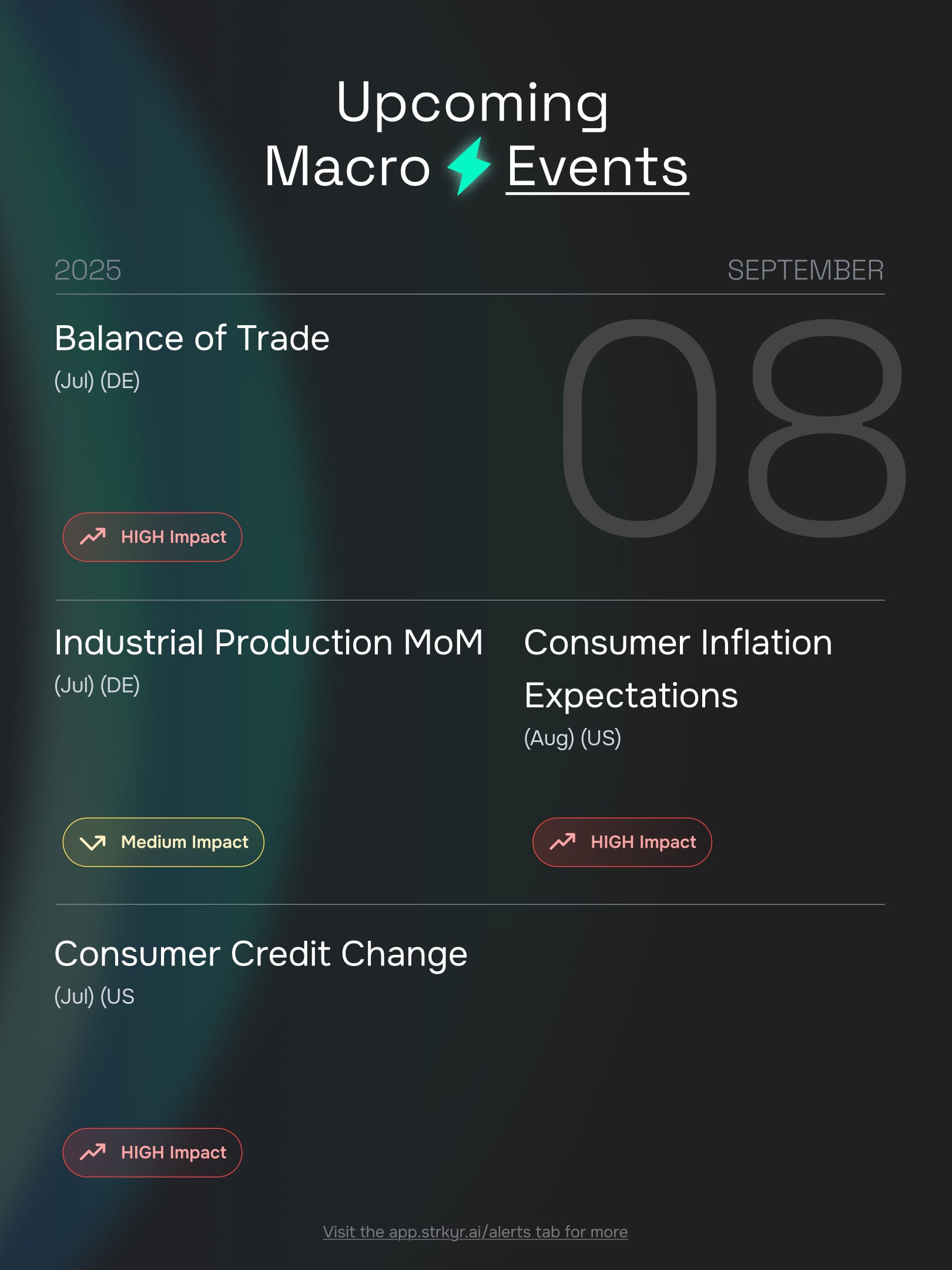

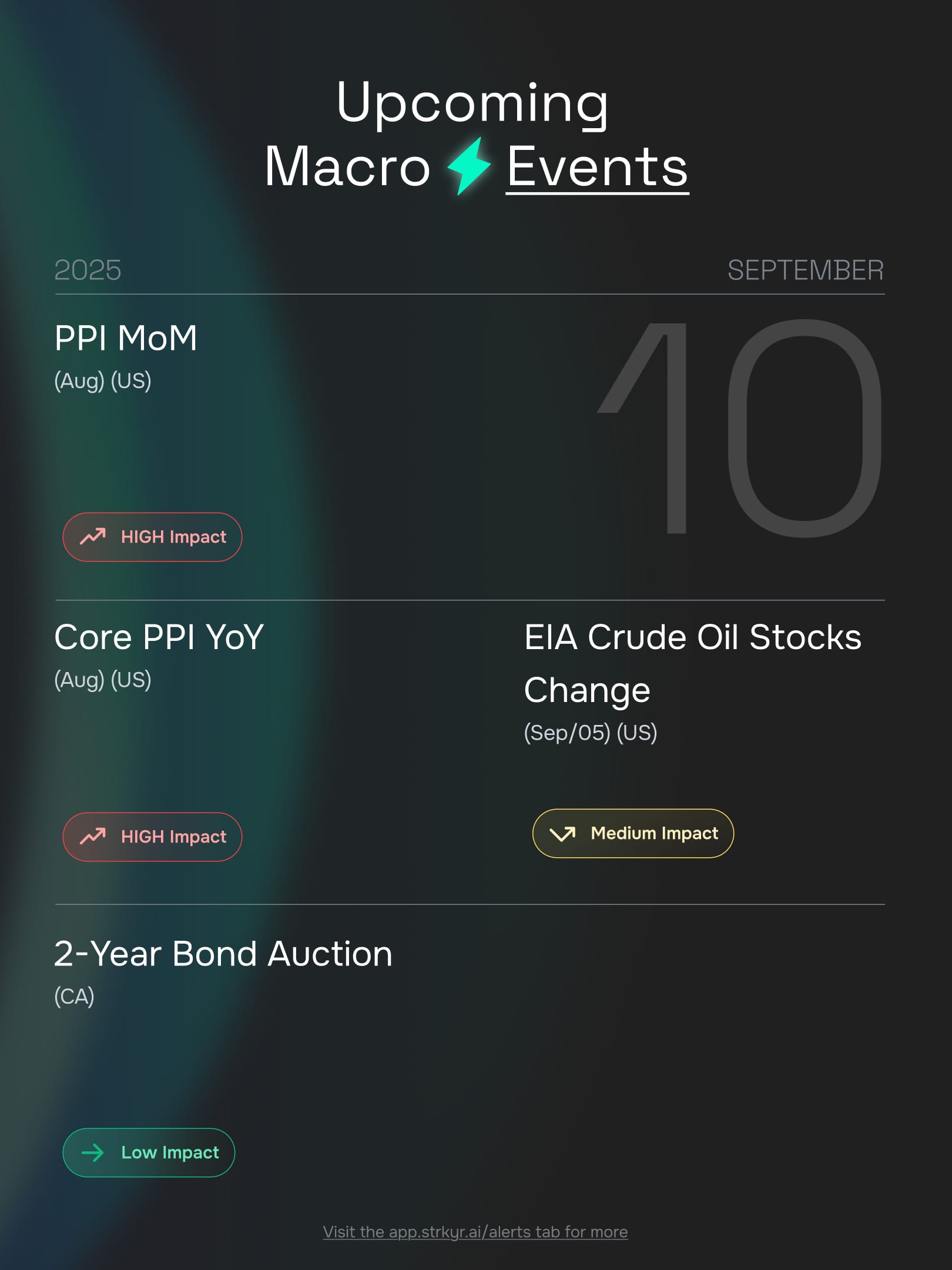

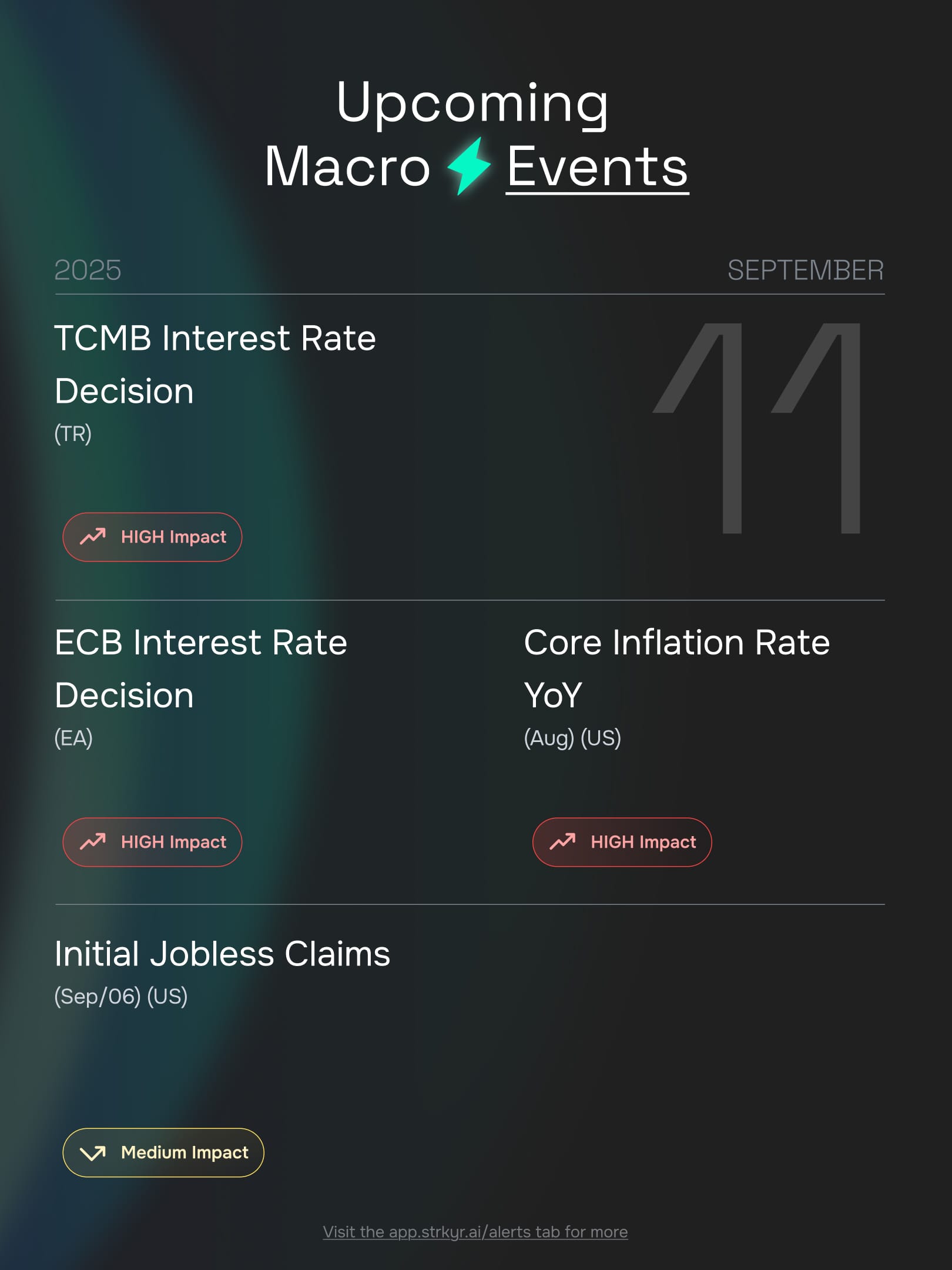

Macro Events: September 8–12

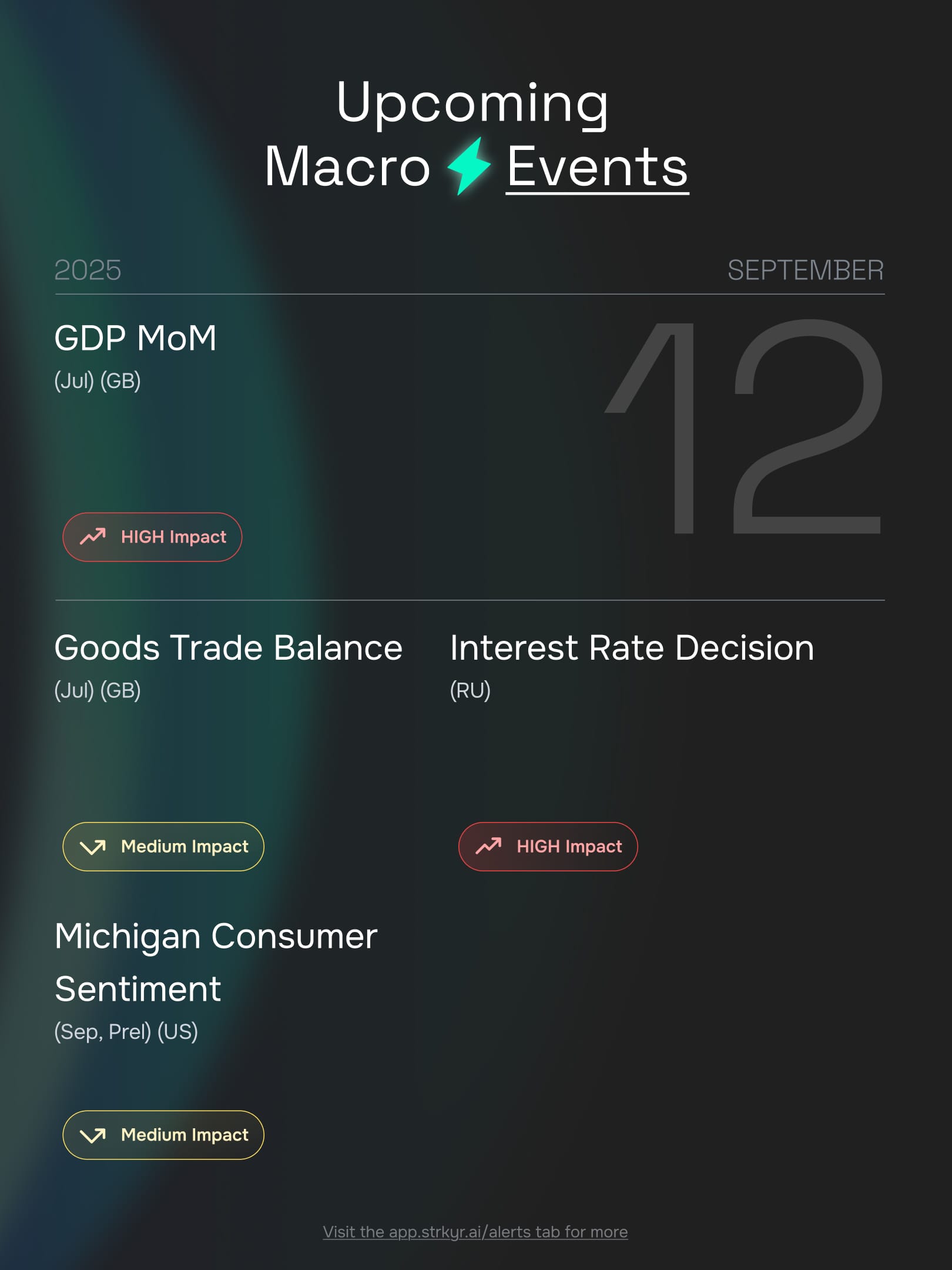

The week was dominated by inflation signals and central bank commentary. In the U.S., consumer inflation expectations and PPI data kept traders on edge. Softer prints supported risk-on flows, while any upside surprises capped rallies intraday. The ECB rate decision drew global focus: policymakers balanced weak growth with stubborn inflation, ultimately leaning cautious. This stance allowed the euro to stabilize and indirectly supported crypto momentum.

Elsewhere, UK GDP data surprised modestly higher, while U.S. consumer credit contracted faster than expected, hinting at tighter household conditions. The blend of softer inflation expectations, cautious central banks, and uneven growth data left traders leaning into selective altcoin plays, particularly tokens showing strong signal activity.

FX & Commodities

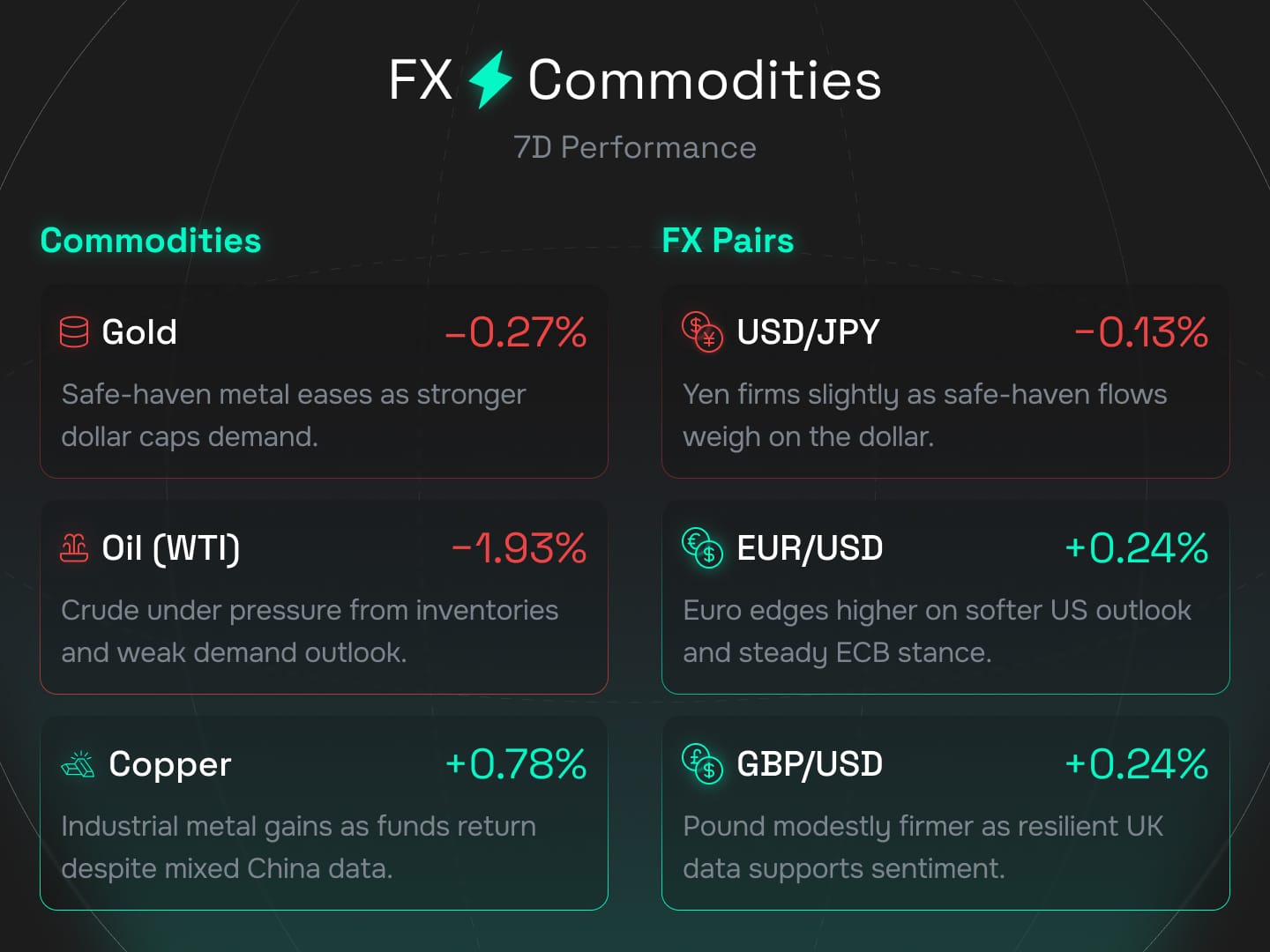

Cross-asset performance showed mixed dynamics. Gold slipped 0.27% as dollar firmness capped safe-haven demand, while oil fell nearly 2% under pressure from inventory builds and weaker demand outlook. Copper gained 0.78%, reflecting modest optimism in industrial flows despite mixed China data.

In FX, USD/JPY eased 0.13% as yen demand ticked higher, while EUR/USD (+0.24%) and GBP/USD (+0.24%) gained ground on a softer U.S. outlook and resilient UK data. This subtle dollar softness helped crypto markets sustain momentum, aligning with ETH’s outperformance.

DeFi Metrics

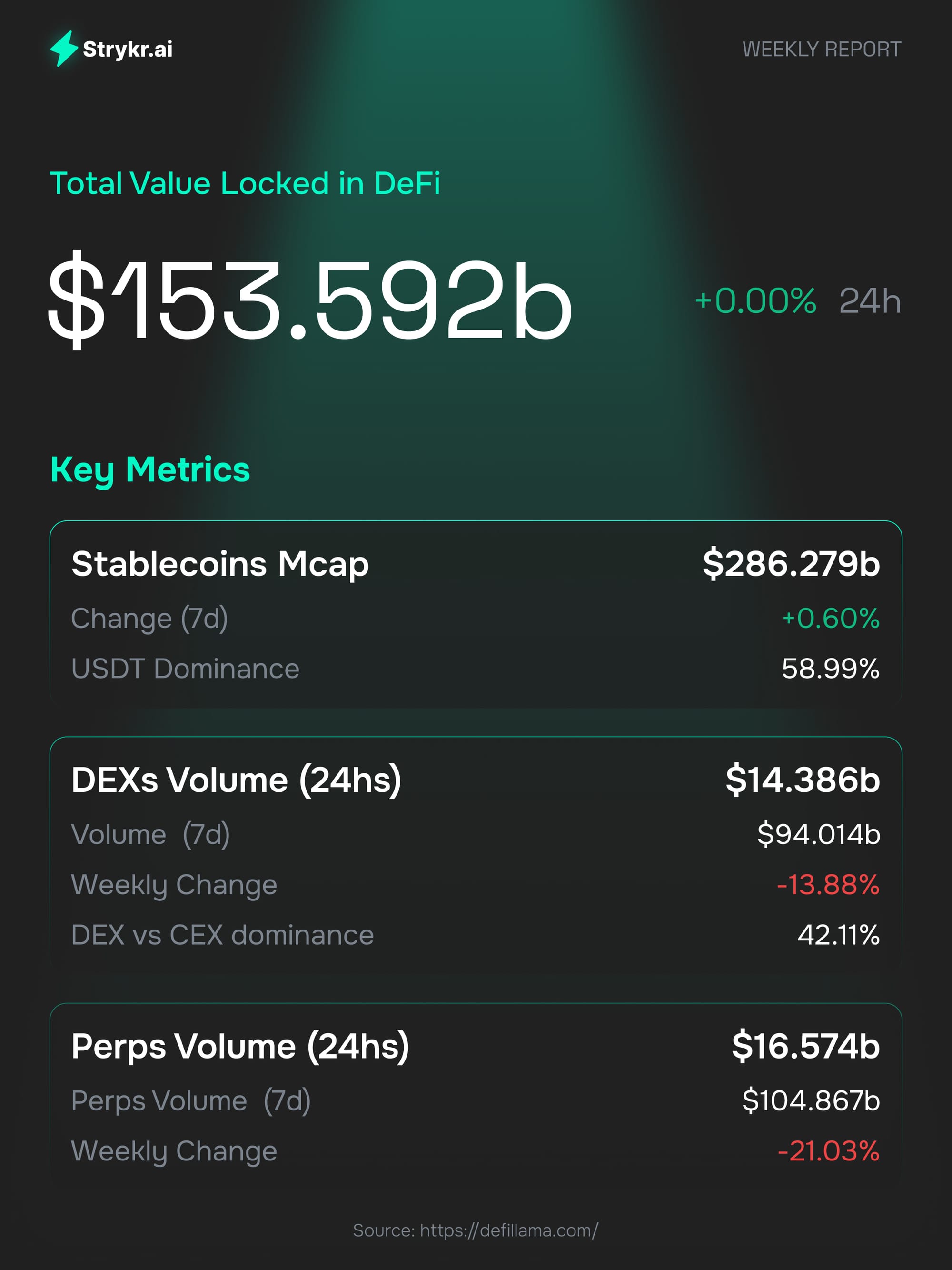

DeFi showed resilience even as volumes fluctuated. Total value locked remained near $153.6B, with stablecoin market cap at $286B and USDT dominance just under 59%. DEX activity slipped by almost 14%, but perps volumes declined further, down 21%. Despite softer week-over-week activity, leading protocols like Lido, Aave, and EigenLayer continued generating meaningful fee revenue, underscoring sticky demand for liquid staking and lending.

The takeaway is that while token prices and trading activity wavered, underlying DeFi usage remains stable, suggesting the sector is insulated from short-term volatility.

Strykr AI View

The second week of September showcased a balanced but bullish tone. BTC and ETH pushed higher, altcoins like MYX and KTA attracted liquidity, while LINK and PUMP proved their staying power. Macro events leaned dovish overall, keeping the door open for risk-on flows. DeFi metrics highlighted stability, and cross-asset softness in FX supported crypto.

Execution outlook: ETH remains the anchor, MYX leads as a momentum giant, KTA solidifies as a balanced growth play, and LINK provides institutional confidence. Traders should remain mindful of inflation data and central bank positioning, but near-term conditions favor continuation of selective altcoin strength.

Execution outlook: ETH remains the high-conviction anchor, MYX the momentum leader, KTA the balanced growth play, and LINK the institutional staple. PUMP continues to serve as the tactical momentum trade for high-beta strategies. The coming week will hinge on inflation releases, central bank commentary, and whether ETH can maintain leadership above $4,500. For now, the rotation backdrop still favors altcoins.

That wraps up Edition No. 2. Next week we’ll track fresh inflation data, central bank narratives, and how majors and alts position into the second half of September. Stay tuned, and thank you for reading Strykr.ai Weekly.