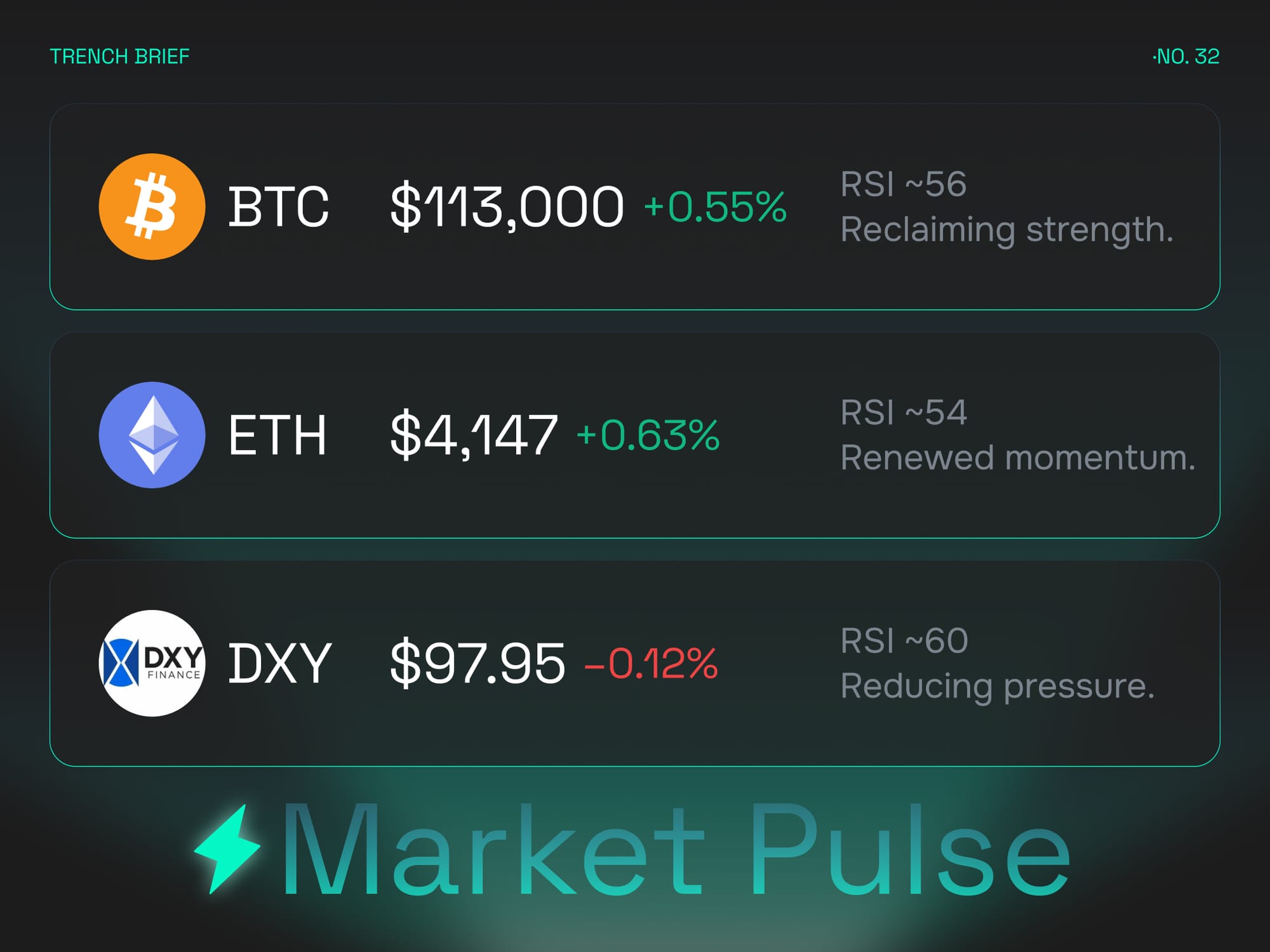

Market Pulse

Markets are beginning the week on firmer ground, with Bitcoin reclaiming $113,000 (+0.55%) and RSI near 56, a sign of improving strength after last week’s choppy range. ETH followed with a push to $4,147 (+0.63%), carrying RSI around 54, suggesting momentum is returning as positioning resets. Meanwhile, the Dollar Index (DXY) edged lower to 97.95 (-0.12%) with RSI near 60, signaling easing pressure from the dollar after a period of sustained firmness.

For traders, the picture is one of cautious rebuilding. BTC holding above the $113K zone is a pivotal marker for short-term sentiment, with stability here acting as the anchor for broader risk appetite. ETH’s lift highlights digestion giving way to renewed participation rather than structural weakness, keeping majors in balance as September closes. The softer dollar adds breathing room but has yet to deliver a decisive pivot in flows.

Altcoins remain reactive to majors. The rotation that drove activity earlier in the month has cooled, but selective narratives—particularly in mid-caps—are still finding traction. Liquidity overall remains measured, with capital waiting for confirmation that majors can consolidate their gains before risk appetite broadens again.

Macro is still the driver of direction. With inflation updates in Europe and the U.S., alongside labor and PMI data, this week’s flow of numbers will frame whether risk can extend higher or remains capped under dollar resilience. A softer tilt in the data opens the door for further upside in BTC and ETH, while firmer readings or hawkish central bank tones risk restraining momentum.

The takeaway: markets are showing signs of strength but not yet conviction. BTC’s hold above $113K steadies sentiment, ETH is regaining footing, and the dollar’s easing removes pressure, but macro clarity will determine whether the rebound builds or stalls into October.

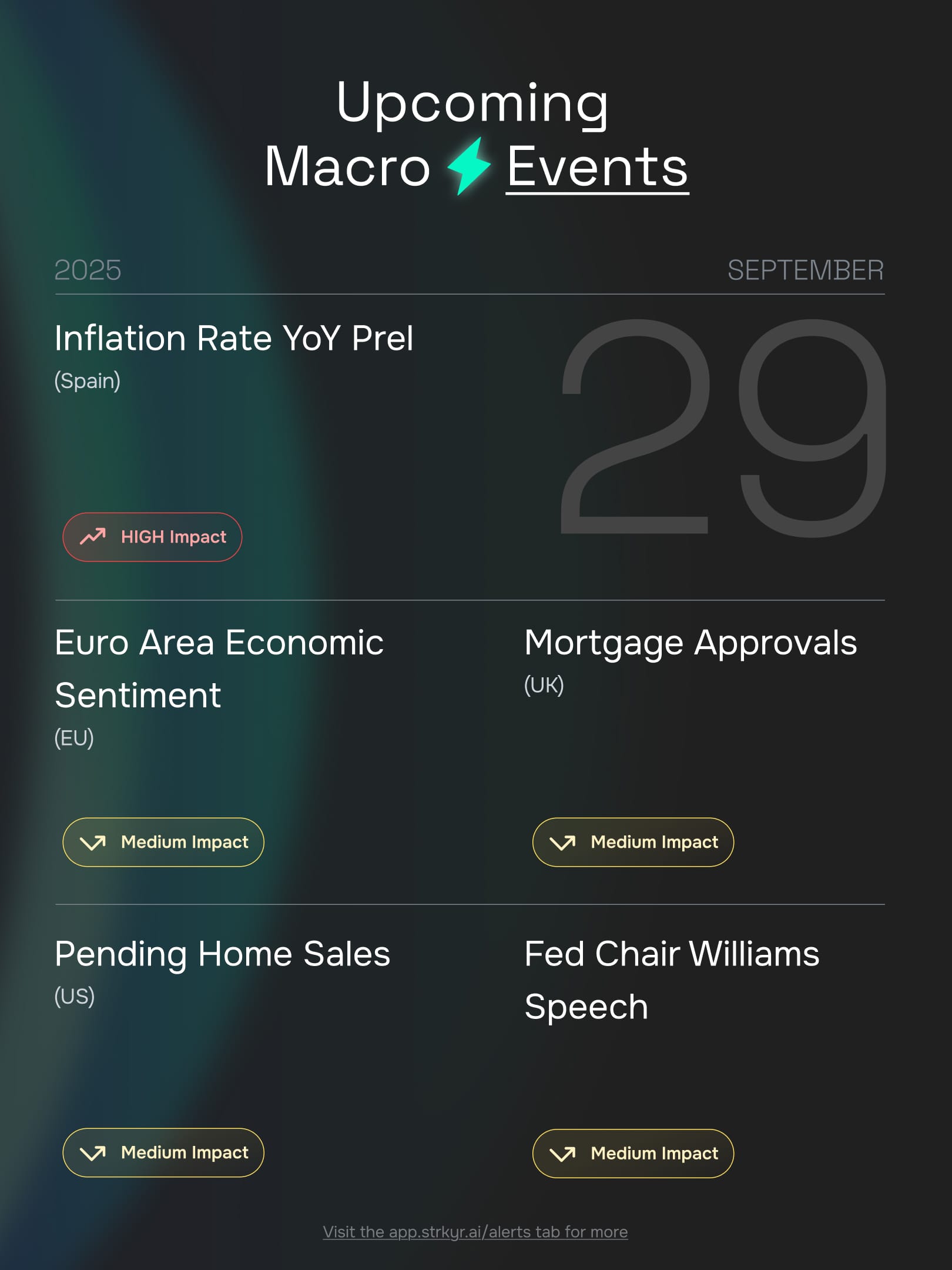

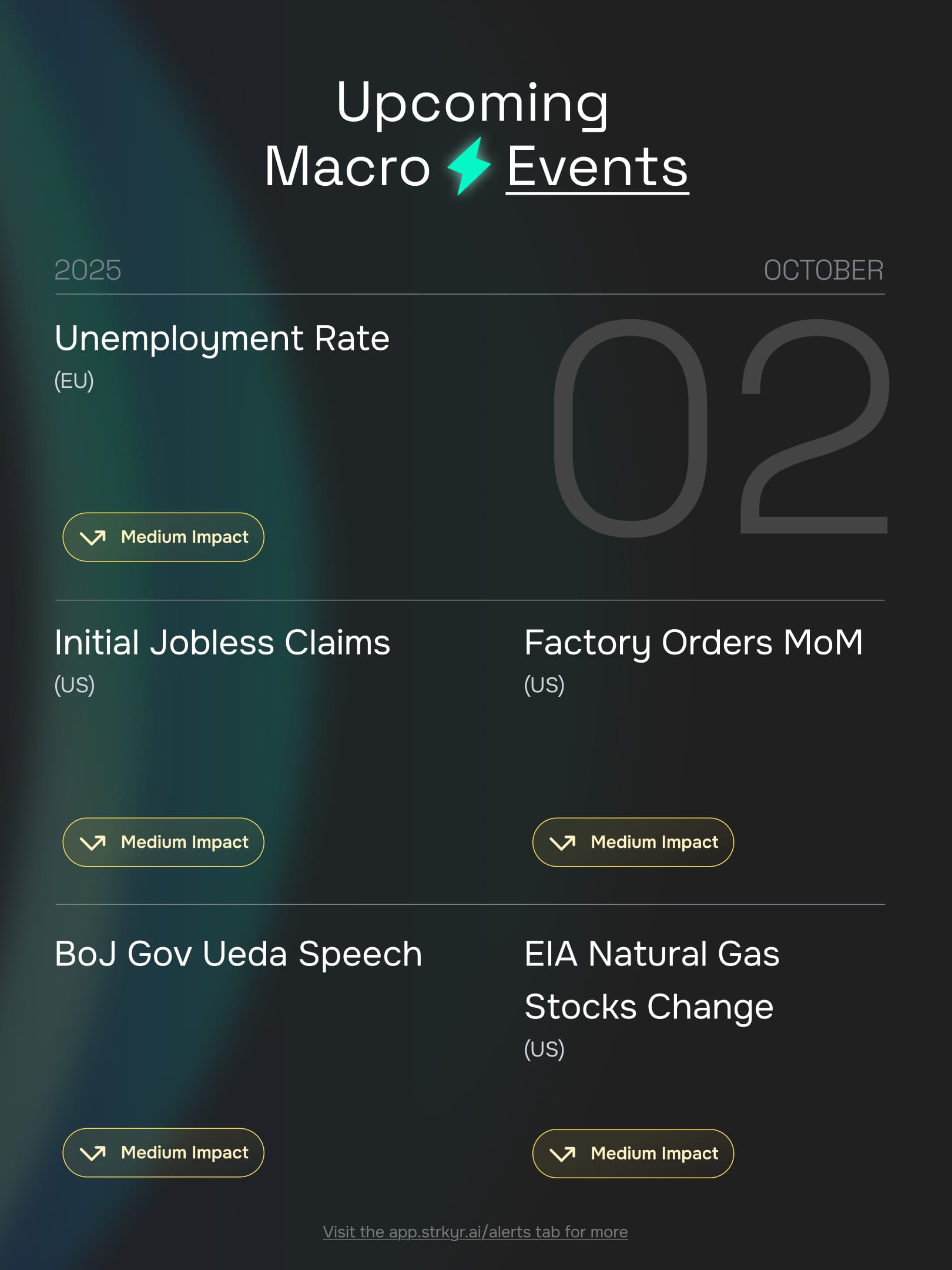

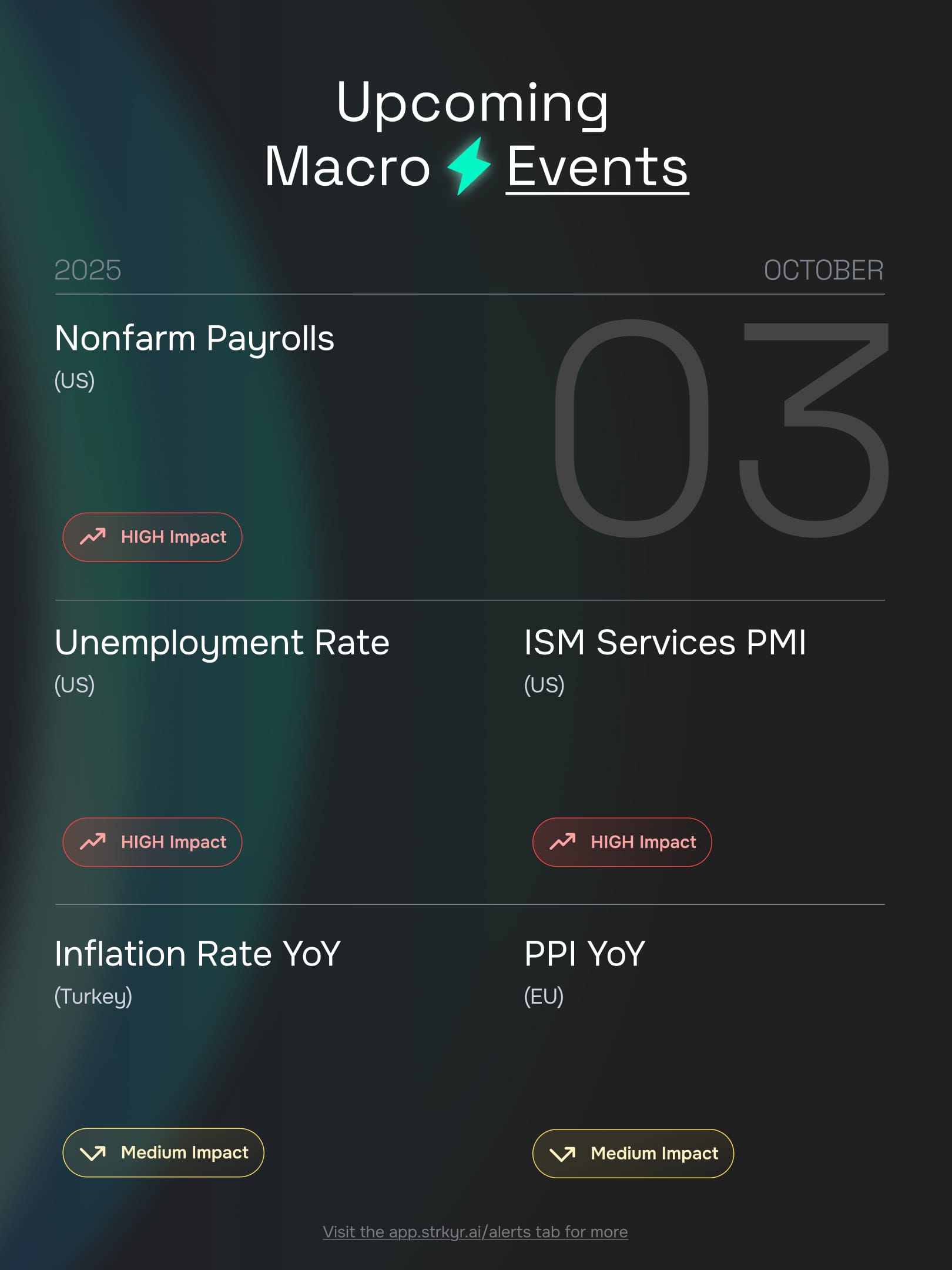

Macro Events

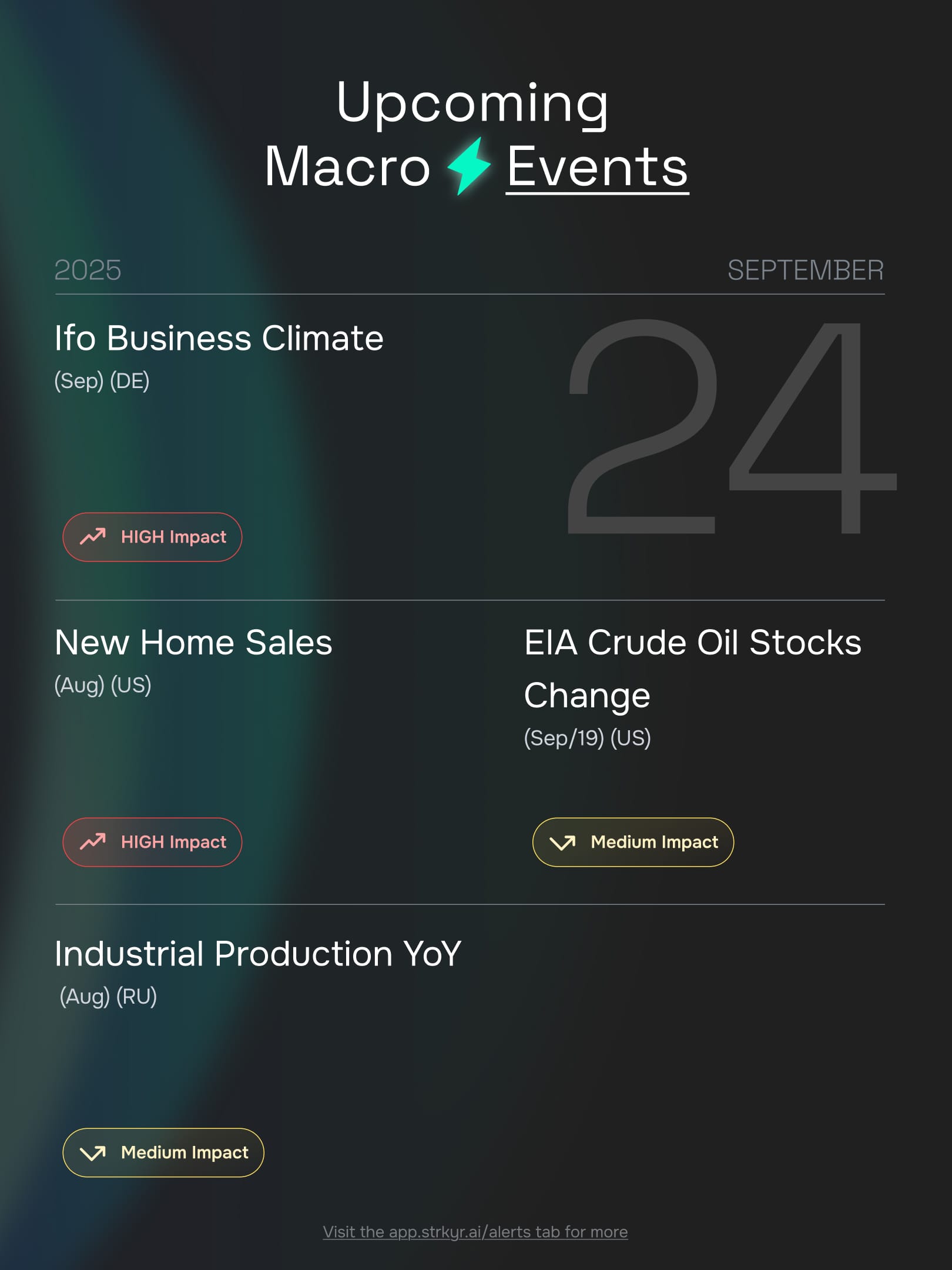

The week ahead is loaded with high-impact releases that will set the tone for global risk sentiment.

Monday (Sept 29): Spain’s inflation rate YoY prelim sets the early tone, with Euro Area economic sentiment and UK mortgage approvals offering additional reads on confidence and housing. U.S. pending home sales and remarks from Fed Chair Williams close the day, giving investors clues on housing strength and policy leanings.

Tuesday (Sept 30): Germany’s inflation rate YoY prelim is the day’s highlight, while ECB President Lagarde’s speech carries weight for euro positioning. In the U.S., CB consumer confidence is a critical test of household sentiment, alongside JOLTs job openings and Chicago PMI—both key to labor tightness and manufacturing momentum.

Wednesday (Oct 1): A heavy session begins with EU inflation and core inflation flashes, both high-impact for ECB policy expectations. U.S. ISM manufacturing PMI will be closely watched as a gauge of activity, while ADP employment change provides a labor market preview ahead of Friday’s payrolls. The Bank of Canada’s deliberations also feed into FX and rate dynamics.

Thursday (Oct 2): The focus spreads across geographies: EU unemployment, U.S. initial jobless claims, and factory orders will test demand resilience, while BoJ Governor Ueda’s speech will influence yen sentiment. Energy markets turn to U.S. natural gas storage data, a key input for commodities traders.

Friday (Oct 3): The week’s climax with U.S. nonfarm payrolls, unemployment, and ISM services PMI—three critical pieces for the Fed’s reaction function. Turkey’s inflation rate and EU PPI add to the global inflation mix, making Friday a decisive session for risk tone heading into October.

Takeaway: the cadence is relentless. Inflation, labor, housing, and manufacturing updates hit in sequence, with Friday’s U.S. labor data as the centerpiece. If prints soften, the dovish pivot narrative gains traction and crypto may extend higher. Firmer data reinforces dollar dominance, capping risk into the new month.

Coin Spotlight

ASTER holds attention this week, trading near $1.81 after slipping just below the $2 mark. Despite softer price action, signal activity remains elevated at 44x, underscoring strong engagement and proving it remains a core player in the mid-cap rotation.

Liquidity is the standout feature. ASTER continues to absorb turnover without losing structural integrity, keeping momentum alive where thinner tokens might falter. Its sustained flows highlight trader preference for names that can support both directional conviction and short-term liquidity strategies.

Narrative strength adds another layer. Positioned as a mid-cap with staying power, ASTER has managed to remain part of the rotation cycle even as broader risk appetite cools. The ability to pair volume depth with consistent participation makes it more than a momentum blip—it’s proving itself as an anchor within the mid-cap landscape.

The takeaway: ASTER is holding its ground as a mid-cap of consequence. For traders scanning beyond majors, its blend of liquidity, turnover, and resilience makes it one to watch as the market decides whether to expand risk back into altcoins.

Last Week Today

Diving into what happened the previous week.

Market Pulse

Midweek trading has shifted the tone from cautious optimism into something more unsettled. After opening with a firm bid, markets have since rolled over, with Bitcoin briefly testing the $108K handle and ETH struggling to keep itself above $4K. What looked like routine consolidation has started to feel more like the market probing for downside, as liquidity thins out and traders hesitate to press long exposure ahead of fresh macro catalysts.

The broader setup is less about one coin and more about how the entire risk complex is trading. Crypto is moving in lockstep with equities and FX again, reflecting the weight of a stronger dollar and sticky inflation data. When DXY holds near 97.5, rotation into high-beta alts becomes harder to sustain. The energy we saw in early September is still there, but it’s now concentrated in select mid-caps like KTA and ASTER rather than across the board. These names are keeping signal counts elevated, showing there’s appetite — just not at the majors.

Sentiment right now is defined by hesitation. Traders aren’t abandoning risk, but they’re not rushing in either. The floor around 108K for BTC and 4K for ETH is holding for now, yet both feel heavy, and that weight filters down into alt rotations. The best-performing tokens are those tied to live narratives or adoption catalysts, while anything without fresh news has been fading quietly.

From a narrative perspective, the market is caught between two forces: macro data that keeps leaning hawkish and a crypto-specific bid that refuses to die. The question is which side breaks first. If upcoming inflation prints and central bank updates show relief, the pullback could turn into a launchpad. If not, this midweek softness could be the start of a grind lower into the end of September.

Top 4 Tokens

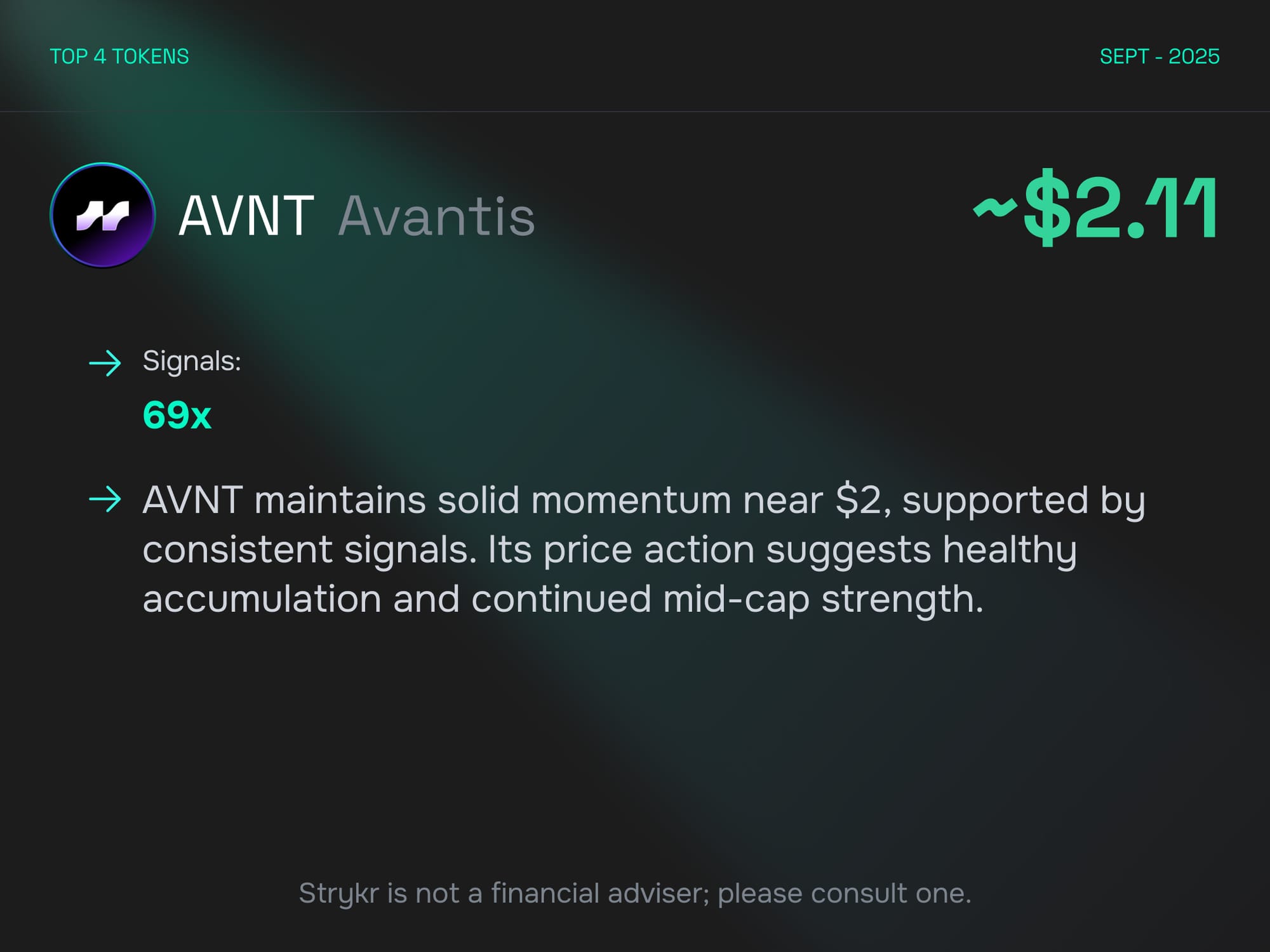

AVNT

Avantis held firm near $2.11 through last week, supported by steady signal flow at 69x. The token showed resilience during broader market churn, with each dip quickly absorbed and breakouts holding their ground. That price behavior suggested real accumulation rather than short-lived speculation. Traders leaned on AVNT as a mid-cap anchor, using it for exposure while rotating risk elsewhere. Its ability to maintain stability while still delivering momentum confirmed that it remained one of the cycle’s reliable performers in mid-cap rotation.

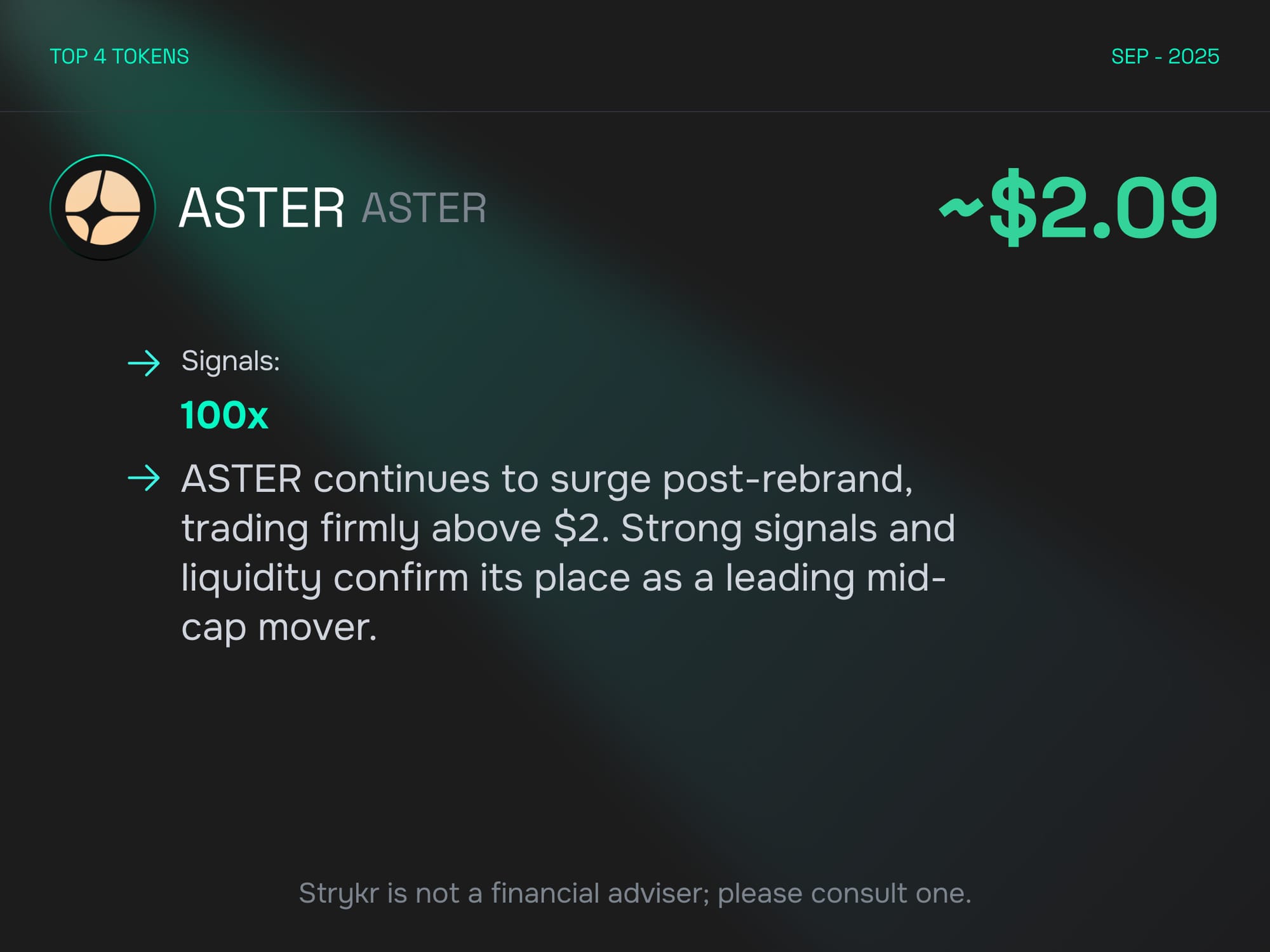

ASTER

ASTER extended its post-rebrand momentum last week, firmly establishing itself above $2. With 100x signals, it was one of the most active tokens in the space. Liquidity held strong, and participation stayed consistent across multiple sessions, signaling that the rally was not just hype-driven. The token’s presence in mid-cap allocation strategies became more apparent, as desks and retail traders alike treated ASTER as a benchmark for rotation. Its ability to sustain flow through pauses in the majors showed that it had matured into a reliable name rather than a one-off mover.

ZRO

ZRO climbed to $2.21 last week with 79x signals, continuing to attract both speculative and structural flows. The breakout above $2 marked a key psychological milestone, and the token managed to hold that level without sharp retracements. Cross-chain narratives kept fueling confidence, giving ZRO more staying power than many of its peers. Traders positioned around it as both a short-term momentum trade and a longer-term bet on infrastructure. The blend of speculative activity and fundamental adoption helped it maintain relevance throughout the week, reinforcing its reputation as a mid-cap with balance and durability.

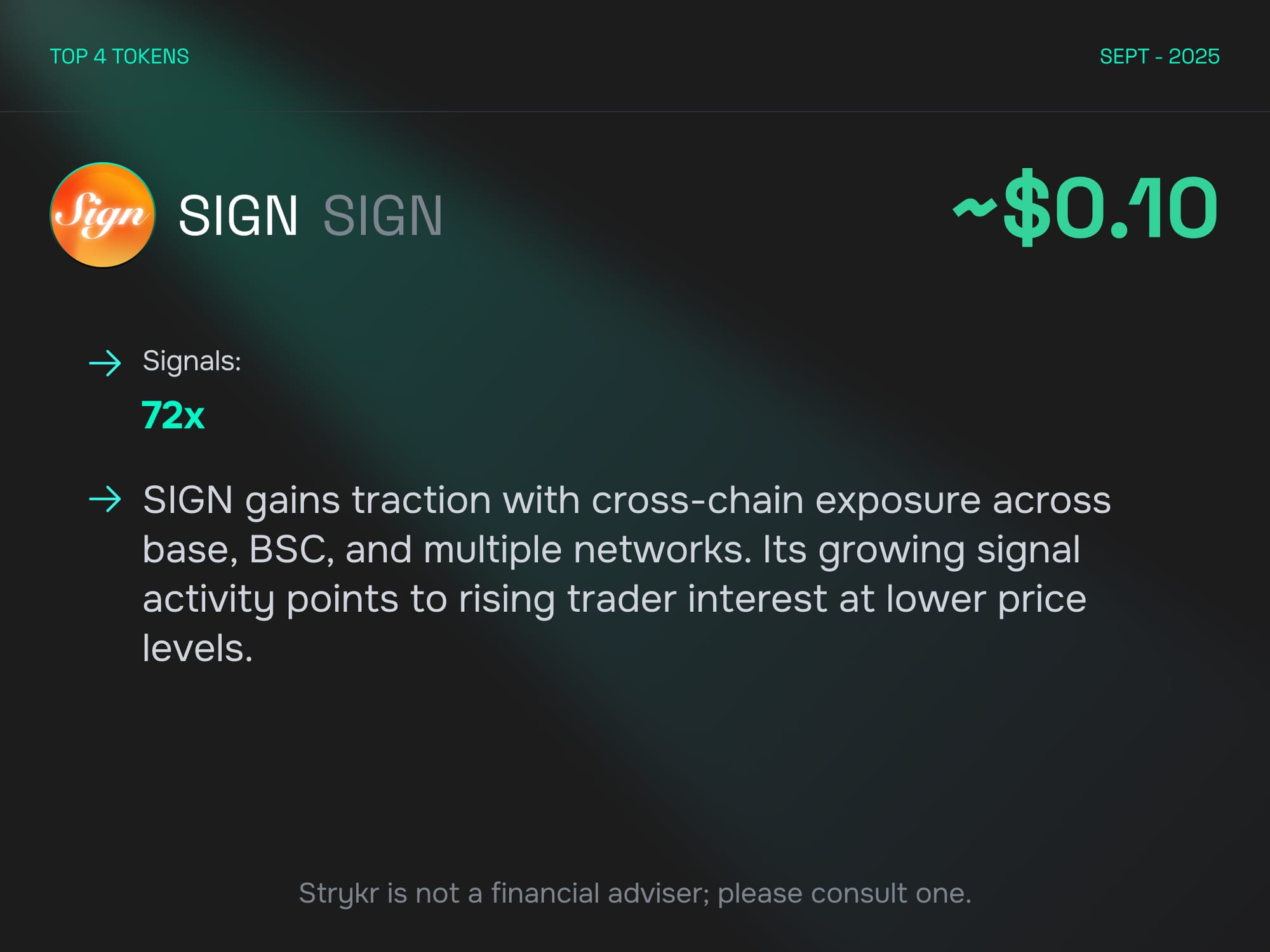

SIGN

SIGN posted a strong week, closing near $0.10 while logging 72x signals. Despite its smaller market size, it captured outsized attention thanks to activity across base, BSC, and multiple other networks. That cross-chain exposure gave it unusual liquidity for a micro-cap and allowed traders to engage without the usual bottlenecks. Participation levels confirmed growing interest, with many viewing SIGN as a speculative rotation play capable of scaling higher. By week’s end, it had secured a spot as one of the most-watched smaller tokens, demonstrating how breadth of access can translate into staying power even at lower price levels.

Macro Events: September 22-26

The macro slate was packed, and every release fed into the market’s cautious tone. Eurozone and US PMI prints confirmed a slowdown in activity, while Powell’s speech reinforced the Fed’s reluctance to rush into cuts. UK housing data and Germany’s Ifo Business Climate added weight to the growth jitters, keeping European currencies under strain. In the US, GDP and durable goods offered no real relief, while Core PCE capped the week by reminding traders that inflationary stickiness remains unresolved.

The effect was straightforward: the dollar stayed firm, keeping risk assets on the defensive. BTC briefly fell to $108K before grinding back above $112K, while ETH stalled near $4K, unable to sustain higher levels. Rotation into alts slowed, and mid-caps that had been leading the charge earlier in the month lost momentum as liquidity narrowed.

For crypto, the question was not whether sentiment had collapsed, but whether the dollar left enough room for follow-through. Majors held their ranges, signaling resilience, but the appetite for outsized moves faded. With global inflation and central bank signals dominating, the setup turned into a waiting game rather than a breakout.

FX & Commodities

Cross-asset flows reflected the same defensive backdrop. Gold slipped 0.07%, holding high ground but capped by stronger yields. Oil (-0.49%) and copper (-0.63%) both softened as demand outlooks weakened. Commodities sent a clear message: supply concerns were real, but demand-side weakness mattered more.

In FX, the dollar flexed against majors. USD/JPY climbed 0.65% toward 149.87, EUR/USD dropped 0.74% on soft European prints, and GBP/USD slid 0.88% under broad USD pressure. The dollar’s resilience limited upside elsewhere, keeping crypto tethered to its ranges.

DeFi Metrics

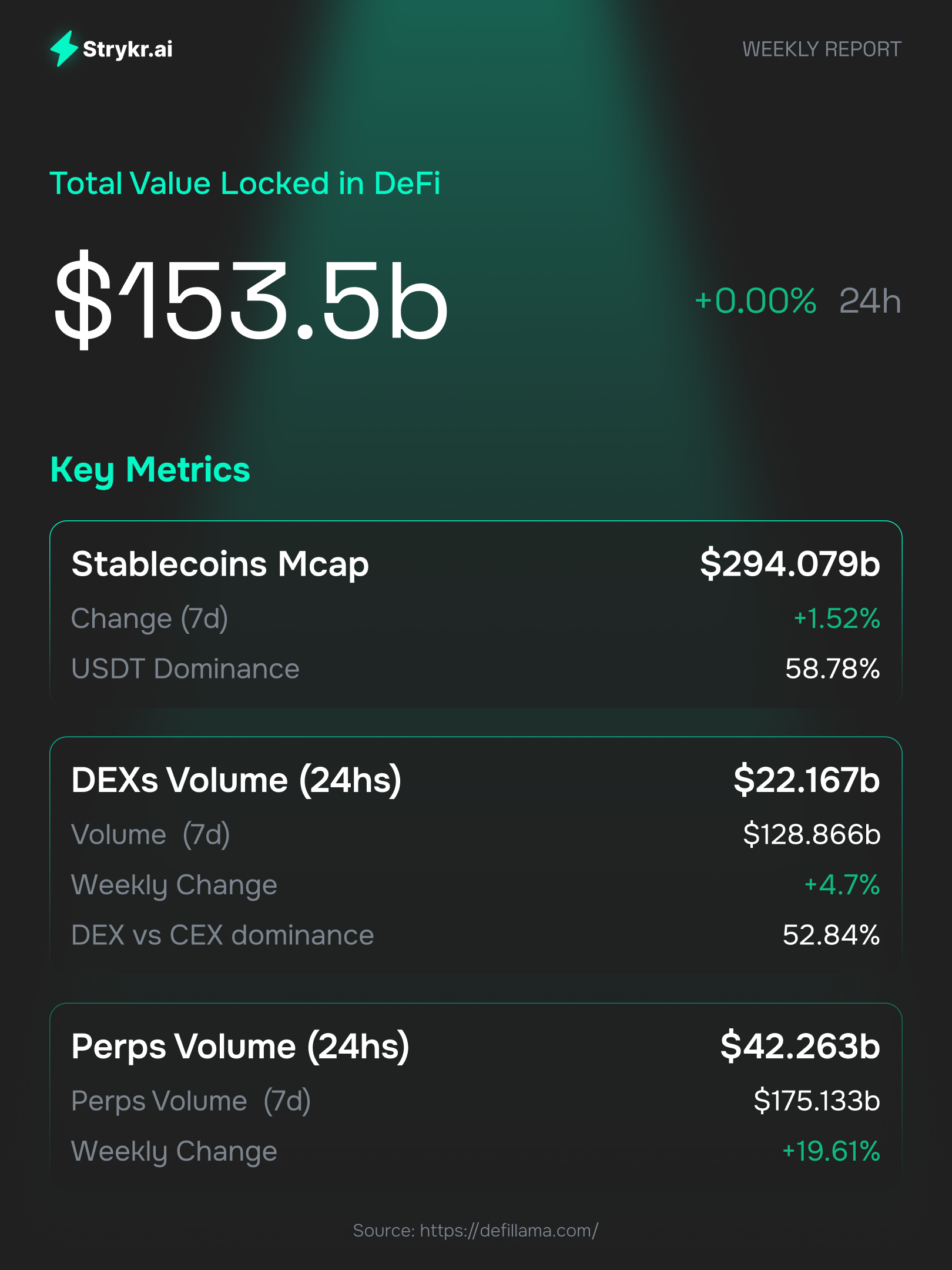

DeFi activity stayed constructive despite macro headwinds. Total value locked held at $153.5B, unchanged day over day but solid on weekly flows. Stablecoin supply climbed to $294B (+1.52%), with USDT keeping nearly 59% dominance.

DEX volumes reached $22.1B daily and $128.8B weekly (+4.7%), while perps surged to $42.3B daily and $175.1B weekly (+19.6%). The data underscored a familiar point: traders remained active on decentralized rails even as majors cooled, ensuring liquidity and revenue stayed sticky across protocols.

Strykr AI View

Last week painted a cautious but steady picture. Majors gave back ground without breaking trend, the dollar reasserted strength, and macro kept risk appetite in check. Yet under the hood, DeFi showed resilience and altcoin signals remained high across a handful of leaders.

Execution outlook: BTC and ETH held as the anchors, Aster stood out as the mid-cap breakout, ZRO and AVNT reflected accumulation, and SIGN showed early-stage traction across chains. Macro remained the swing factor. If PCE and inflation trends eased, rotation could reaccelerate. If not, expect more chop with liquidity clustering in high-signal names.

That wraps up Edition No. 4. Next week we will track US payrolls, Eurozone inflation, and how majors navigate into the first week of October. Stay tuned, and thank you for reading Strykr.ai Weekly.