Market Pulse

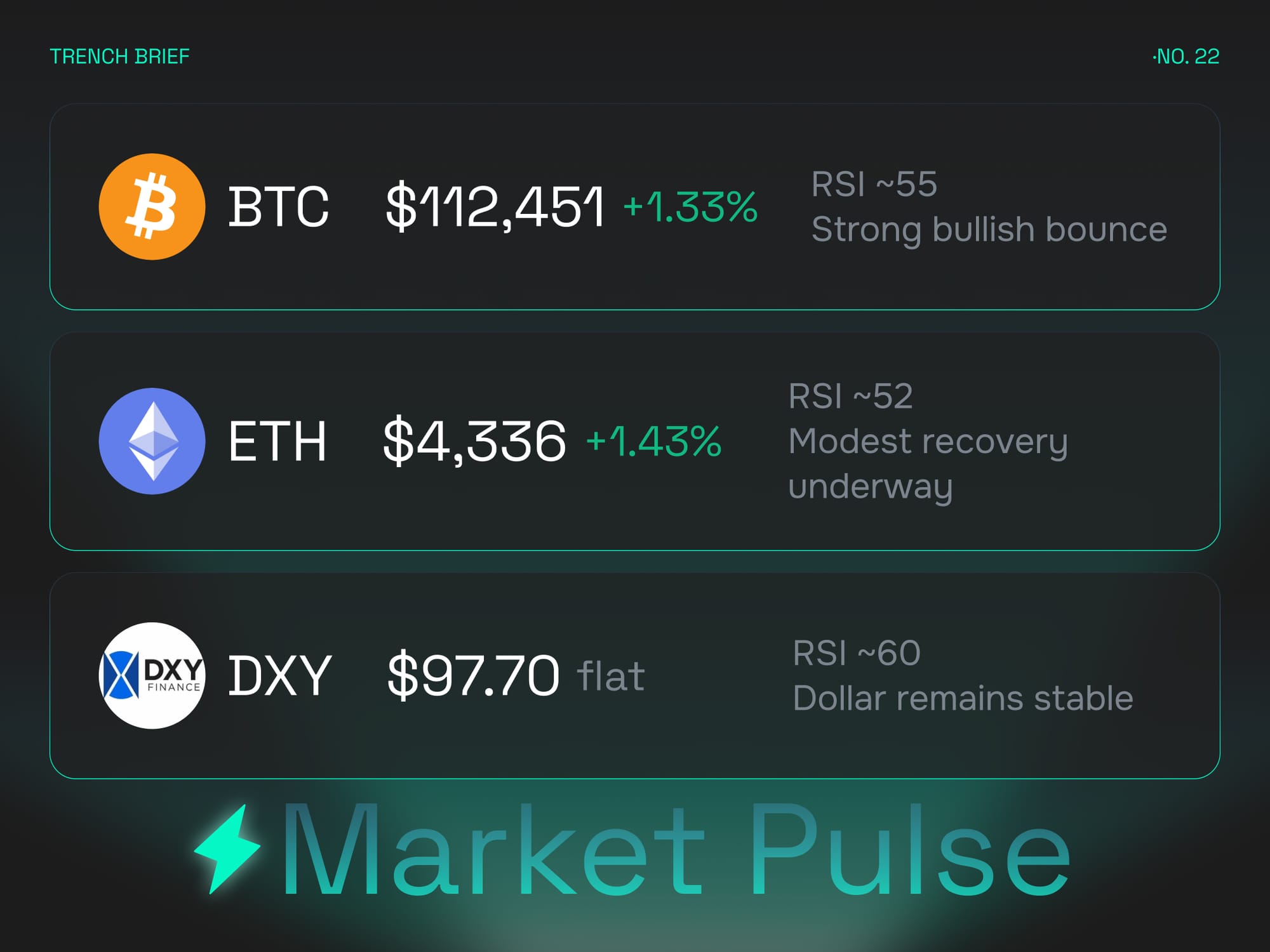

Markets opened the week on a firmer footing, with Bitcoin climbing to $112,451 (+1.33%) and holding RSI near 55, reinforcing a strong bullish bounce. Ethereum advanced to $4,336 (+1.43%) with RSI at 52, showing a modest but steady recovery after last week’s consolidation. The dollar index (DXY) settled flat at 97.70 with RSI around 60, underscoring stability in the global liquidity backdrop.

The tone for the week ahead hinges on whether BTC can extend momentum beyond $113K while ETH builds on its rebound. If both benchmarks hold these levels, capital rotation into altcoins is likely to accelerate, particularly toward tokens with strong technical setups and active narrative flows. DXY’s stability suggests macro headwinds remain muted, giving crypto room to operate without major dollar-driven pressure.

Looking forward, traders will be watching U.S. inflation data and ECB commentary midweek for directional cues. A softer inflation print could fuel further crypto upside, while any hawkish surprises might stall the recovery. For now, momentum tilts cautiously bullish, with ETH regaining traction as the market’s anchor and BTC providing a stable backdrop for selective altcoin rallies.

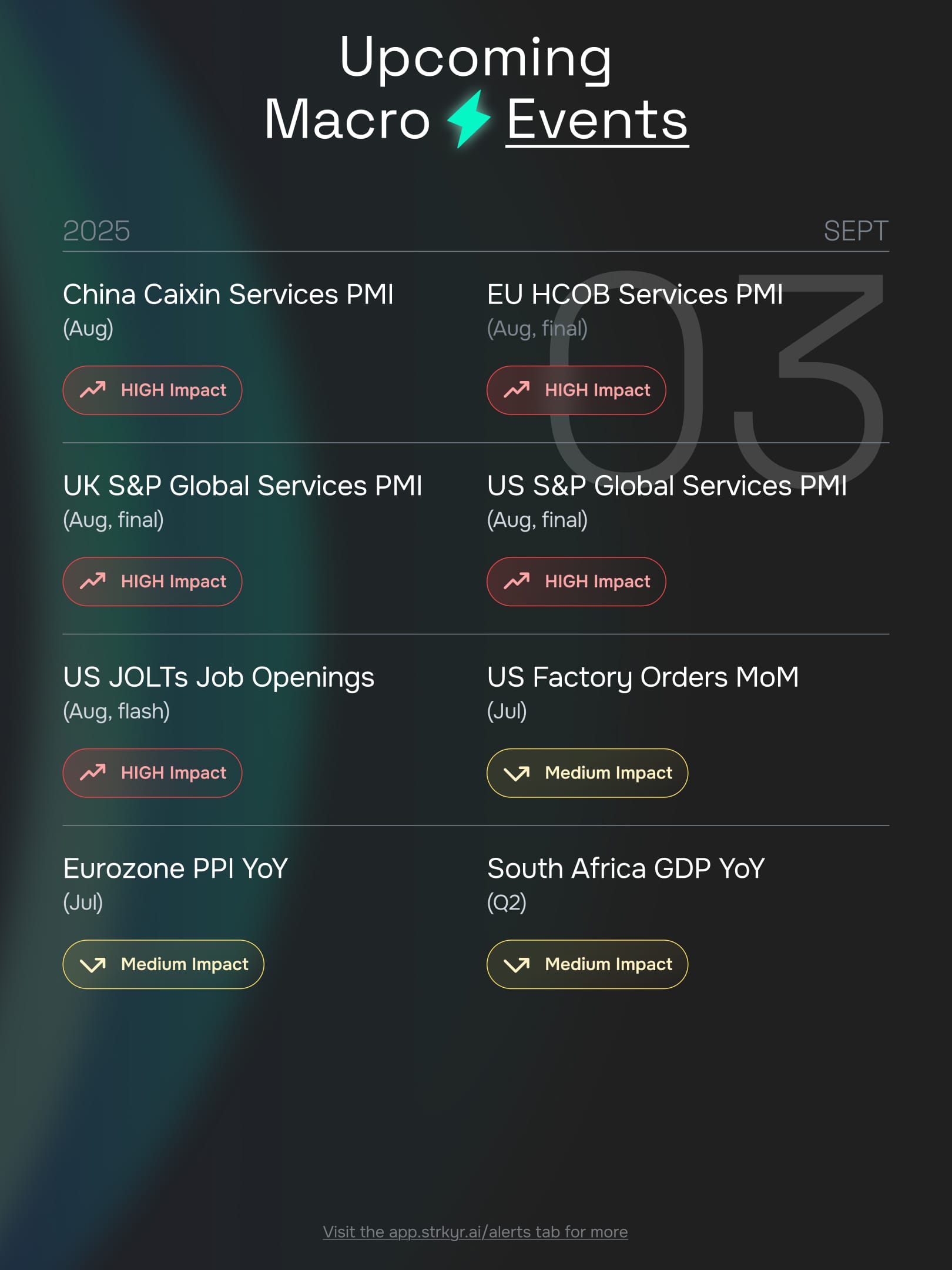

Macro Events

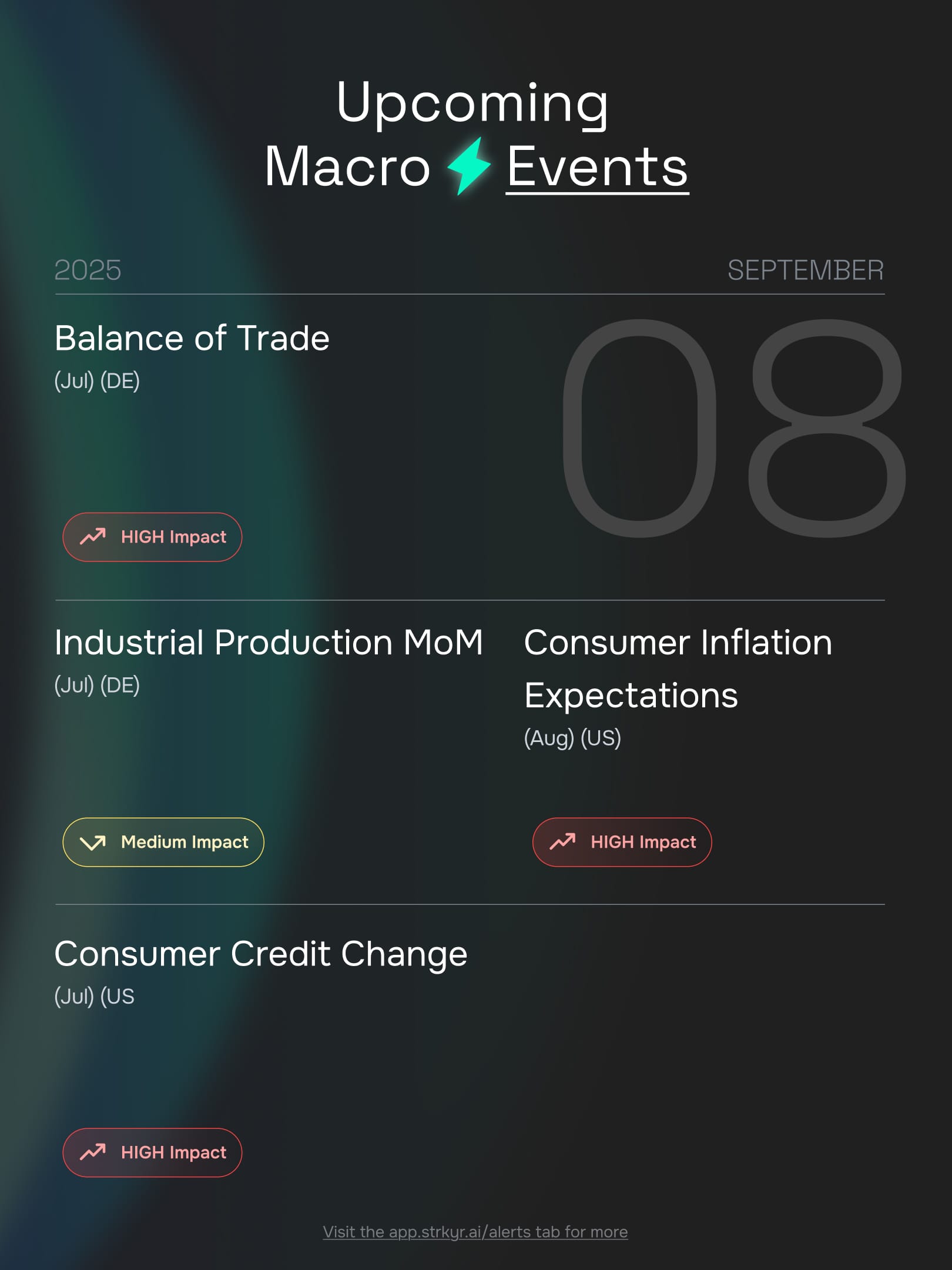

Markets head into the week with eyes locked on inflation and central banks. In the US, consumer inflation expectations and producer price data will set the tone. If households and businesses show signs of easing price pressures, traders will lean into the view that the Fed is positioned to cut before year-end. That backdrop would support the recent rebound in ETH and sustain speculative appetite across altcoins. On the other hand, any surprise to the upside risks reawakening dollar strength, keeping BTC pinned closer to current levels.

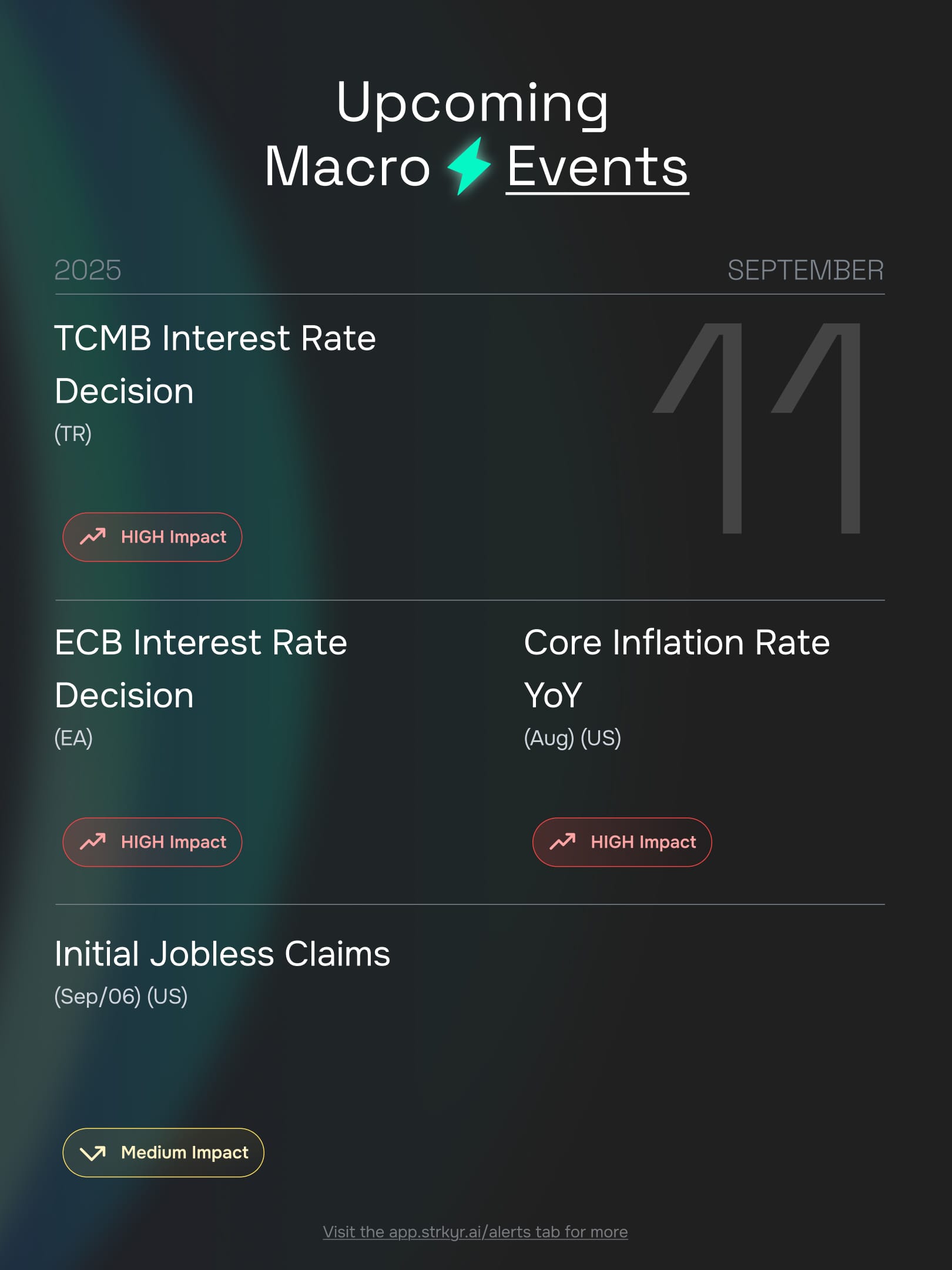

Midweek brings the ECB interest rate decision, a potential pivot point for global liquidity flows. The eurozone faces the delicate balance of weak growth but still-stubborn inflation. A dovish stance could pressure the euro and embolden the dollar, while even modest hawkishness would soften dollar momentum and indirectly benefit crypto markets.

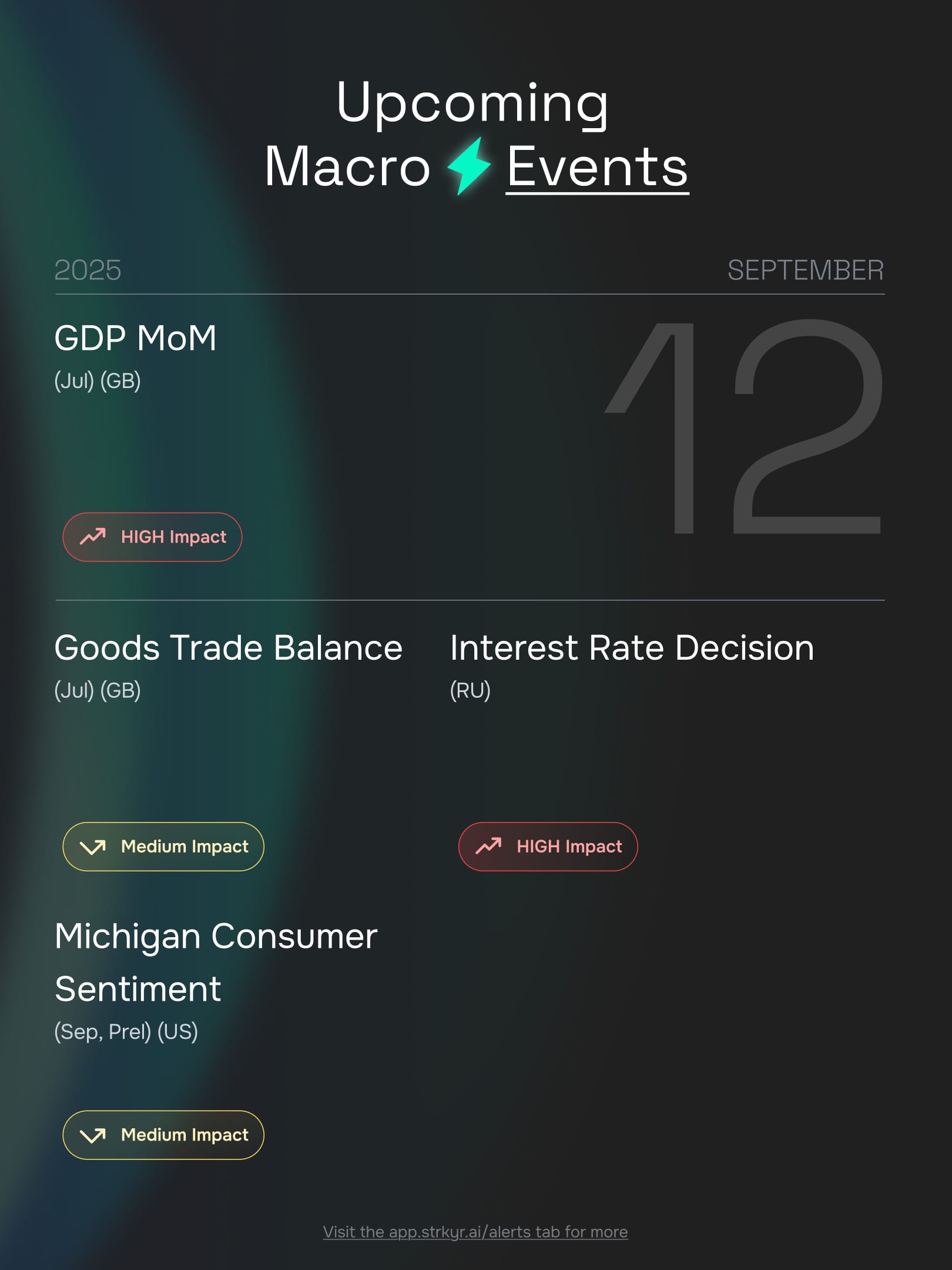

Taken together, the week is less about individual prints and more about the narrative they form. A string of softer inflation signals paired with a cautious ECB could fuel another leg higher for alts, while firmer data in the US might cap rallies and keep traders defensive heading into mid-September.

Coin Spotlight

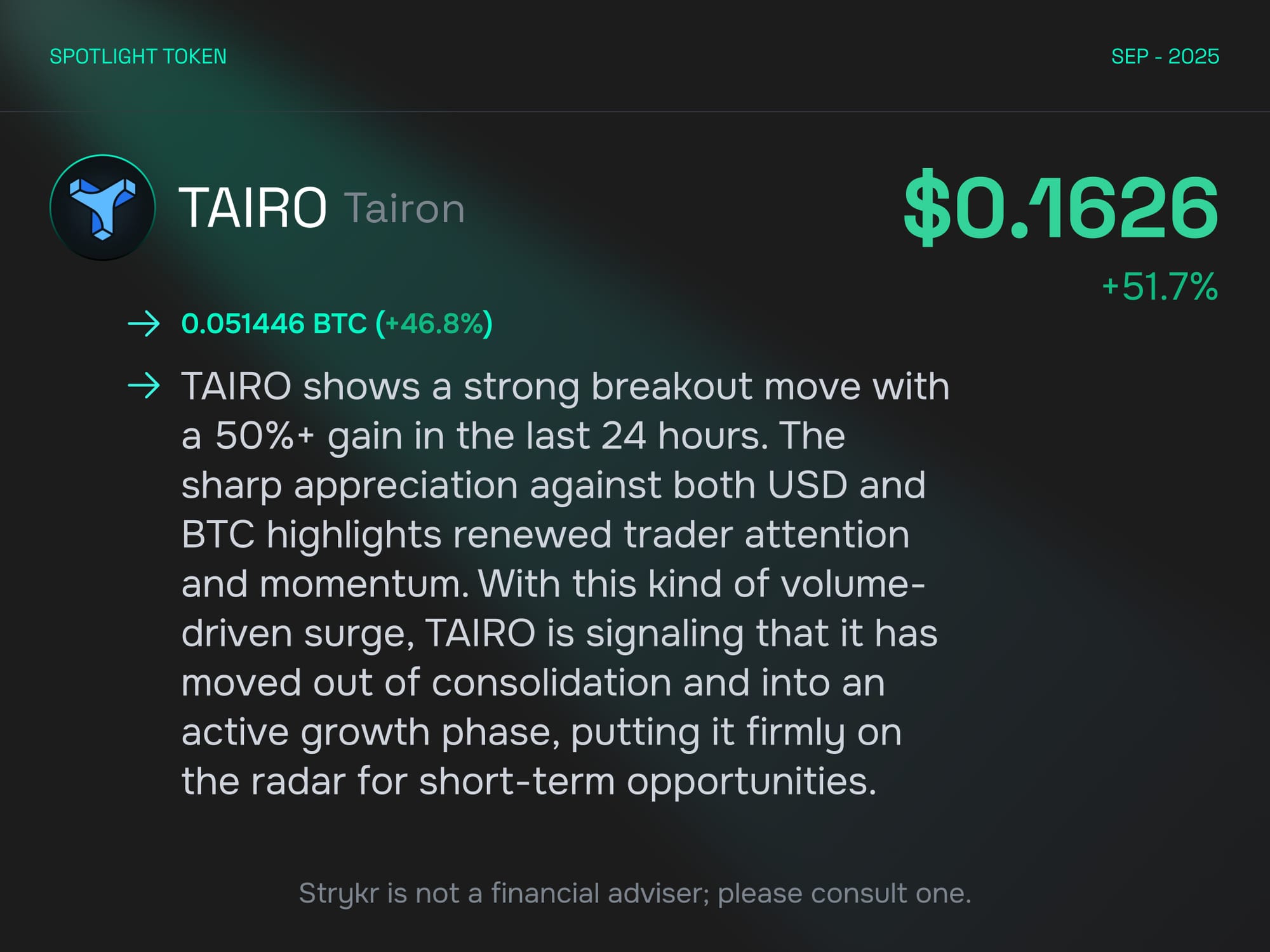

This week’s spotlight token is Tairo, which at the time of writing has surged more than 50 percent on fresh momentum and expanding development milestones.

Tairo surged with a breakout move, climbing more than 50 percent in the last twenty-four hours and trading at $0.1626. The sharp appreciation against both USD and BTC underscores renewed trader attention and volume-driven momentum. The move marks a transition from consolidation into a more active growth phase, establishing Tairo as one of the week’s most dynamic performers.

Momentum is not being fueled by price alone. Tairo recently achieved Integration number 100 with its Plasma Testnet v0.1, rolling out more than fourteen tools for gas estimation, transaction tracking, real-time monitoring, and simulation. These advancements tie directly into the project’s mission to become the first native crypto AI oracle, a goal drawing increasing attention across DeFi and AI-focused narratives.

The team has also teased significant developments in the near term, including the addition of new advisors and partners from multiple top fifty Web3 projects. With growing community engagement, strong signal activity, and speculative inflows, Tairo is drawing liquidity and focus ahead of these announcements.

For traders, the combination of technical breakout, expanding roadmap, and narrative positioning makes Tairo a clear candidate for continued short-term opportunity while also showing signs of building the foundation for longer-term relevance.

Last Week Today

Diving into what happened the previous week.

Market Pulse

The first week of September opened with markets settling into a cautiously constructive rhythm. Bitcoin hovered at $112,219, up 0.82 percent, maintaining a mild bullish momentum with RSI near 55. Ethereum rebounded to $4,465, a 3.62 percent weekly gain, supported by a neutral RSI of 53. Meanwhile, the U.S. Dollar Index (DXY) slipped to 98.16, down 0.24 percent, its RSI at 60 reflecting ongoing strength but with signs of softening.

This alignment set the tone: Bitcoin provided a floor of stability, Ethereum signaled renewed rotation potential, and the dollar’s modest retreat loosened financial conditions. Together these benchmarks hinted that liquidity remained intact, though growth jitters tempered exuberance. Altcoin signals spiked, showing traders selectively redeployed capital as majors held steady.

The overall pulse was one of balance. BTC’s steadiness, ETH’s recovery, and DXY’s easing created conditions for tactical alt rallies while broader momentum remained muted. It was a week of digestion rather than breakout, with markets positioning for the heavy macro calendar ahead.

Top 4 Tokens

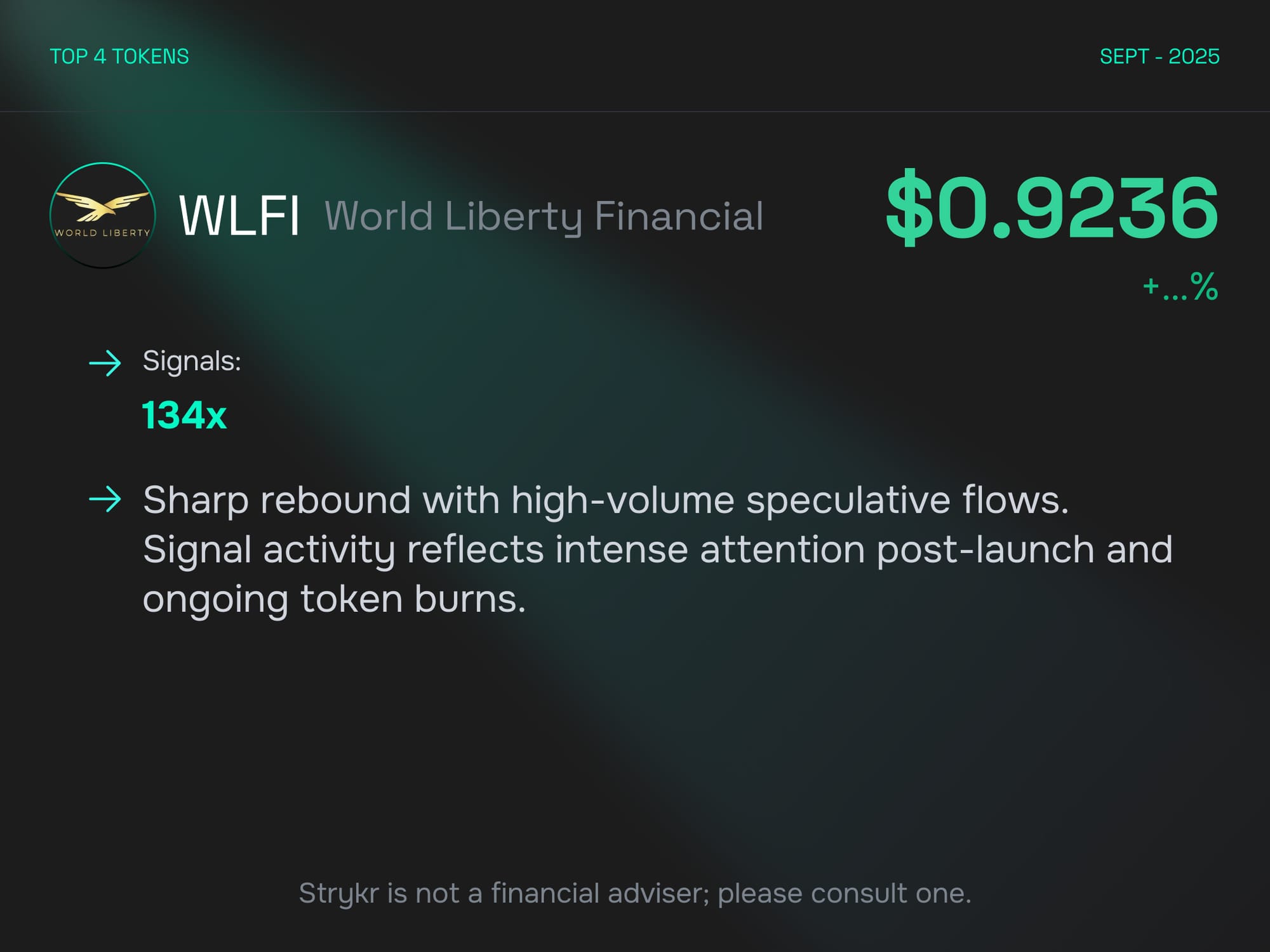

WLFI

WLFI remained one of the most pedigree names in the market, closing the week at $0.9236 after a string of sharp rebounds. The token’s 134x signal count underscored intense speculative flows, reflecting heavy turnover and liquidity chasing its narrative. Unlike majors, WLFI is still dominated by sentiment swings, and last week highlighted just how quickly traders cycle in and out of exposure.

The appeal here is narrative-driven rather than purely technical. WLFI has positioned itself at the intersection of hype, tokenomics, and political theater, which amplifies both its risk and upside potential. Ongoing token burns have provided a deflationary storyline that traders continue to latch onto, even when broader conditions look unstable.

Looking forward, WLFI’s liquidity profile ensures it will remain a trading magnet. For institutions it is too early to treat it as a core holding, but for retail and high-frequency traders, WLFI’s volatility makes it a natural vehicle for capturing short bursts of performance in uncertain weeks.

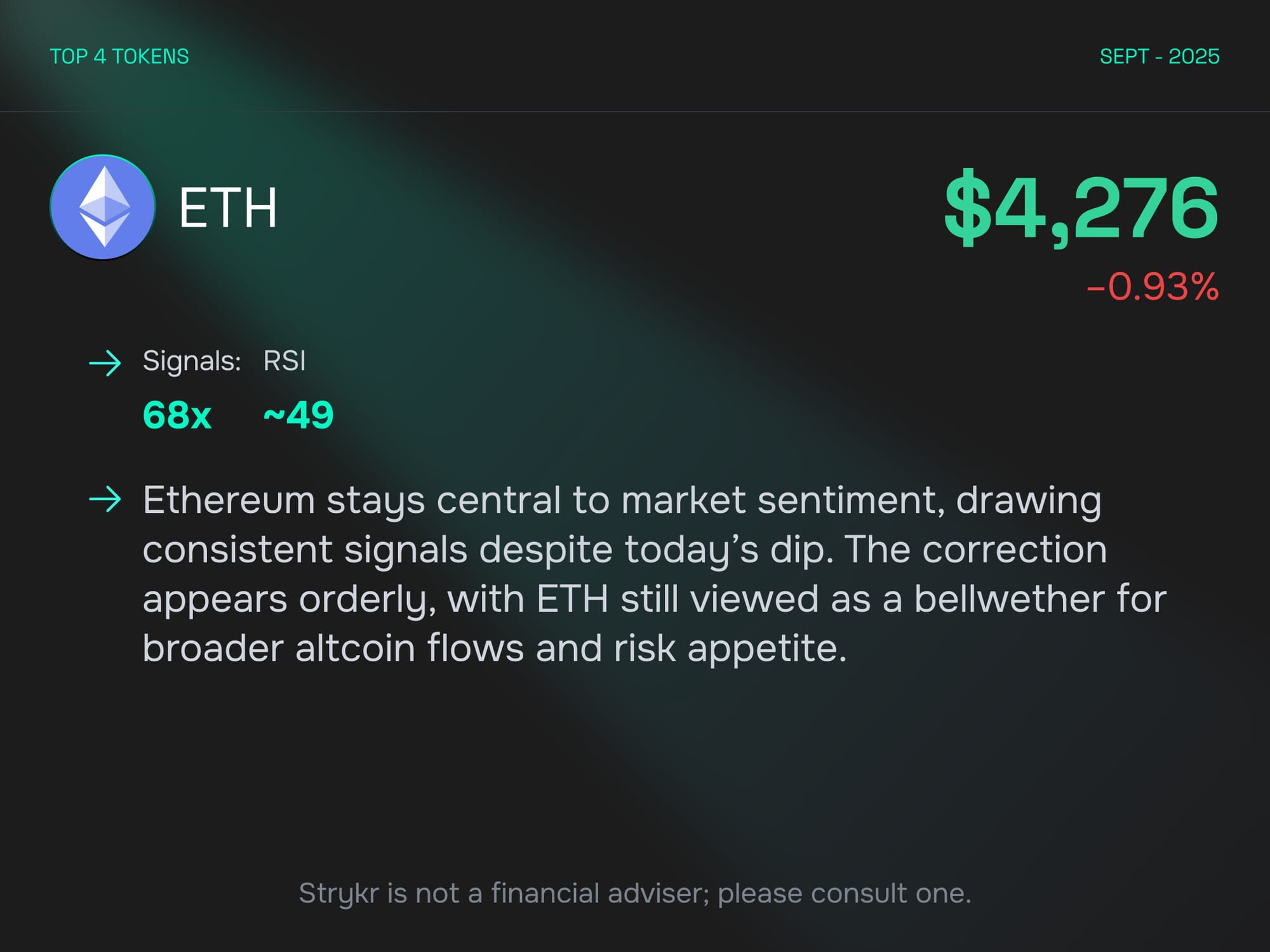

Ethereum

Ethereum held its role as the market’s compass, closing the week near $4,276 with 68x signals and RSI around 49. Despite a minor pullback, ETH reinforced its reputation as the structural anchor for crypto sentiment.

Price action clustered near key moving averages, showing orderly correction rather than weakness. Institutional flows remained active, with ETH volumes sustaining $60B+ levels, confirming consistent demand in both trading and DeFi ecosystems. Meanwhile, staking participation and Layer 2 activity kept Ethereum firmly at the center of broader altcoin positioning.

The takeaway is clear: ETH is absorbing liquidity without tipping into overheated territory. Traders continue to use ETH as the baseline for rotation, measuring broader risk appetite by how ETH reacts at these levels. Its resilience ensures that, even in weeks dominated by speculative tokens, ETH remains the critical gauge for crypto’s health.

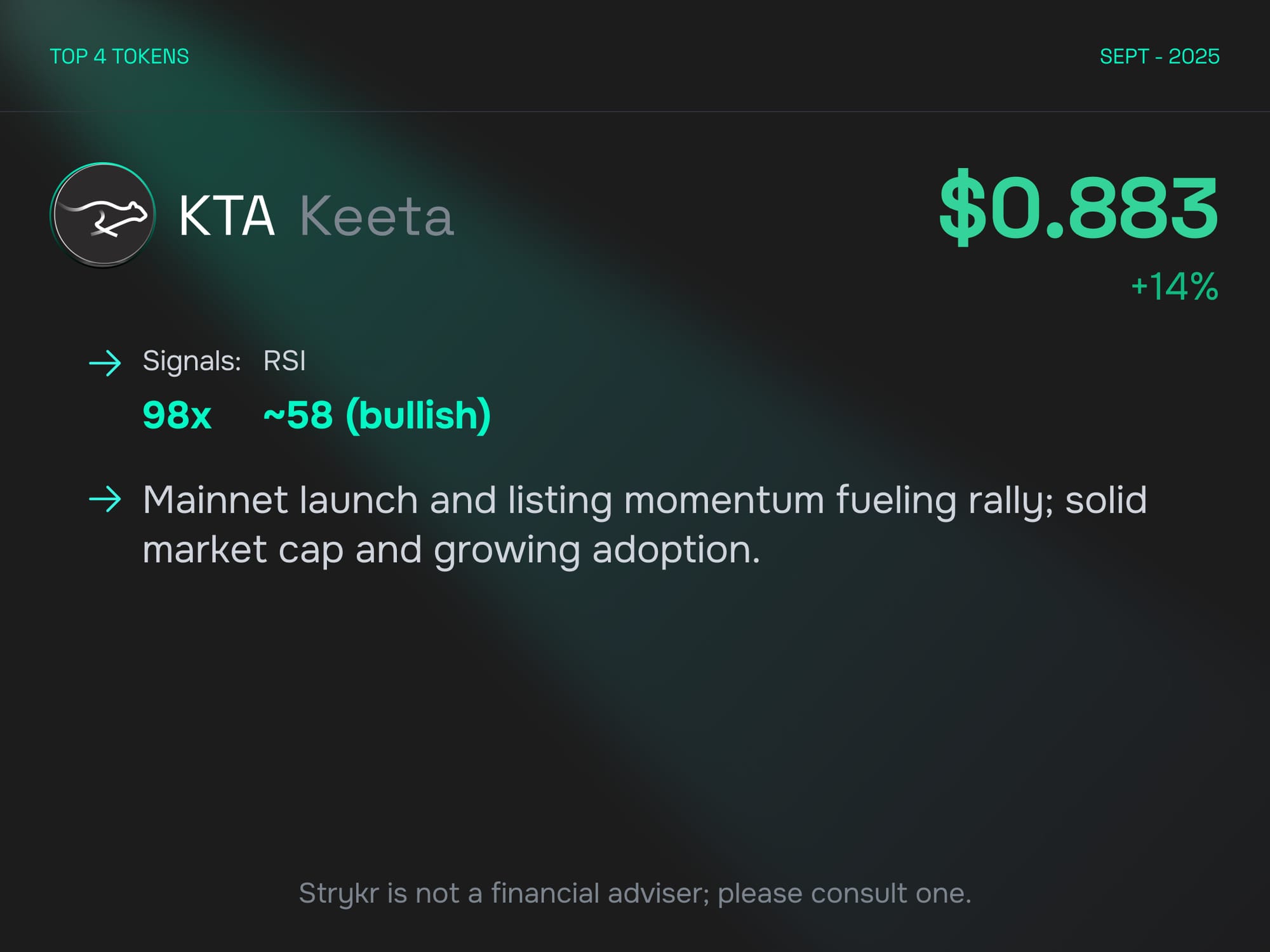

Keeta

Keeta delivered one of the most impressive rallies of the week, climbing to $0.883, up 14%, with signals at 98x and RSI showing bullish momentum near 58. The mainnet launch, combined with strong exchange listings, drove a wave of adoption that positioned KTA as the leading mid-cap mover.

The combination of fundamental traction and speculative excitement makes KTA unique among this week’s gainers. Its expanding liquidity base highlights growing confidence in the project’s sustainability, while the signal activity points to heightened participation from both retail and high-frequency trading desks.

Unlike pure hype tokens, KTA’s underlying adoption narrative gives it legs. Traders view it as a play with both immediate upside and long-term potential, making it one of the most balanced bullish bets this cycle. If momentum persists, KTA could transition from a breakout trade into a structural allocation in altcoin portfolios.

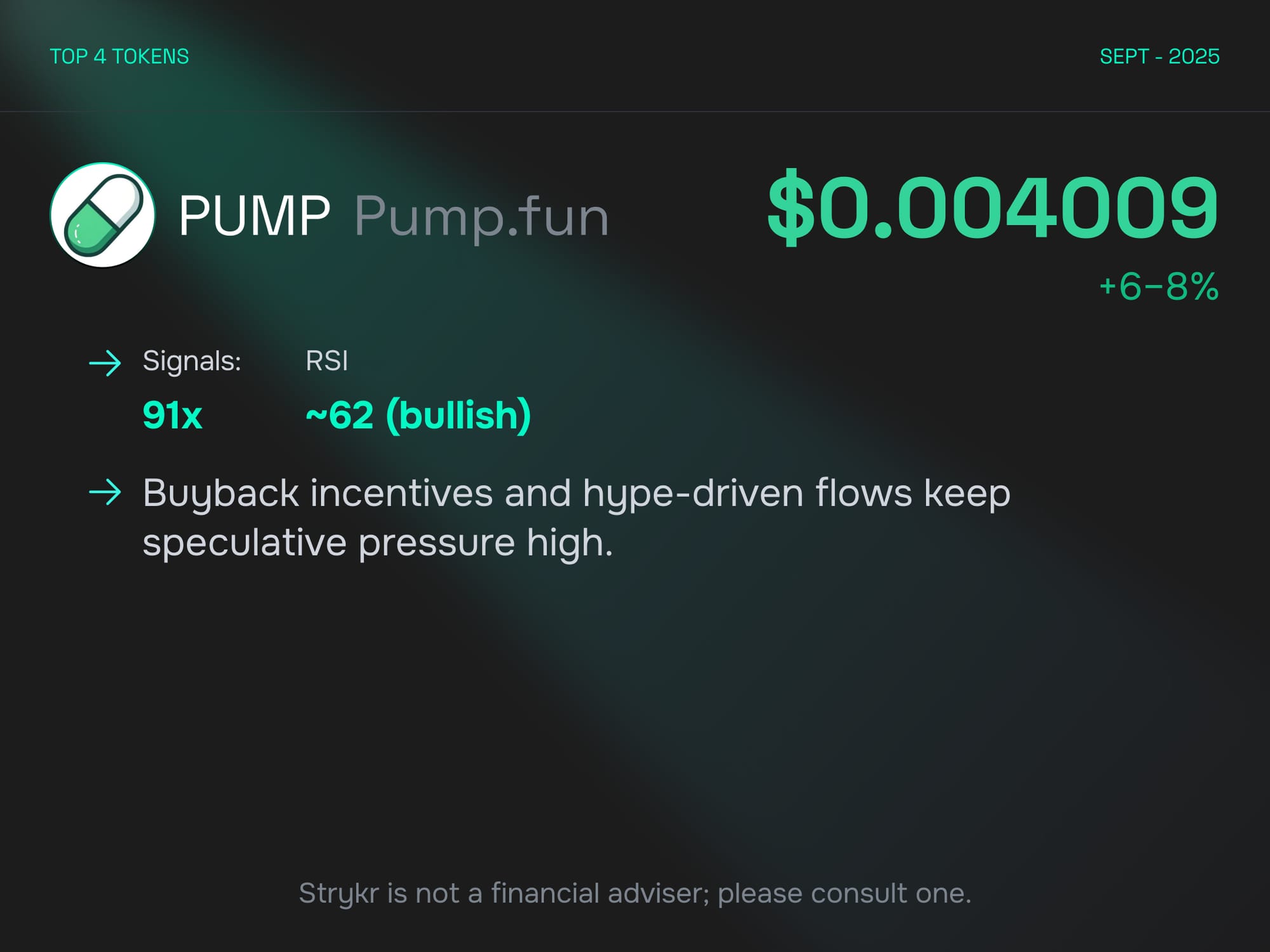

Pump

Pump.fun maintained its stronghold as the speculative heartbeat of Solana’s ecosystem. With 91x signals and a bullish RSI of 62, PUMP’s price advanced into the $0.0040 zone, supported by buyback incentives and relentless hype-driven flows.

Momentum traders continue to gravitate toward PUMP because of its sustained signal strength, which outpaces most other tokens in its class. The consistent presence of PUMP among the highest daily signal counts underscores deep speculative engagement that goes beyond a one-off spike.

For many traders, PUMP is the quintessential short-term momentum vehicle — volatile, liquid, and narrative-rich. Its ability to maintain position across multiple days of trading confirms its relevance. As long as buyback mechanics and speculative sentiment hold, PUMP will remain central to high-beta trading strategies.

Macro Events of the Week

The defining macro catalyst was the global PMI and CPI cycle. U.S. ISM Manufacturing held weaker than expected, while Eurozone CPI came in soft, and the RBA held rates steady. Together, these releases painted a picture of slowing growth but sticky inflation, reinforcing bets that global central banks may need to balance patience with dovish leanings.

For crypto, the message was constructive: softer inflation and weaker industrial output reduce the urgency of tightening, leaving space for liquidity to flow into risk assets. Traders responded by rotating into speculative altcoins, while ETH and BTC stabilized as the macro backdrop tilted slightly risk-on.

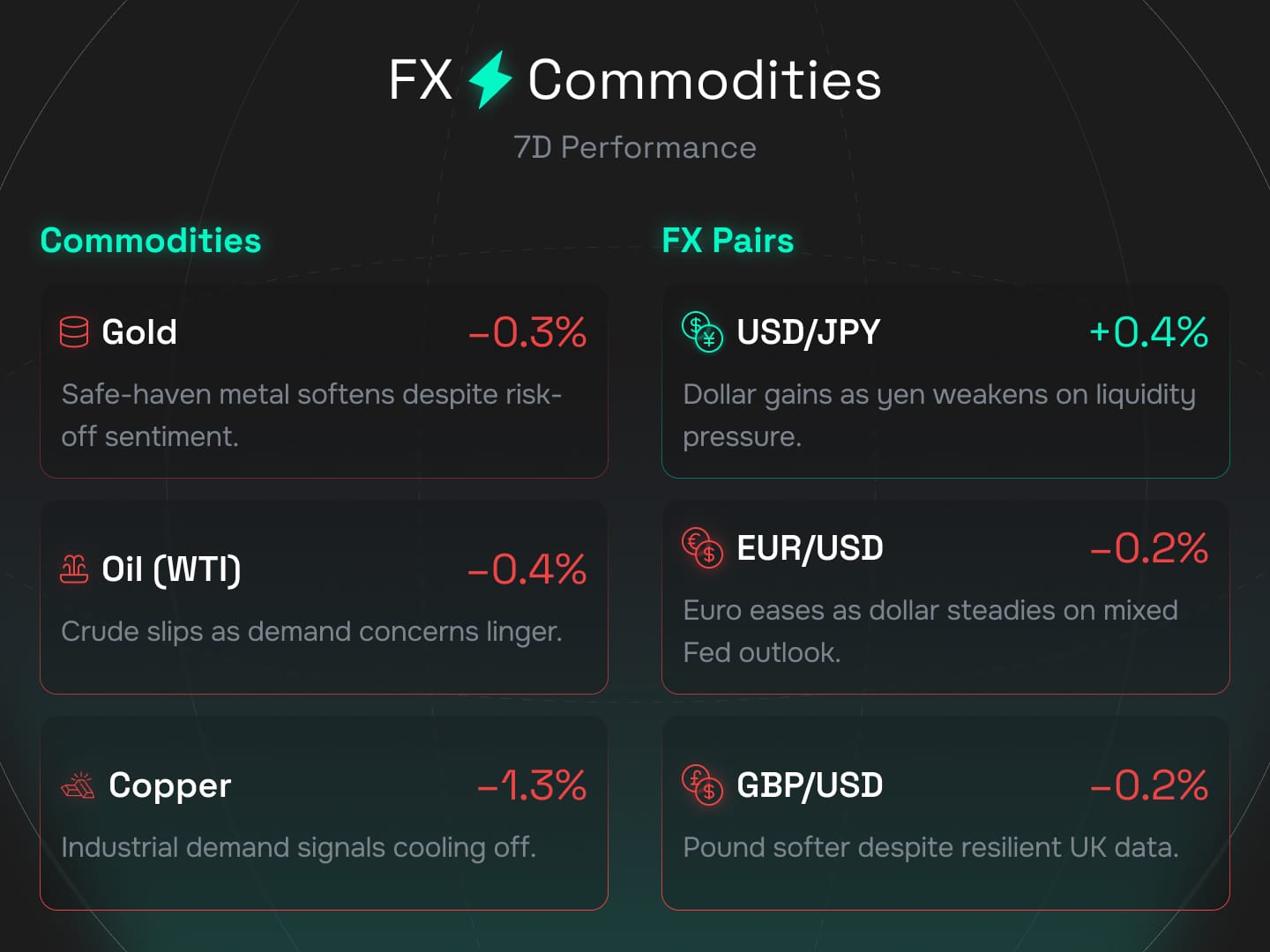

FX & Commodities

Cross-asset flows provided further nuance. Gold held firm near $1,950, adding 0.6% as safe-haven demand persisted. Copper rose 1.2%, signaling a tentative rebound in industrial activity, while oil inched up modestly after weeks of downward pressure.

In FX, USD/JPY weakened slightly as yen demand ticked higher, while EUR/USD rose 0.4% on dovish Fed bets. The marginal softness in the dollar provided a supportive backdrop for altcoins, particularly those already benefiting from rotation flows.

The blend of steady commodities and softer FX suggested global liquidity conditions were tilting constructive, aligning neatly with crypto’s rebound narrative.

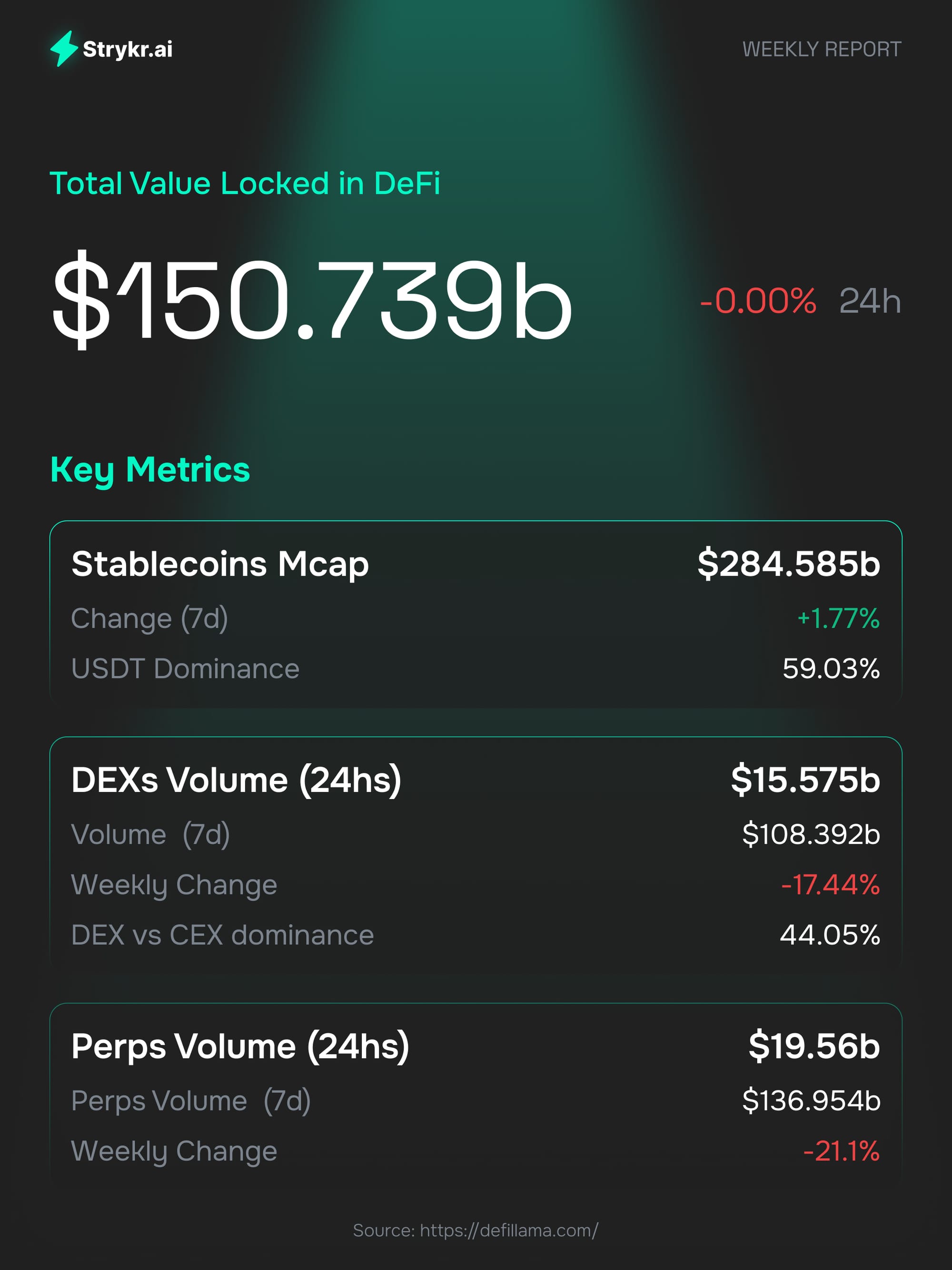

DeFi Metrics

DeFi fundamentals reinforced the sector’s strength. Total value locked finished the week at $153.7B, while stablecoin supply held steady near $277.8B with USDT dominance close to 60%. DEX activity grew 4% week-over-week, hitting $21.3B in daily volume, and perpetuals volume climbed to $31B, up nearly 5%.

Among protocols, Lido generated $22M in fees, Aave added $22.5M with $3.15M revenue, and EigenLayer continued its momentum with $1.5M in weekly fees. These figures illustrate that beyond speculative surges, DeFi activity remains sticky and robust.

DeFi continues to function as crypto’s backbone, weathering short-term volatility with steady growth in usage and fees. The structural story remains bullish, even as token prices ebb and flow.

Strykr AI View

The first week of September highlighted a market in balance: BTC stable near $112K, ETH holding as the compass, and DXY softening modestly. This backdrop allowed altcoins to take center stage. WLFI emerged as the clear speculative leader, ETH reinforced structural confidence, KTA surged on adoption momentum, and PUMP dominated high-beta trading.

Macro data leaned dovish, commodities and FX aligned with risk-on flows, and DeFi metrics showcased resilience. Together, the picture is one of cautious optimism: stable anchors with room for selective, aggressive plays.

Execution outlook: ETH remains the high-conviction anchor, WLFI the speculative standout, KTA the balanced growth play, and PUMP the tactical momentum trade. September will hinge on inflation prints and Fed commentary, but for now, the rotation backdrop favors altcoins.

That wraps up Edition No. 1. Next week we’ll track inflation prints, central bank decisions, and how altcoins position into mid-September. Stay tuned, and thank you for reading Strykr.ai Weekly.