Market Pulse

Markets are beginning the week in consolidation mode, with Bitcoin trading at $112,219 (-0.35%) and RSI near 55, holding ground after last week’s pullback. ETH slipped to $4,173 (-0.62%) with RSI around 53, reflecting balanced momentum as price action stabilizes at mid-range levels. The Dollar Index (DXY) edged up to 97.49 (+0.11%) with RSI at 61, underscoring continued dollar firmness and modest pressure across risk assets.

The story for traders is one of recalibration. BTC defending the $112K zone is crucial, as this level now acts as the short-term pivot for broader sentiment. A clean hold here signals resilience despite dollar strength, while any break lower risks shaking out the recent base. ETH’s softer move highlights digestion rather than structural weakness, as positioning resets after a strong early-month performance.

Altcoin flows remain sensitive to majors. Last week’s rotation has cooled, but capital is poised to re-enter if BTC and ETH maintain stability. For now, liquidity remains cautious, with selective narratives still finding traction but broad risk appetite on pause.

Macro remains the real driver. Inflation prints in the US and central bank commentary out of Europe and the UK will frame the next leg. A softer inflation tone could provide fuel for majors to rebound and altcoins to re-engage, while stronger data may reinforce dollar dominance and cap upside in the near term.

The takeaway: consolidation, not capitulation. BTC and ETH are anchoring in stable ranges, while the dollar keeps pressure in play. Traders are watching closely, waiting for macro clarity to decide whether this week sets up a fresh breakout or extends the cooling period into late September.

Macro Events

The week ahead brings a heavy calendar that could set the tone for global risk sentiment.

Monday (Sept 22): Consumer confidence numbers out of Turkey and Canada’s PPI kick things off, with both acting as early reads on inflation and sentiment. The Eurozone’s consumer confidence flash is the first high-impact event of the week, while BoE Governor Bailey’s speech may shape expectations for sterling heading into Thursday’s GDP and inflation focus.

Tuesday (Sept 23): The data load intensifies with Eurozone composite PMI flash, U.S. services and manufacturing PMI, and Fed Chair Powell speaking. Any downside surprise in PMIs would amplify fears of a slowdown, while Powell’s tone will be scrutinized for how quickly the Fed is willing to lean into cuts. Together, this day has the potential to set the global risk tone for the rest of the week.

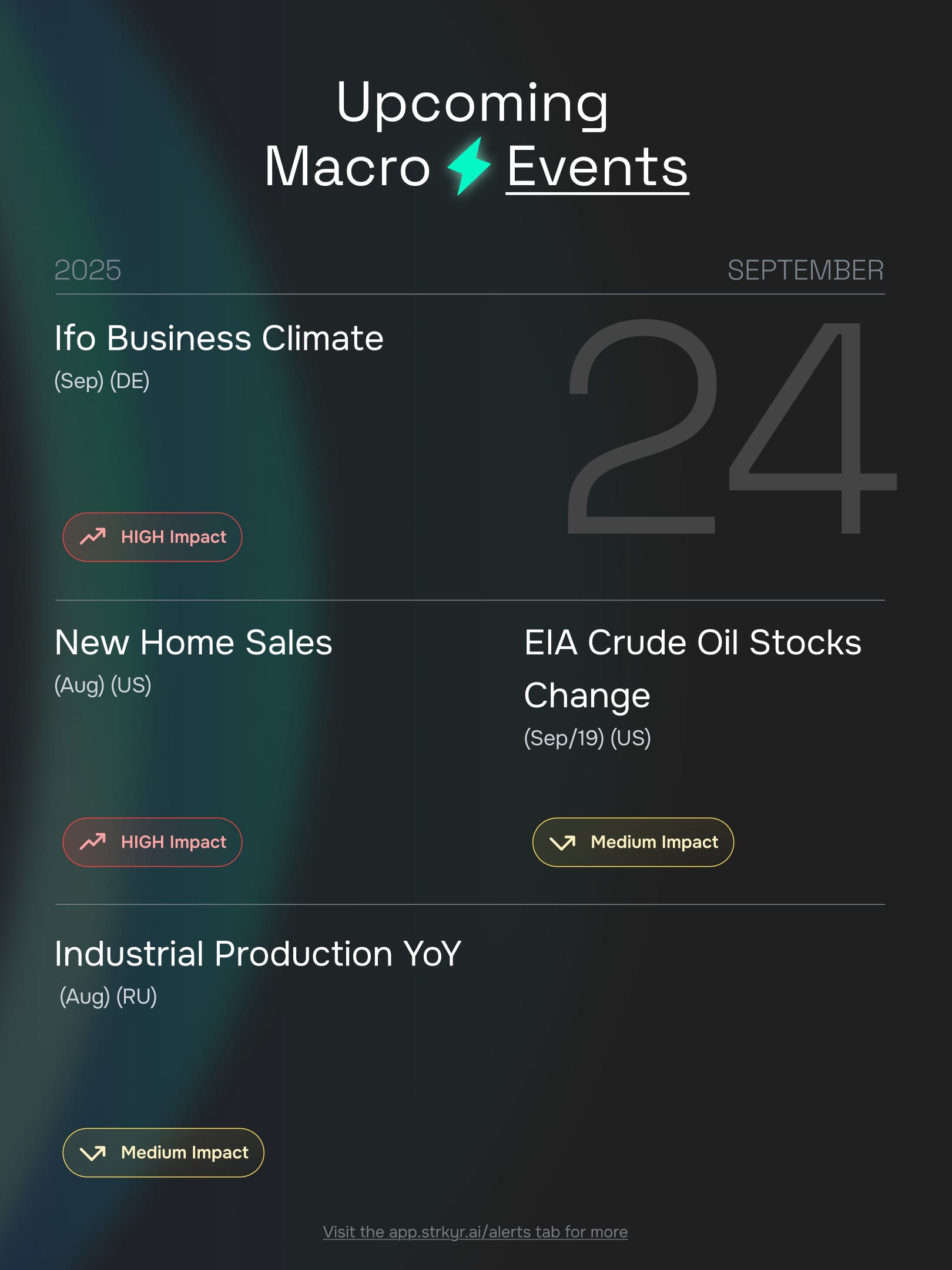

Wednesday (Sept 24): Focus shifts to Europe and the U.S. with Germany’s Ifo Business Climate and U.S. new home sales. Both are high-impact indicators that can sway risk appetite if business confidence or consumer demand softens further. Energy markets will watch U.S. crude oil stock changes, while Russia’s industrial production release adds another layer to the global growth picture.

Thursday (Sept 25): U.S. GDP growth (final) is the key event, alongside durable goods orders. Mexico’s interest rate decision could ripple through emerging market FX. Japan’s Tokyo CPI is another important check on inflation trends in Asia. Traders will be watching whether the U.S. data confirms resilience or signals deeper cracks in consumption.

Friday (Sept 26): A packed end to the week with U.S. core PCE, the Fed’s preferred inflation gauge, and the University of Michigan’s consumer sentiment final. Both are high-impact and will anchor the market narrative heading into October. China’s industrial profits release rounds out the week, providing another check on whether the world’s second-largest economy is stabilizing or still under pressure.

Takeaway: The data cadence is relentless, spanning confidence, growth, housing, and inflation. If prints lean soft, the dovish pivot narrative will gain traction and give crypto breathing room. Firmer data or hawkish central bank tones could put the dollar back in the driver’s seat, capping risk assets.

And this is not even half of what is on deck. You can find the full calendar of upcoming macro events directly inside our app.

Coin Spotlight

Story (IP) continues to command attention, trading just under $14 after weathering a modest pullback. Daily trading volume near half a billion underscores that this is not a thin market move but one supported by consistent participation across both institutional desks and retail momentum chasers. With a market cap above $4.3B, IP is positioning itself less as a speculative side play and more as a structural part of the mid-cap landscape.

What makes IP stand out is its liquidity profile. Unlike many newer entrants that surge on hype but struggle to hold volume, IP has maintained steady flows, suggesting traders see it as a reliable vehicle for capital rotation. The depth in its order books has allowed it to absorb volatility without losing structural integrity, a key sign that the token is becoming a favored instrument for both directional bets and short-term liquidity plays.

Narrative strength is also at play. Story’s branding as a network asset with broad exposure has resonated, giving it both speculative traction and longer-term positioning potential. As alt rotation picks up, IP’s ability to combine high turnover with market depth puts it in a unique spot: a token that traders can pile into without worrying about thin liquidity or runaway slippage.

The takeaway: Story (IP) has graduated into the category of tokens that matter beyond one-week momentum. For traders, its blend of size, liquidity, and consistent signal activity makes it a name to track closely as September unfolds.

Last Week Today

Diving into what happened the previous week.

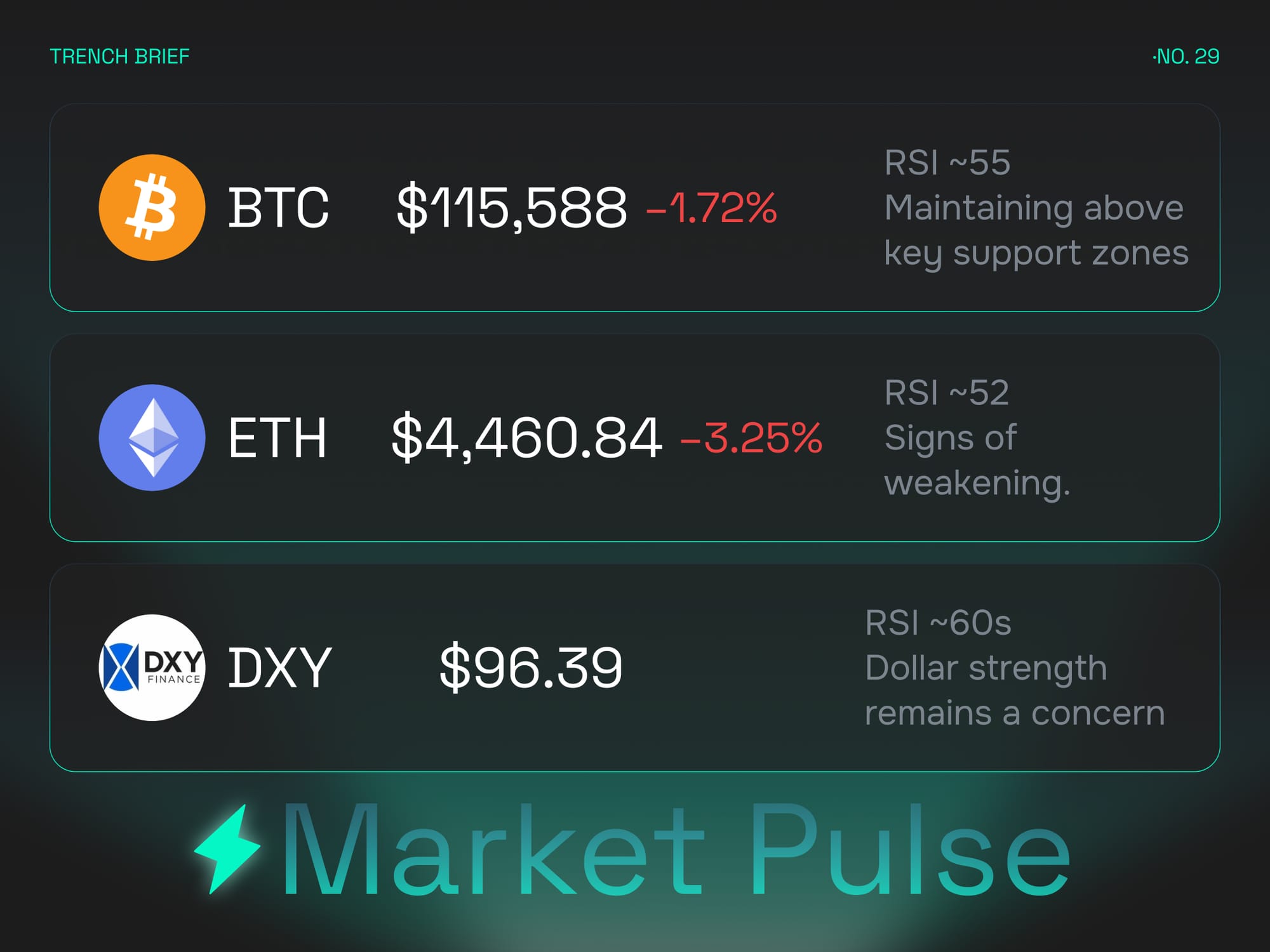

Market Pulse

The second full week of September leaned more defensive, with BTC slipping 1.7% to $115,588 and holding RSI near 55 as buyers defended support zones. ETH tracked lower, retreating 3.2% to $4,460 with RSI softening to 52, signaling waning momentum after an early September rebound. Meanwhile, the dollar index (DXY) firmed to 96.39, its RSI anchored in the 60s, reinforcing a mildly bullish tone that applied subtle pressure across risk assets.

The picture was less about breakdowns and more about digestion. BTC maintained its role as the structural floor, while ETH showed the first signs of fatigue after weeks of steady inflows. DXY’s renewed strength kept upside capped, forcing traders to rotate capital with more caution. Altcoin signal counts stayed elevated, but activity tilted toward shorter bursts of speculation rather than broad-based rallies. The overall pulse was one of consolidation, as markets adjusted positioning ahead of a heavy macro week.

Top 4 Tokens

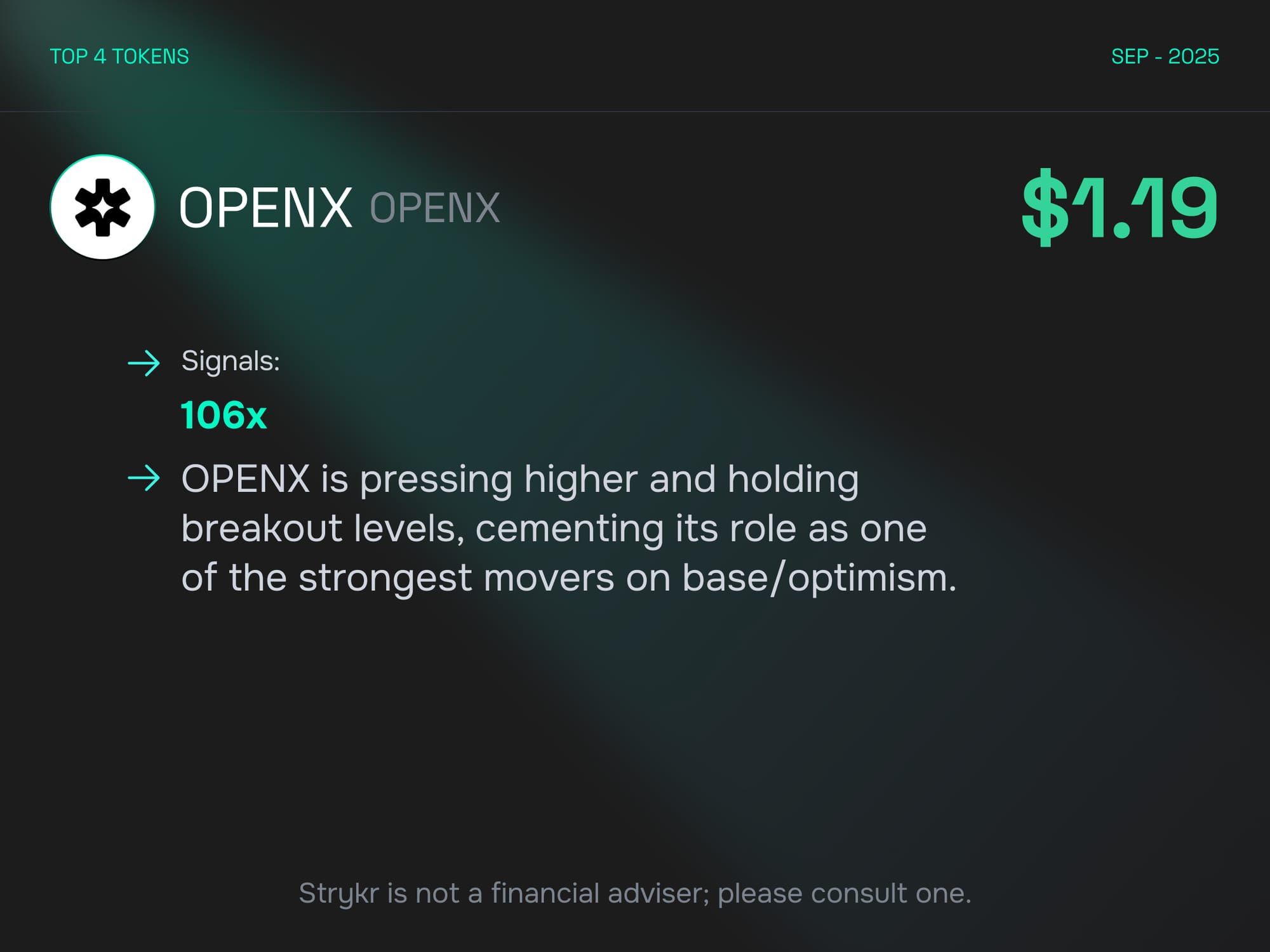

OPENX

OpenX advanced to $1.19 with 106x signals, pressing higher and consolidating breakout levels on Base/Optimism. This performance reflects both its technical strength and the structural bid behind activity on L2 ecosystems. OpenX has begun to separate itself from one-off speculative names, showing the ability to hold gains even as broader sentiment cooled. The strong signal activity underscores robust turnover, while steady price action points to disciplined participation. OpenX remains one of the cleanest breakout trades in the market, and as long as Base/Optimism flows continue, it is well positioned to capture sustained attention.

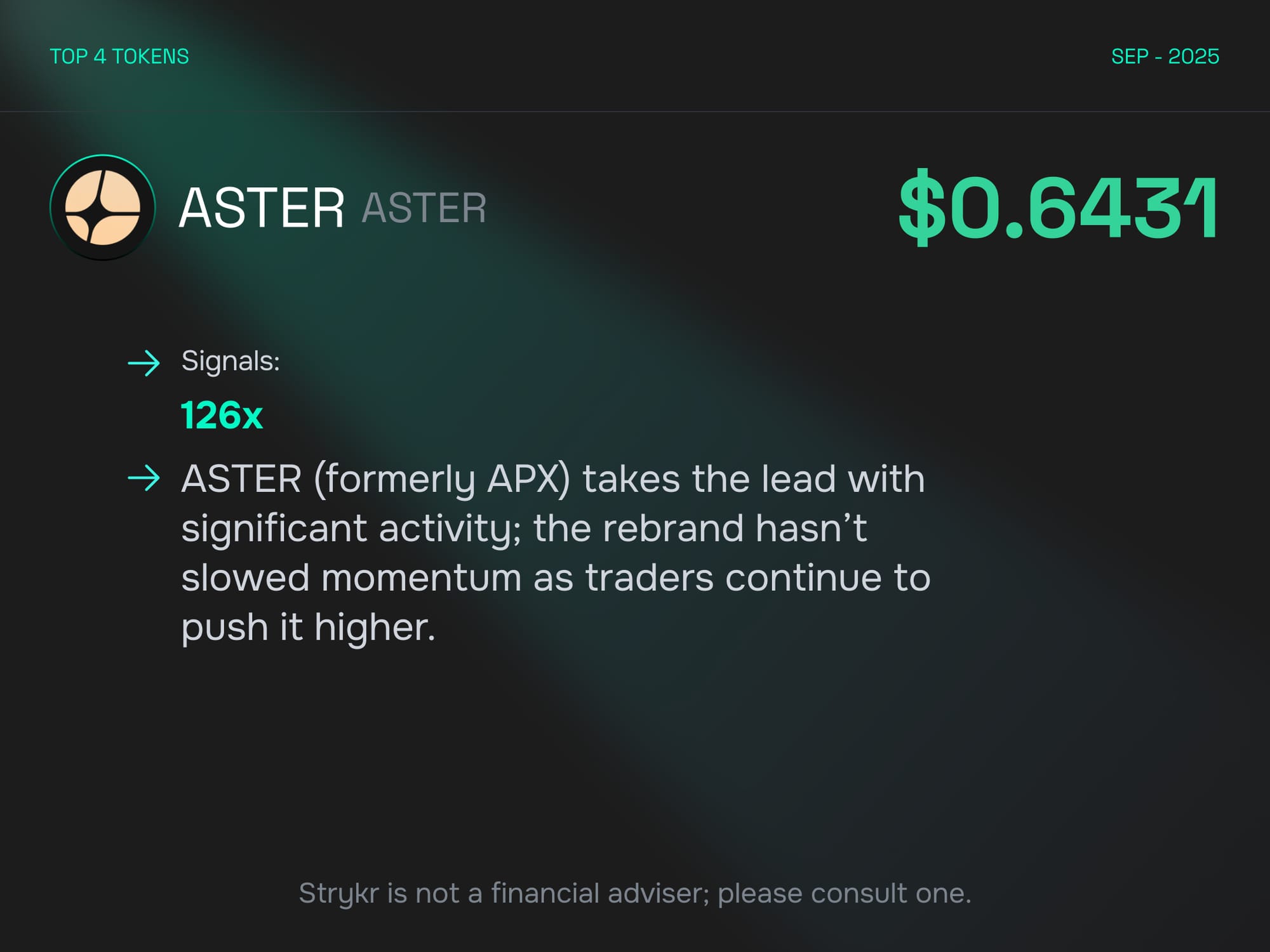

ASTER

Aster (formerly APX) closed the week at $0.6431 with a commanding 126x signals, leading the field in activity. The rebrand has not slowed momentum; in fact, traders appear to be treating the transition as a catalyst rather than a hurdle. Sustained demand and strong turnover suggest Aster is maturing into more than just a speculative rebound story. Its consistency across multiple sessions points to deeper participation, with both retail traders and larger desks rotating in. For now, Aster is positioning itself as a mid-cap bellwether, capturing liquidity in a way that mirrors how prior cycles produced standout tokens early in their rebrand phases.

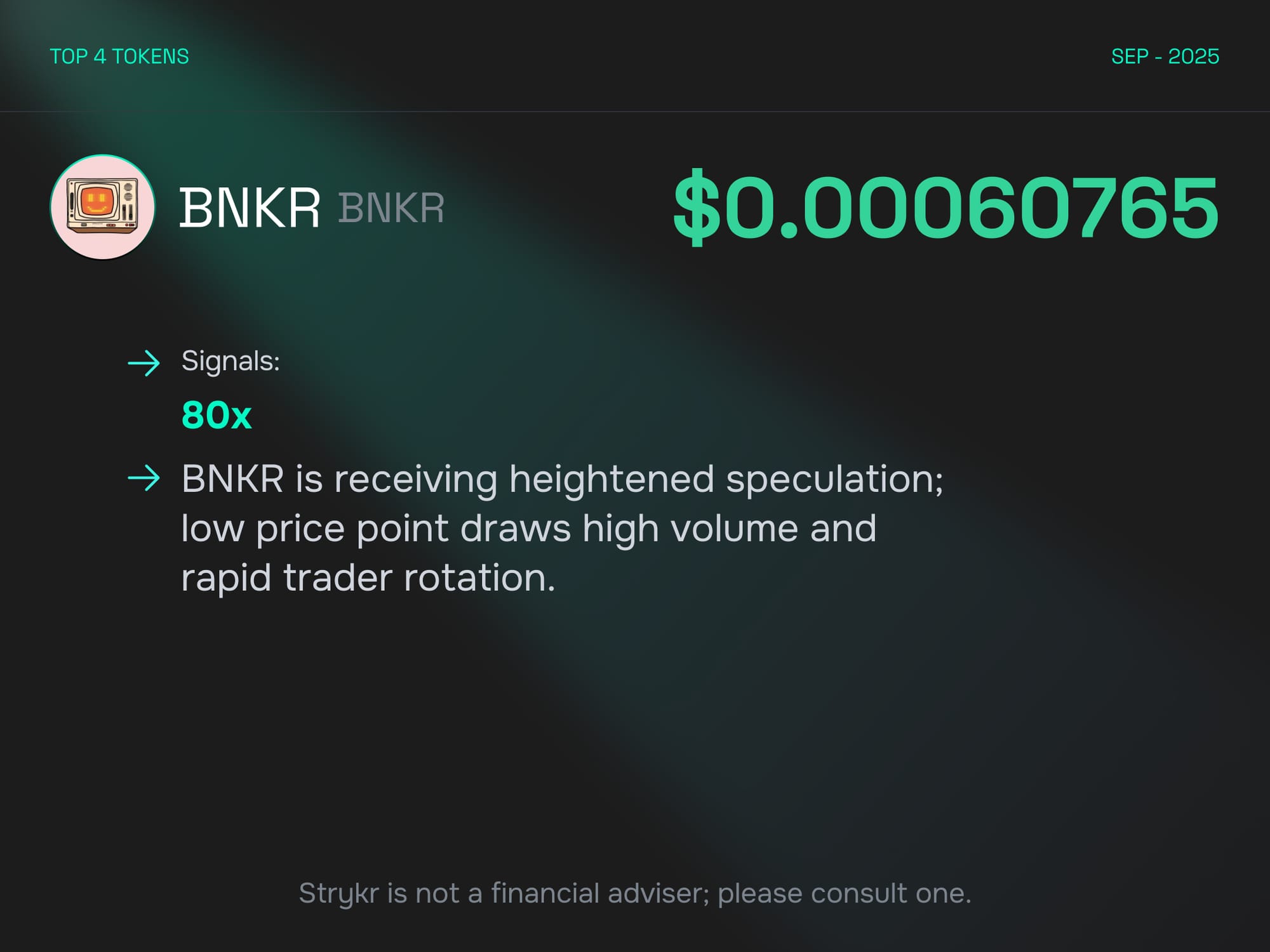

BNKR

BNKR ended the week at $0.00060765 with 80x signals, once again proving its appeal as a high-volume rotation token. Its extremely low price point creates a natural draw for speculative traders, who cycle in and out quickly, driving rapid liquidity churn. The heightened signal activity confirms that BNKR continues to attract significant traffic despite its microcap profile. While its valuation remains modest, its liquidity velocity makes it one of the most tradable tokens in the current market. BNKR thrives in weeks of indecision, when traders seek quick, tactical exposure, and last week’s activity reinforced that dynamic.

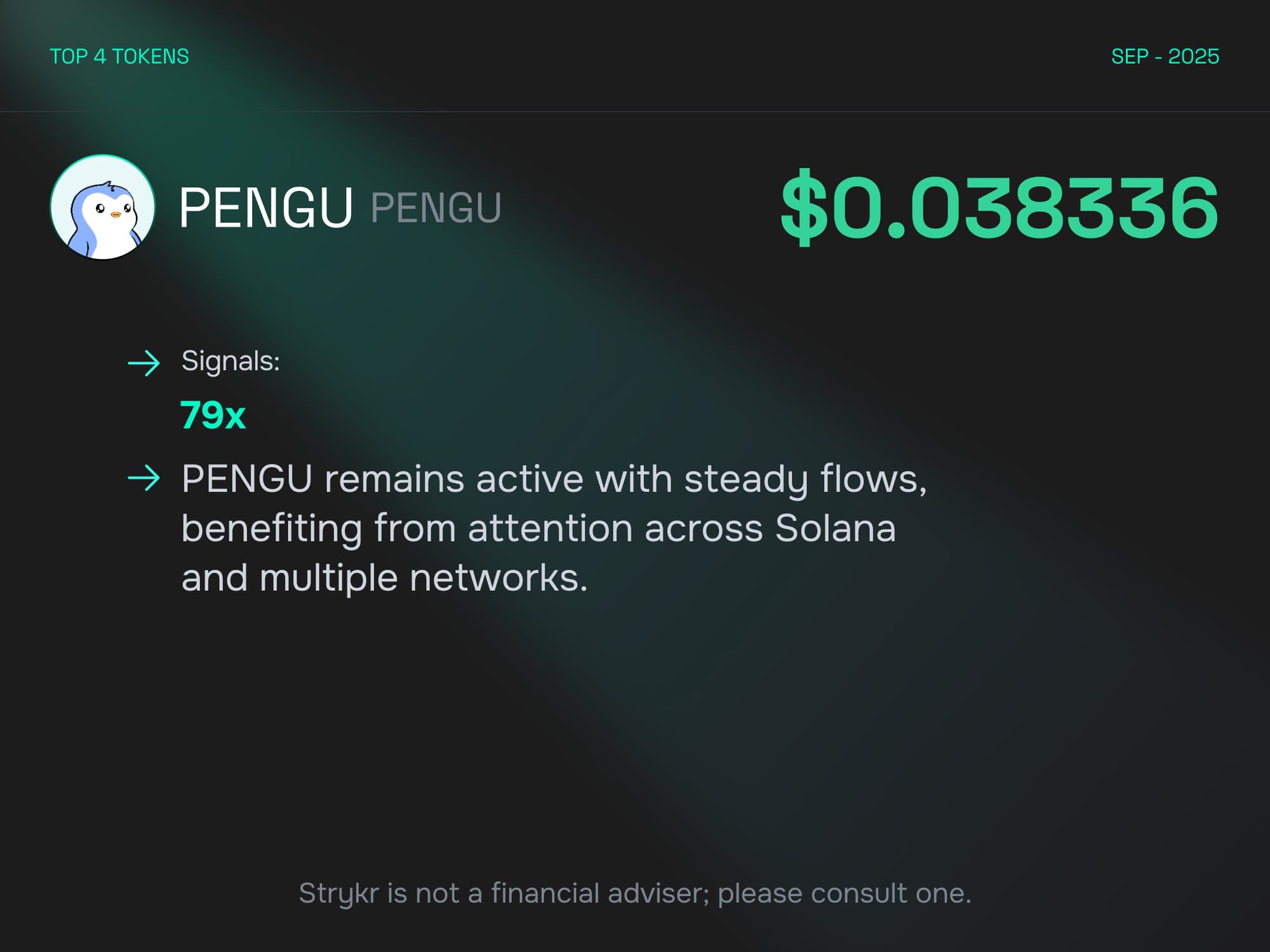

PENGU

PENGU traded at $0.0383 with 79x signals, maintaining steady flows across Solana and other networks. Its ability to sustain relevance across ecosystems sets it apart from many peers in the small-cap space. Traders continue to gravitate toward PENGU for its combination of meme-driven visibility and multi-chain engagement. While not the week’s most explosive mover, its stability reflects a loyal base and consistent turnover. For traders looking for exposure to Solana narratives without chasing extreme volatility, PENGU remains a go-to option. Its staying power confirms that it is more than a passing fad, even as broader market conditions ebb and flow.

Macro Events: September 15-19

The macro slate was stacked, and every print carried weight for crypto. UK unemployment and inflation numbers added pressure on the pound, while the ZEW index revealed a deteriorating Eurozone outlook. Across the Atlantic, US retail sales data came in firmer than expected, bolstering the Fed’s case to remain cautious on cuts.

This week, eyes are on UK inflation and the Bank of England’s rate decision. If inflation undershoots expectations, the BoE has cover to pivot dovish, softening the pound and boosting risk appetite. But if inflation remains sticky, rate hawkishness will keep GBP under strain, strengthening the dollar by default.

For crypto, it comes down to how much oxygen the dollar leaves in the room. Softer prints in the UK and Canada could take some edge off USD strength, fueling relief in alts. On the other hand, another round of firm data risks extending dollar dominance and keeping BTC pinned near support. Macro is not an afterthought this week, it is the main driver of whether the rebound sticks or stalls.

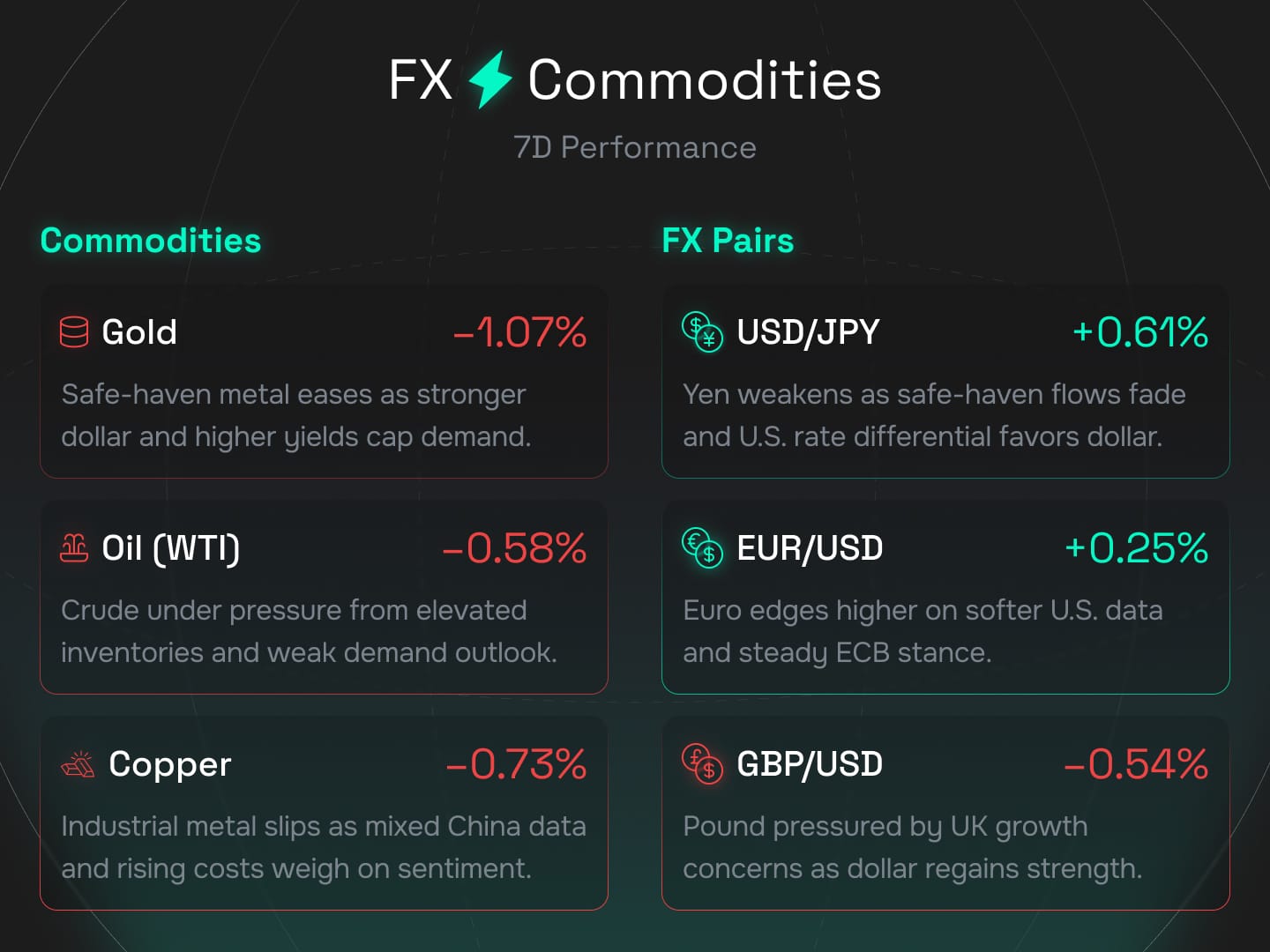

FX & Commodities

Cross asset flows underscored the broader risk tone. Gold slipped 1.07% as higher yields capped demand, while oil (-0.58%) and copper (-0.73%) both weakened on soft demand and mixed China data. Commodities are flashing a message of caution: growth jitters are still alive, and safe haven demand is not enough to offset stronger dollar conditions.

In FX, USD/JPY rose 0.61% as yen weakness persisted, EUR/USD ticked up 0.25% on softer US data, and GBP/USD slid 0.54% under growth concerns. The takeaway is straightforward: dollar resilience remains the theme, even as cross currents play out in Europe and Asia. This backdrop keeps crypto capped on the upside, but it also prevents a major breakdown. The dollar is strong, but not surging uncontrollably.

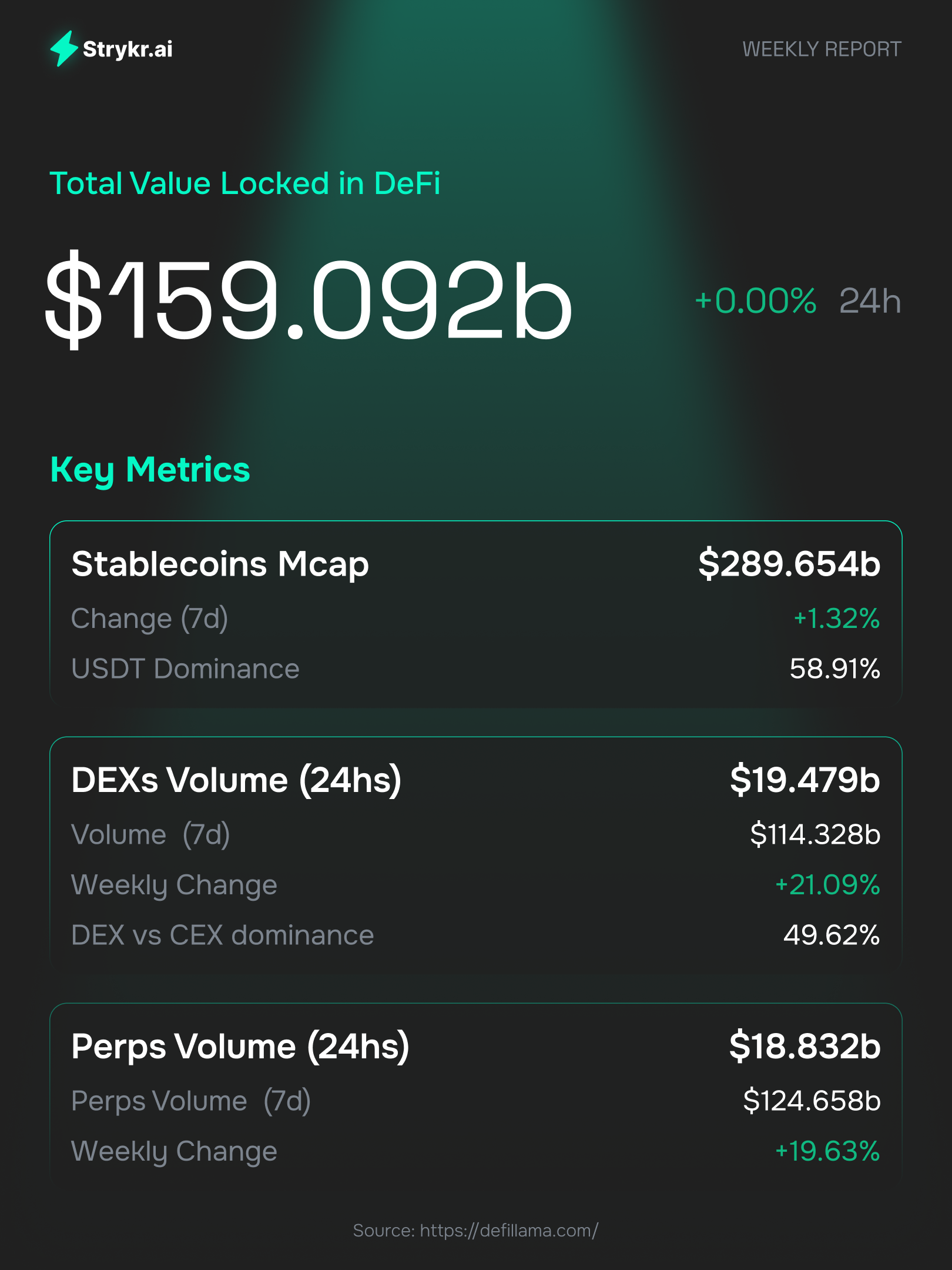

DeFi Metrics

DeFi fundamentals stayed resilient. Total value locked held at $159.1B, with stablecoin supply climbing to $289.6B (+1.32%). USDT dominance remains near 59%, underscoring tether’s role as the sector’s anchor. DEX volumes rose to $19.5B daily (+21%), while perps surged to $18.8B (+19%).

The data tells the same story we saw last week: DeFi is sticky. Volumes are expanding even when majors cool, showing that traders are staying active within decentralized rails. For protocols, this means revenue streams remain intact, and for traders it means liquidity is available even in choppier conditions. The structural backbone of crypto continues to strengthen, setting the floor for the next leg of risk appetite.

Strykr AI View

Last week painted a mixed picture: majors softened, the dollar stayed firm, and macro added new pressure points. But under the hood, altcoins continued to rotate, DeFi activity remained robust, and speculative favorites kept turnover high.

Execution outlook: ETH remains the high conviction anchor, Aster is the breakout leader, OpenX is the L2 momentum play, BNKR provides speculative velocity, and PENGU is the steady cross chain driver. Macro remains the swing factor. If inflation data softens and the dollar eases, altcoin rotation will accelerate. If not, expect more chop with liquidity clustering around breakout names.

That wraps up Edition No. 3: Next week we will track US CPI, central bank decisions in the UK and Japan, and whether altcoin momentum can sustain into late September. Stay tuned, and thank you for reading Strykr.ai Weekly.