Market Pulse

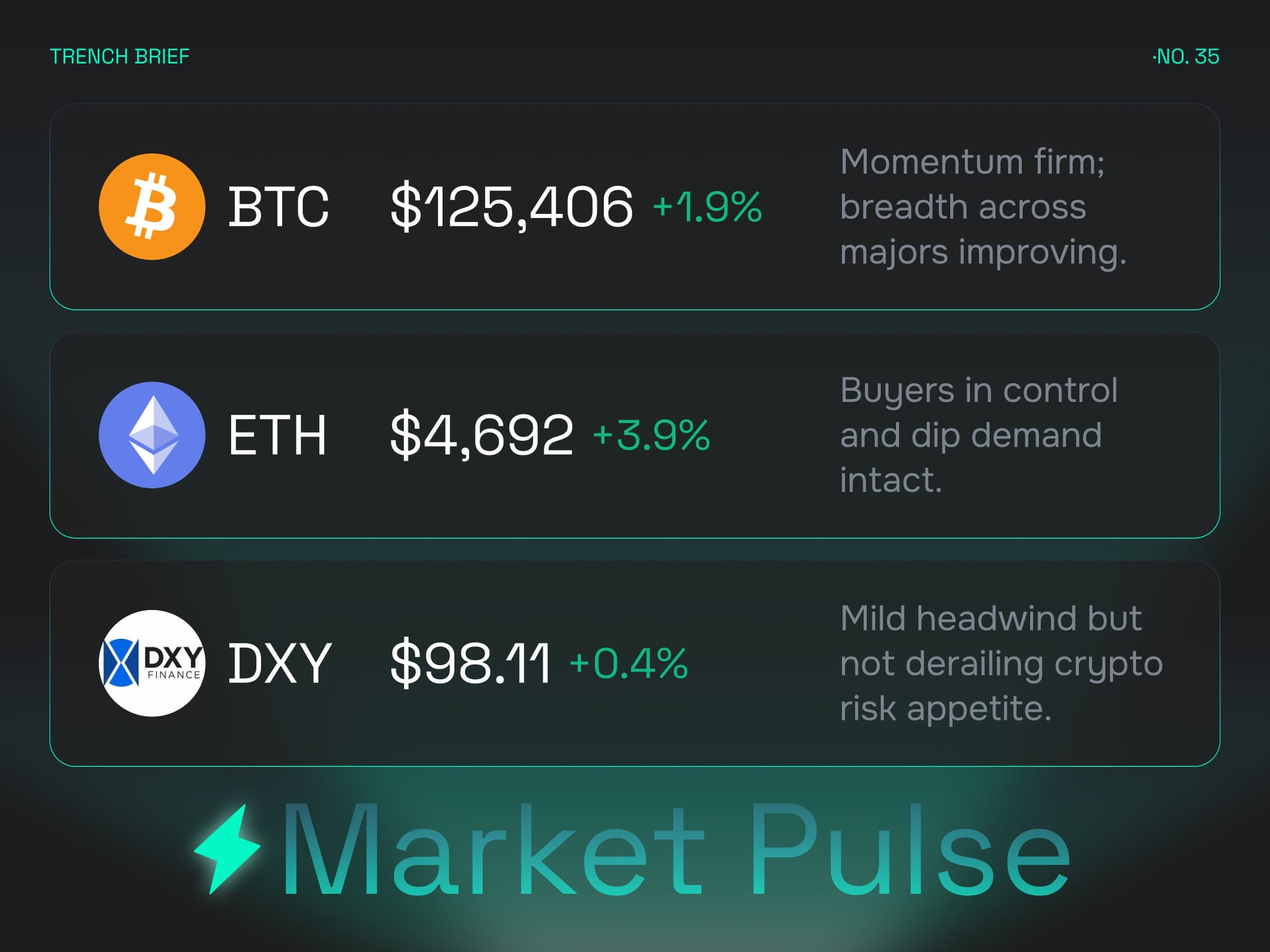

Markets are starting the week with renewed strength as crypto continues to push higher. Bitcoin is trading around $125,406 (+1.9%), showing firm momentum and improved breadth across majors. Ethereum has climbed to $4,692 (+3.9%), with buyers clearly in control and dip demand intact. The Dollar Index (DXY) has edged up to 98.11 (+0.4%), posing a mild headwind but not enough to derail crypto risk appetite.

The tone across the market is confident but measured. BTC’s clean break above the 120K range has opened the door for further upside, while ETH’s renewed strength continues to lead capital rotation into high liquidity pairs. The structure of the rally remains healthy, with spot demand leading and leverage still contained. That combination gives bulls room to extend the move without immediate overheating.

Altcoin participation is improving as liquidity begins to flow more evenly across mid and large caps. Rotation remains tactical, but the shift in sentiment is clear. Traders are again positioning for continuation rather than defense, especially as broader risk sentiment stays constructive.

Macro conditions are still the silent driver in the background. The dollar remains resilient, but its gains have slowed, giving crypto space to breathe. This week’s data slate, centered on inflation and labor updates, will determine whether the current breakout has legs or fades into consolidation.

The takeaway: momentum is back, breadth is widening, and the dollar’s uptick has yet to slow crypto’s push. BTC and ETH are leading cleanly, with risk appetite improving across the board. Traders will watch closely to see if upcoming macro data confirms the shift from recovery to full acceleration.

Macro Events

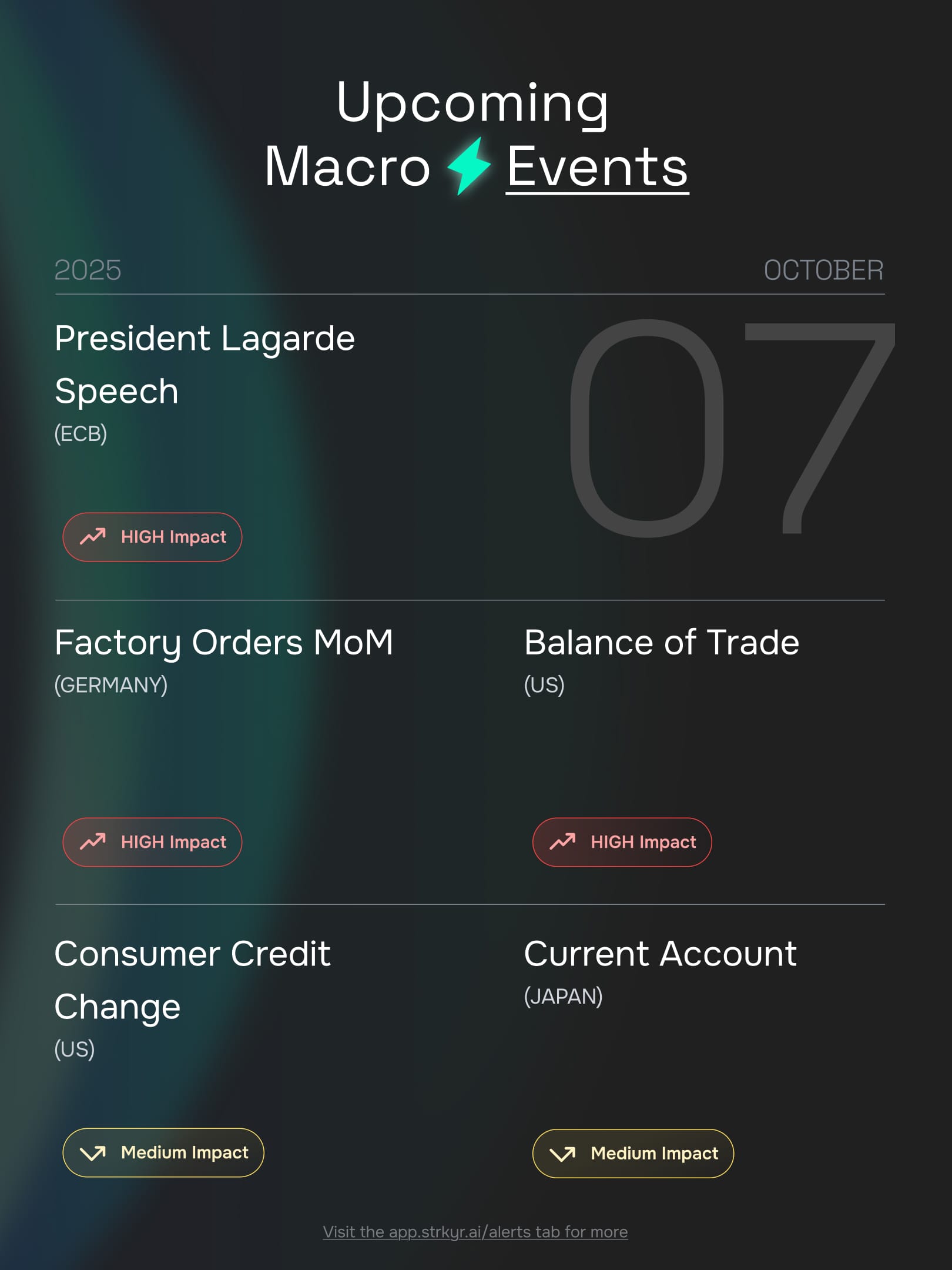

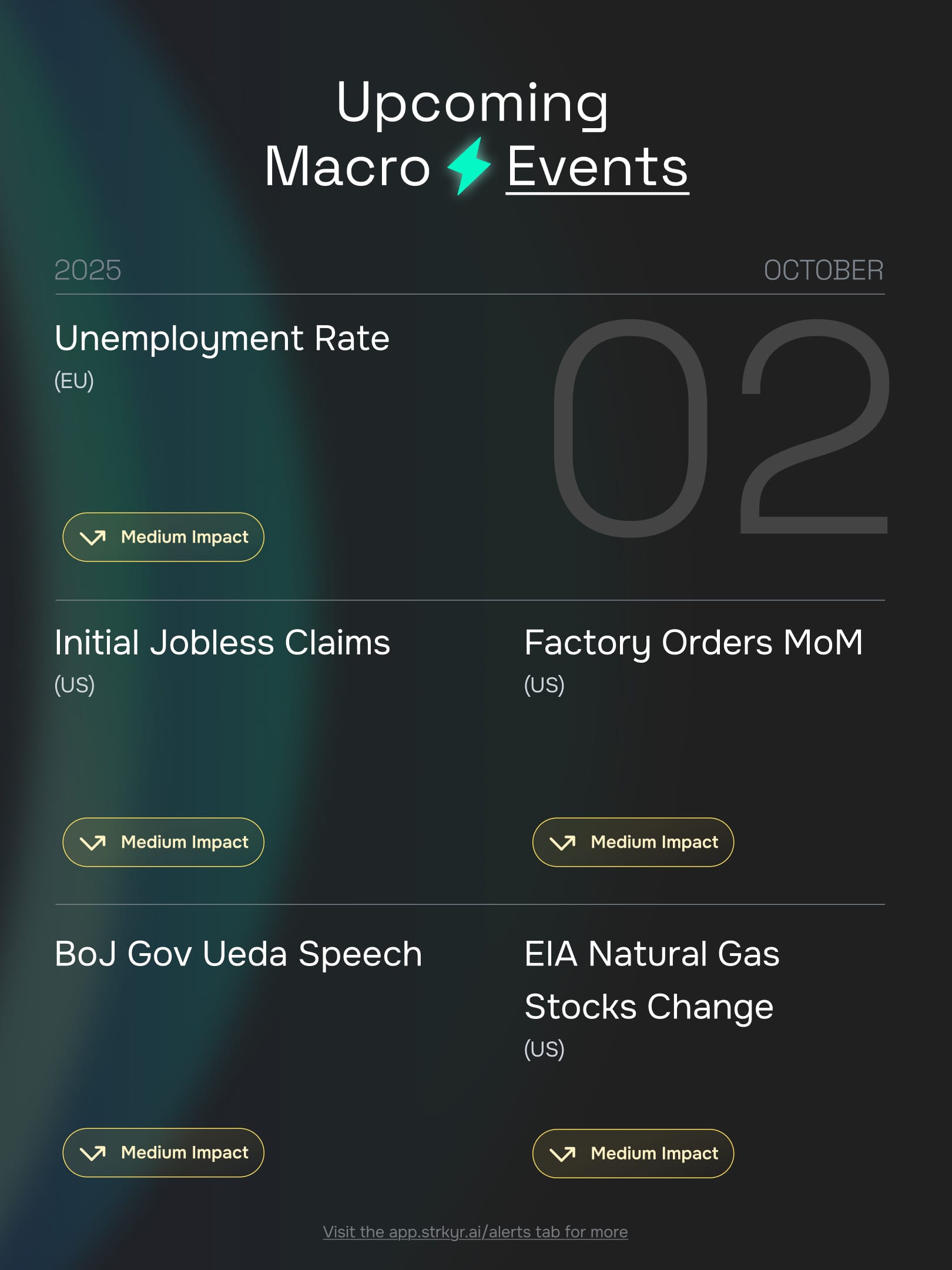

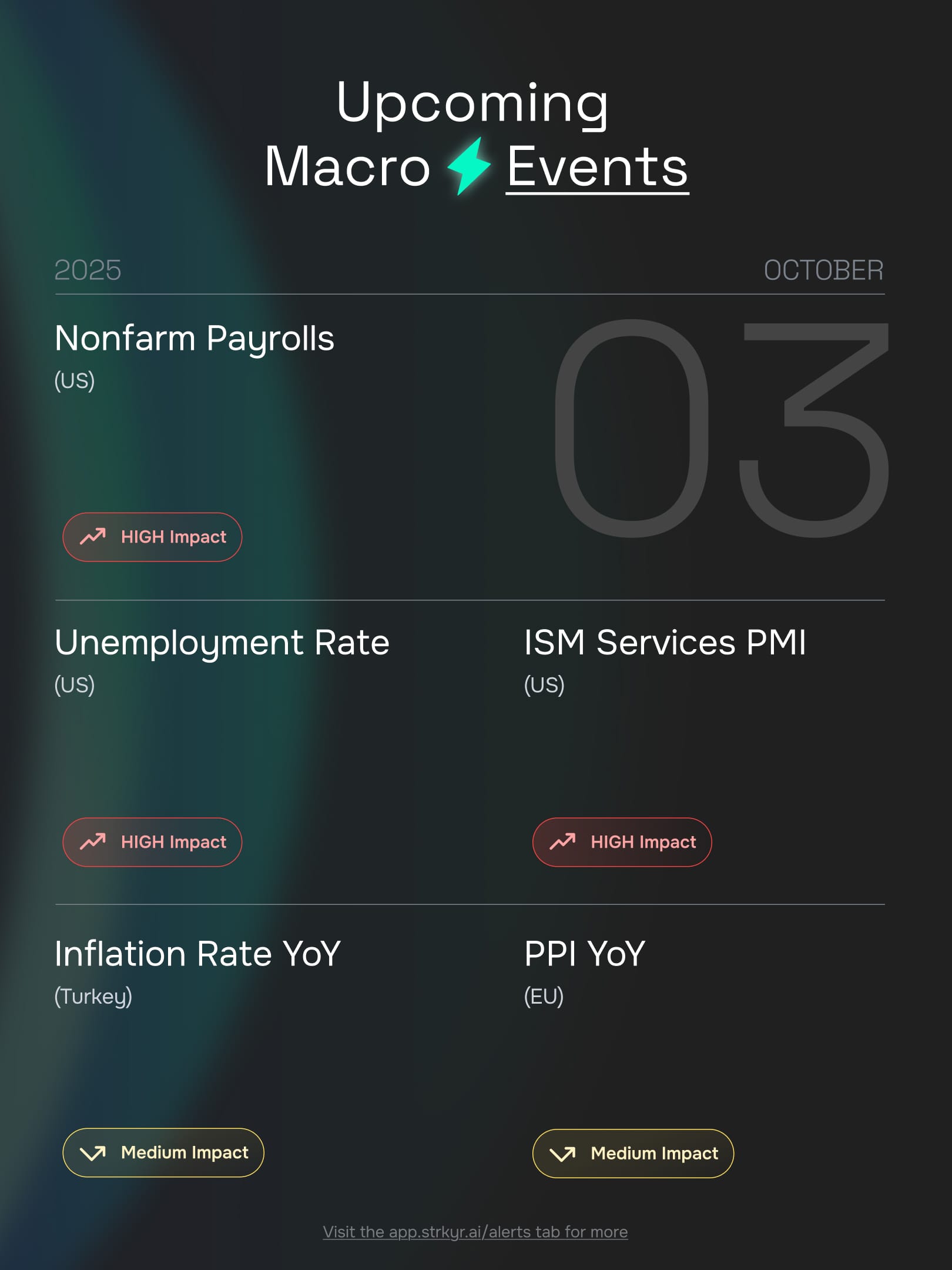

The week ahead is lined with high-impact events that could reshape global sentiment and guide risk positioning.

Monday (Oct 6): The spotlight falls on speeches from ECB President Lagarde and BoE Governor Bailey, both likely to influence rate expectations in Europe and the UK. Accompanying data on Euro Area retail sales and Spanish industrial output will give an early read on growth momentum across the bloc.

Tuesday (Oct 7): Attention turns to Germany’s factory orders and the US balance of trade, both high-impact indicators of industrial health and external demand. Lagarde speaks again, keeping policy expectations front of mind, while the US consumer credit report rounds out the day with insight into household leverage and spending.

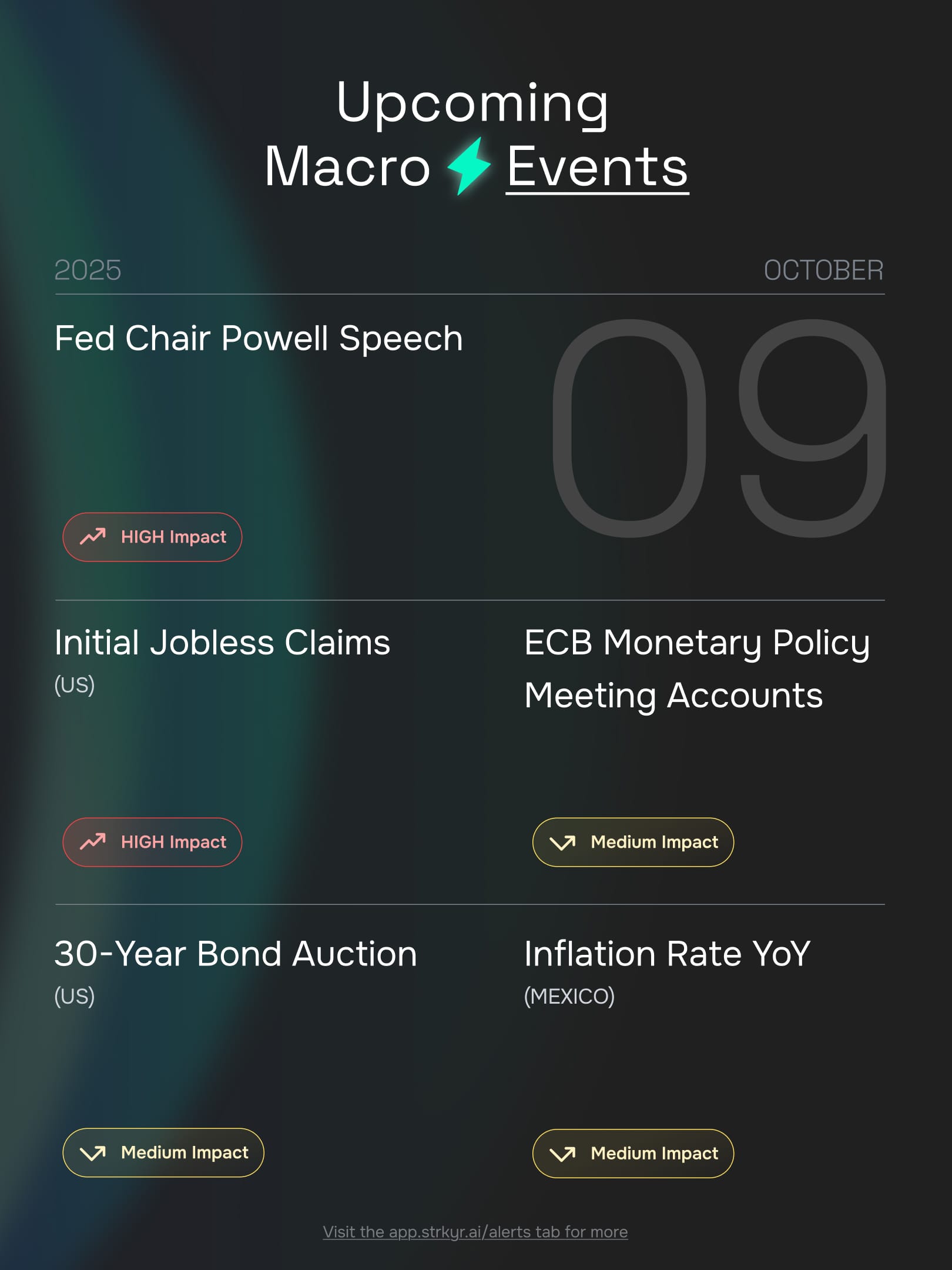

Wednesday (Oct 8): The FOMC Minutes take center stage, offering clues into the Fed’s internal debate over timing and pace of future rate cuts. Supporting data from Germany’s industrial production and US crude oil stock changes will feed into broader growth and energy narratives.

Thursday (Oct 9): Fed Chair Powell delivers a key address alongside the ECB’s monetary policy meeting accounts. Both will be watched for any divergence in tone. Meanwhile, US initial jobless claims and Mexico’s inflation rate add layers to the labor and inflation picture across North America.

Friday (Oct 10): The week closes with the US Michigan Consumer Sentiment preliminary reading, a crucial gauge of forward-looking demand. Canada’s unemployment rate and Russia’s inflation print will add further texture to global inflation trends, while Italy’s industrial production and the US budget statement complete the macro sweep.

Takeaway: Central banks dominate the narrative this week. A dovish tone from the ECB or Fed could extend risk appetite across crypto and equities, while any signs of renewed hawkishness would reinforce dollar strength and keep pressure on risk assets. Traders should expect elevated volatility as markets digest back-to-back policy signals and high-frequency data through Friday.

And this is not even half of what is on deck. You can find the full calendar of upcoming macro events directly inside our app.

Coin Spotlight

ASTER continues to command attention as one of the few mid-cap tokens maintaining consistent strength through recent volatility. Trading near $2.07, it has held steady following a period of sector-wide rotation, confirming that buyers remain active even as broader liquidity tightens. Volume has stayed stable across exchanges, showing that ASTER’s market participation is not momentum-driven but rooted in sustained investor engagement.

What sets ASTER apart is its ability to absorb volatility without breaking structure. While many mid-caps have seen sharp retracements, ASTER’s consolidation beneath resistance has been orderly, signaling strong hands in control. Liquidity depth across multiple chains continues to reinforce its reputation as one of the more structurally sound assets within its tier.

Narrative alignment has also played a role. ASTER’s ongoing integrations and developer traction keep it positioned at the center of cross-chain discussions, and that visibility has supported steady inflows even when sentiment cooled elsewhere. With price reclaiming key levels and signal flow consistent week over week, ASTER remains a benchmark for resilience within the current mid-cap cycle.

The takeaway: ASTER has evolved from a short-term momentum token into a dependable name in mid-cap rotations. Its liquidity stability, structural strength, and consistent trading flow make it a reliable indicator of risk appetite as the broader market regains traction.

Last Week Today

Diving into what happened the previous week.

Market Pulse

The first week of October carried a more constructive tone, with BTC climbing 2.6% to $122,610 as renewed bullish momentum took hold. ETH followed suit, rising 0.95% to $4,503, grinding steadily higher and holding above key averages. The Dollar Index (DXY) remained firm at 97.96, keeping a measured lid on risk appetite but failing to derail crypto’s steady advance.

It was a week defined by controlled optimism. BTC’s higher lows reflected a confident base, while ETH’s steady climb showed persistent accumulation rather than speculative bursts. The dollar’s firmness provided a natural counterbalance, but the lack of follow-through in traditional markets allowed crypto to maintain its own rhythm.

Underneath the surface, liquidity rotated efficiently. Altcoins lagged early in the week before catching up as traders shifted capital into mid-cap names showing clean technicals. Signal flow improved across both majors and second-tier assets, indicating that market participants were willing to take on selective risk again after weeks of hesitation.

In short, last week was not euphoric but decisive. Momentum returned without excess, the market structure strengthened, and participation broadened. As October opened, the tone shifted from defense to cautious expansion — a subtle but meaningful step forward for risk sentiment.

Top 4 Tokens

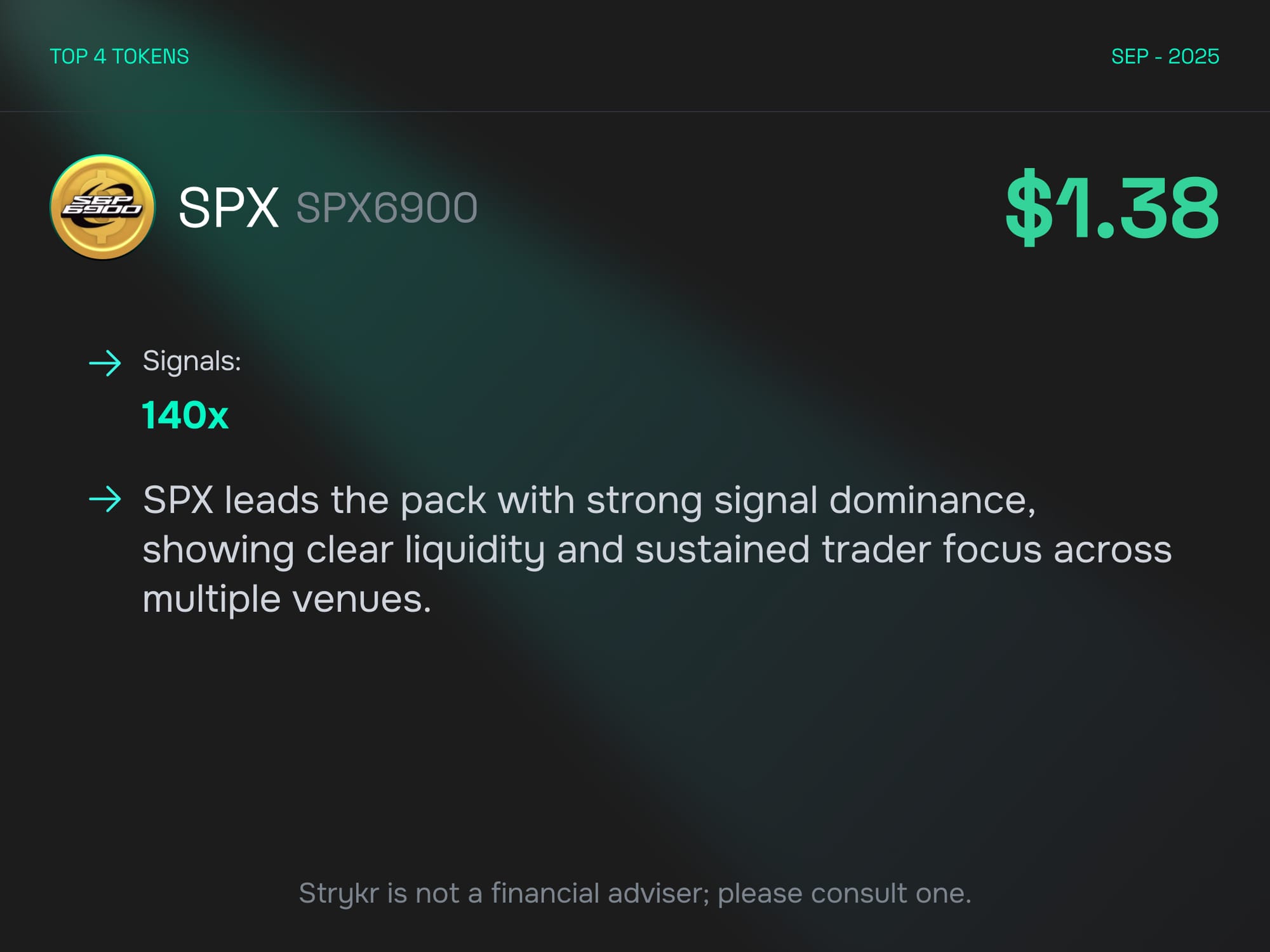

SPX

SPX dominated signal activity last week, cementing itself as the clear leader in trader attention. Liquidity across venues remained deep, and price action was clean—reflecting confidence rather than short-term churn. Despite modest volatility in broader markets, SPX held structure and continued to generate sustained flow from both momentum traders and automated systems. The consistency of signal strength suggests that SPX has become a benchmark trade for active participants rotating through the higher-liquidity layer of the market.

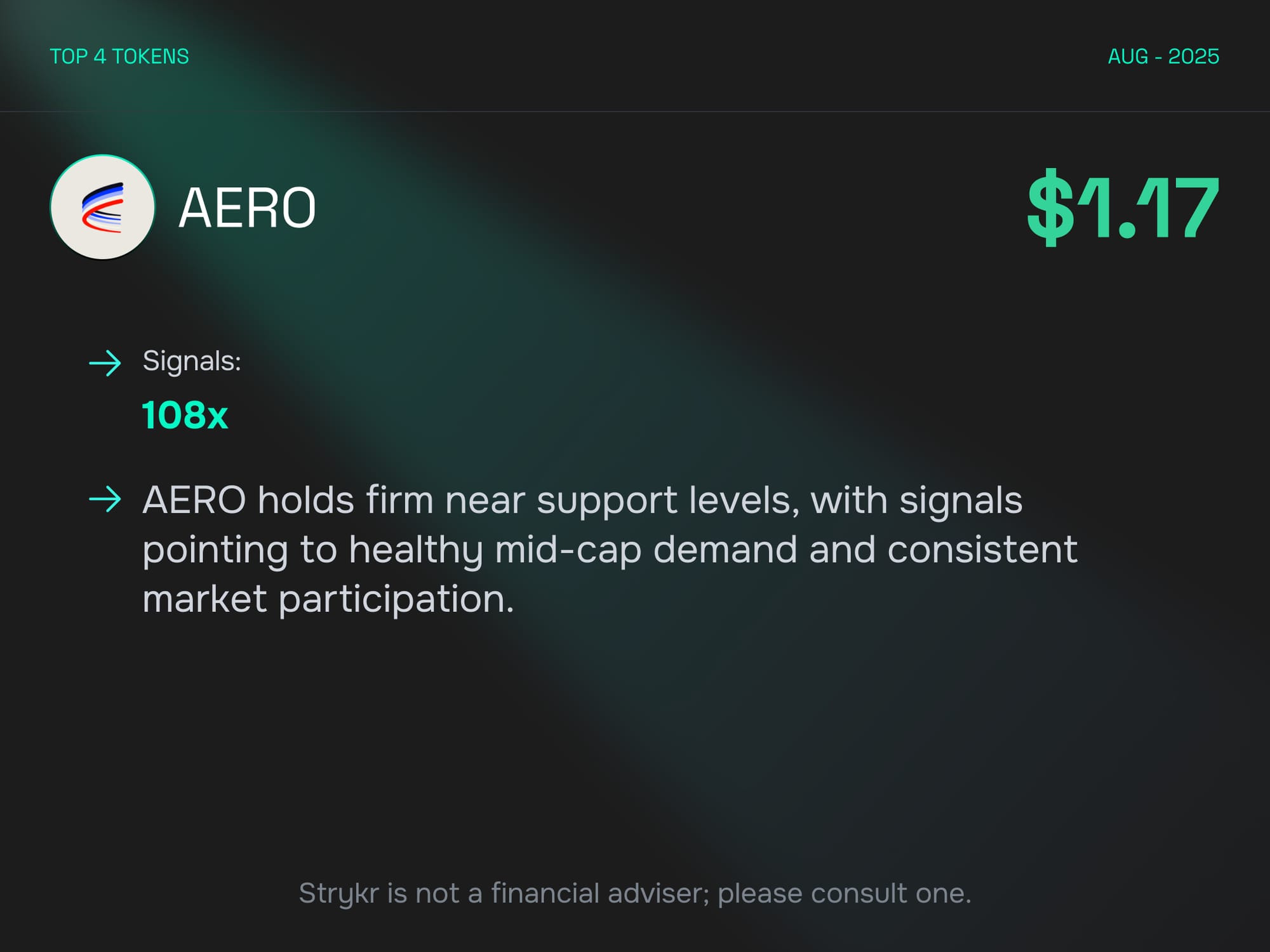

AERO

AERO held its ground through a week of shifting sentiment, defending key support while maintaining healthy signal activity. The token’s steady participation reflects resilient mid-cap demand and an anchored trading base willing to accumulate dips. AERO’s signal structure continues to mirror stable organic flow, suggesting buyers are positioning for a potential extension higher rather than speculative spikes. As capital rotation trends back toward quality mid-caps, AERO remains a reliable barometer of confidence within that tier.

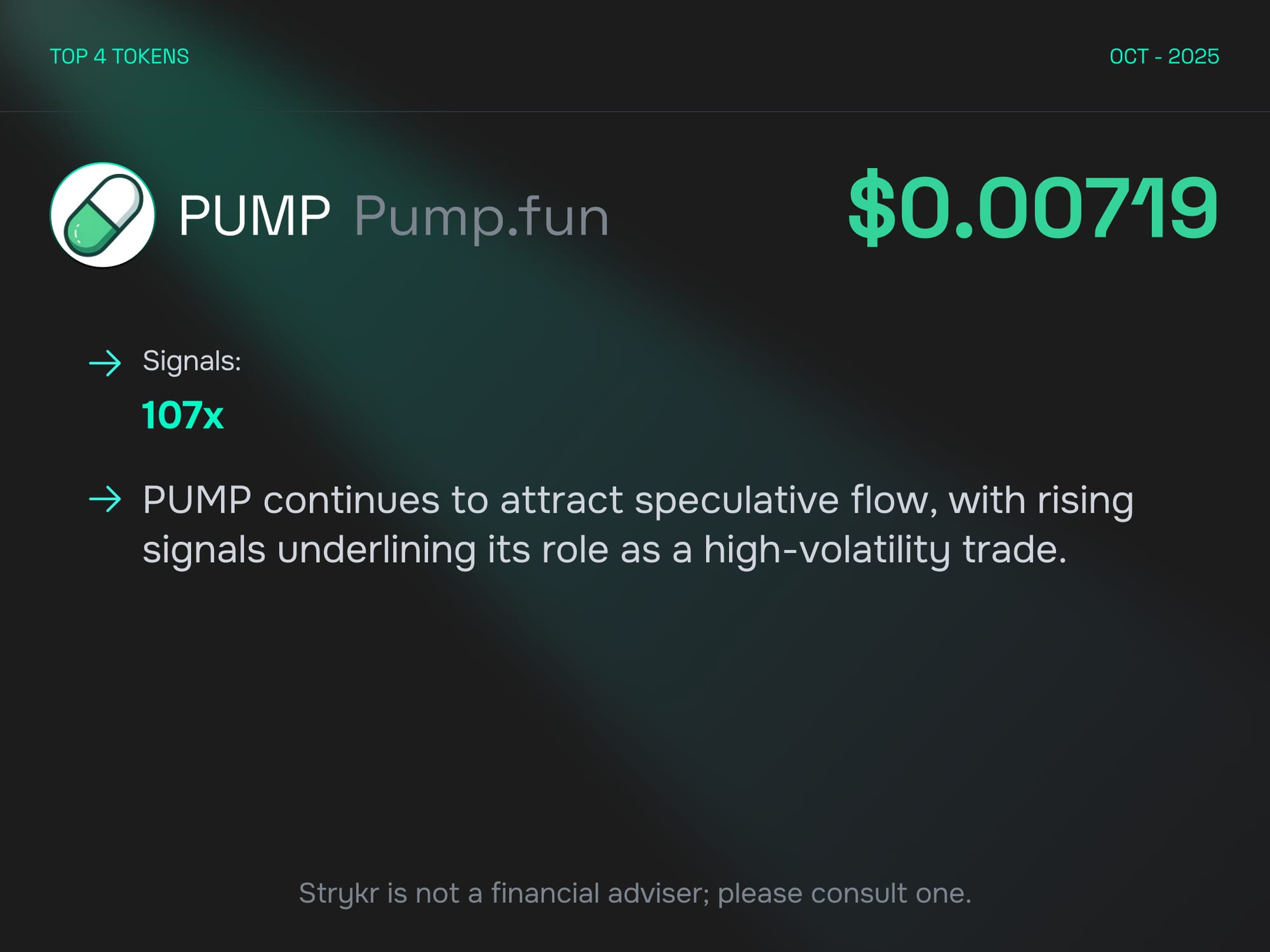

PUMP

PUMP continued to thrive in high-volatility conditions, drawing persistent speculative attention. Signal activity stayed elevated throughout the week, reinforcing its status as one of the most actively traded names in the microcap category. While price swings were sharp, volume depth and liquidity turnover kept PUMP firmly in play for short-term traders. The token’s consistent engagement signals that volatility-seekers are still finding opportunity here, making it a standout for momentum and scalping strategies.

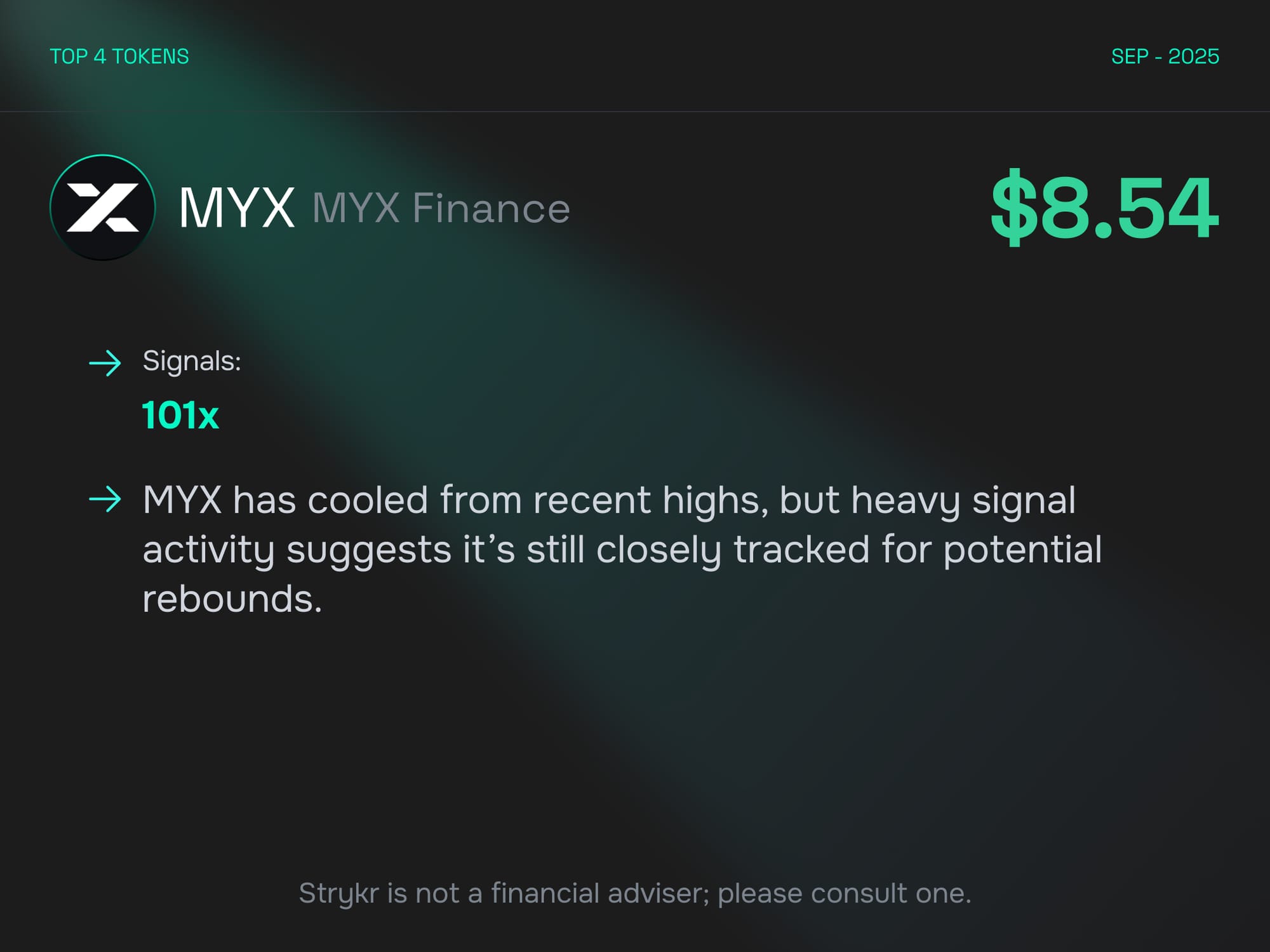

MYX

MYX cooled from recent highs but remained firmly tracked by traders across DeFi venues. The dip in price coincided with rotation into newer narratives, yet signal intensity stayed strong, hinting at continued interest in potential rebounds. MYX’s heavy turnover shows it has not been abandoned but rather repositioned by larger participants. The token’s stability near current levels reinforces its role as a mature, liquid instrument within DeFi, one that traders revisit once broader sentiment steadies.

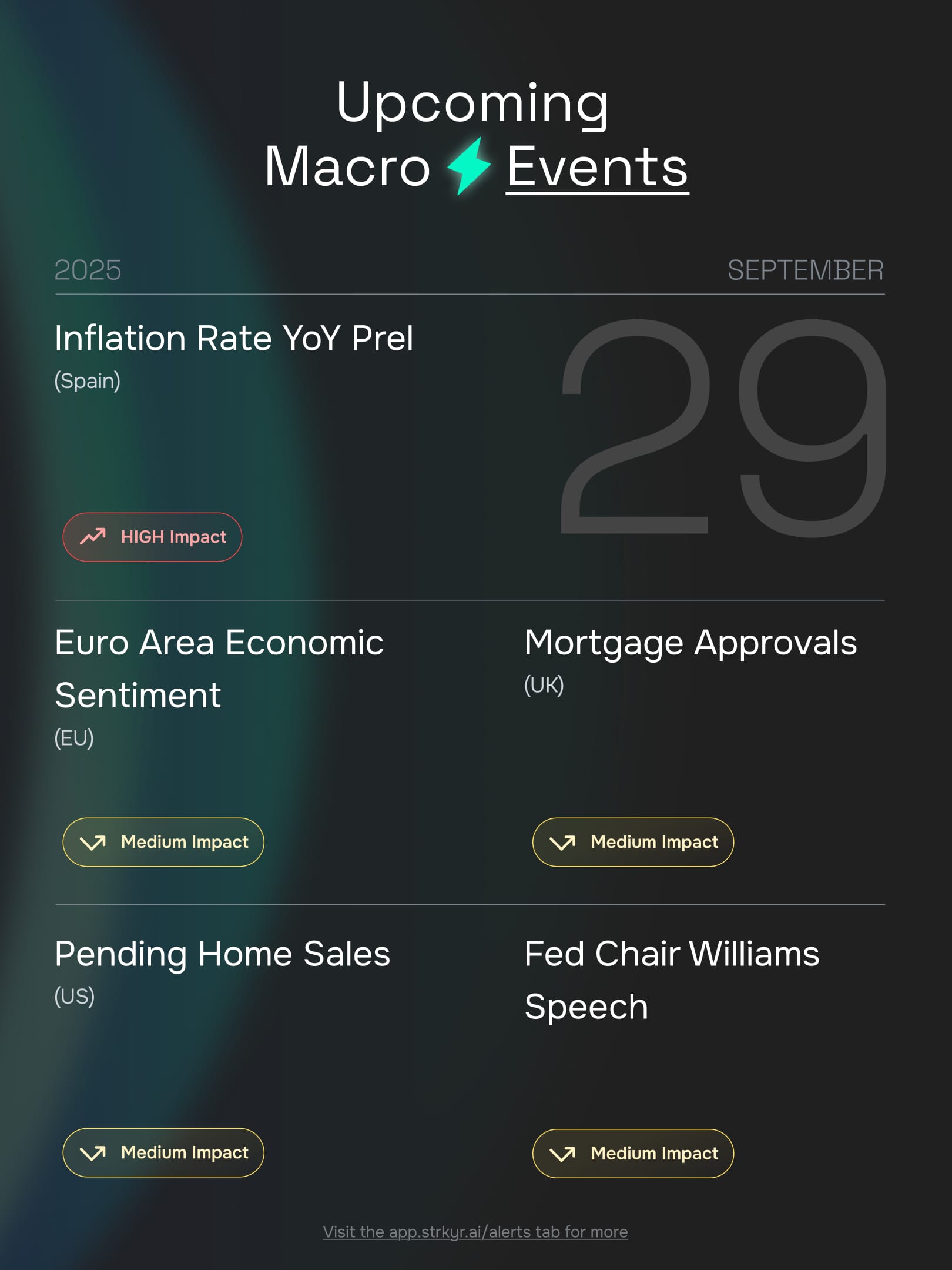

Macro Events: September 29 - October 3

The macro slate last week was packed and carried real weight across risk assets. Inflation and confidence readings in Europe set the early tone, while housing and labor data in the US shaped the narrative into Friday’s close. Every major print tied back to the same core question: is global demand cooling fast enough to justify easing, or will central banks stay on edge into Q4?

The week began with preliminary inflation figures from Spain and Germany showing mixed progress, headline rates eased slightly, but core pressures stayed sticky. In the Eurozone, consumer confidence remained subdued, and sentiment surveys signaled lingering caution despite improved financial conditions. Across the Channel, UK mortgage approvals firmed modestly, suggesting that domestic demand was holding up better than feared.

Midweek, US data took over. The JOLTs report showed job openings stabilizing, and consumer confidence slipped from prior highs, hinting that households are growing cautious but not collapsing. Manufacturing PMI data held near expansion territory, reflecting resilience even as inflation readings stayed uneven across regions. The combination reinforced the “soft landing” narrative: slower but not stalled growth.

By Thursday and Friday, attention pivoted to the US labor market and services data. Nonfarm payrolls surprised slightly to the upside, unemployment remained contained, and ISM services printed stronger than expected. Together, they kept the dollar bid into the weekend, with DXY hovering near 98. Crypto markets absorbed the firmness with relative calm, BTC and ETH held their midrange, reflecting that traders are watching macro rather than reacting to it.

The takeaway: last week’s data flow kept central banks cautious and markets balanced. Growth isn’t collapsing, inflation isn’t gone, and traders are navigating the middle ground, where neither the dovish pivot nor a tightening scare has fully taken hold. Macro remains the quiet force shaping the path for risk through early October.

FX & Commodities

Cross asset flows leaned cautious but balanced, reflecting a market still anchored by central bank expectations. Gold climbed 0.34% and held near record highs as traders priced in potential rate cuts and looked for safety amid uneven growth data. Oil (WTI) gained 0.31% on modest supply concerns and speculation of stronger seasonal demand, while copper edged up 0.10%, signaling resilience despite ongoing global manufacturing softness.

In FX, the dollar held firm but not aggressive. USD/JPY rose 0.10%, hovering near 147 as yen weakness persisted under policy divergence. EUR/USD added 0.06% after softer US data, while GBP/USD dropped 0.58% as weak UK growth projections weighed on sentiment.

The takeaway: the tone is steady, not stressed. Dollar strength continues to keep crypto and broader risk appetite capped, but the absence of sharp volatility shows a market still waiting for a clear catalyst from upcoming inflation and policy events.

DeFi Metrics

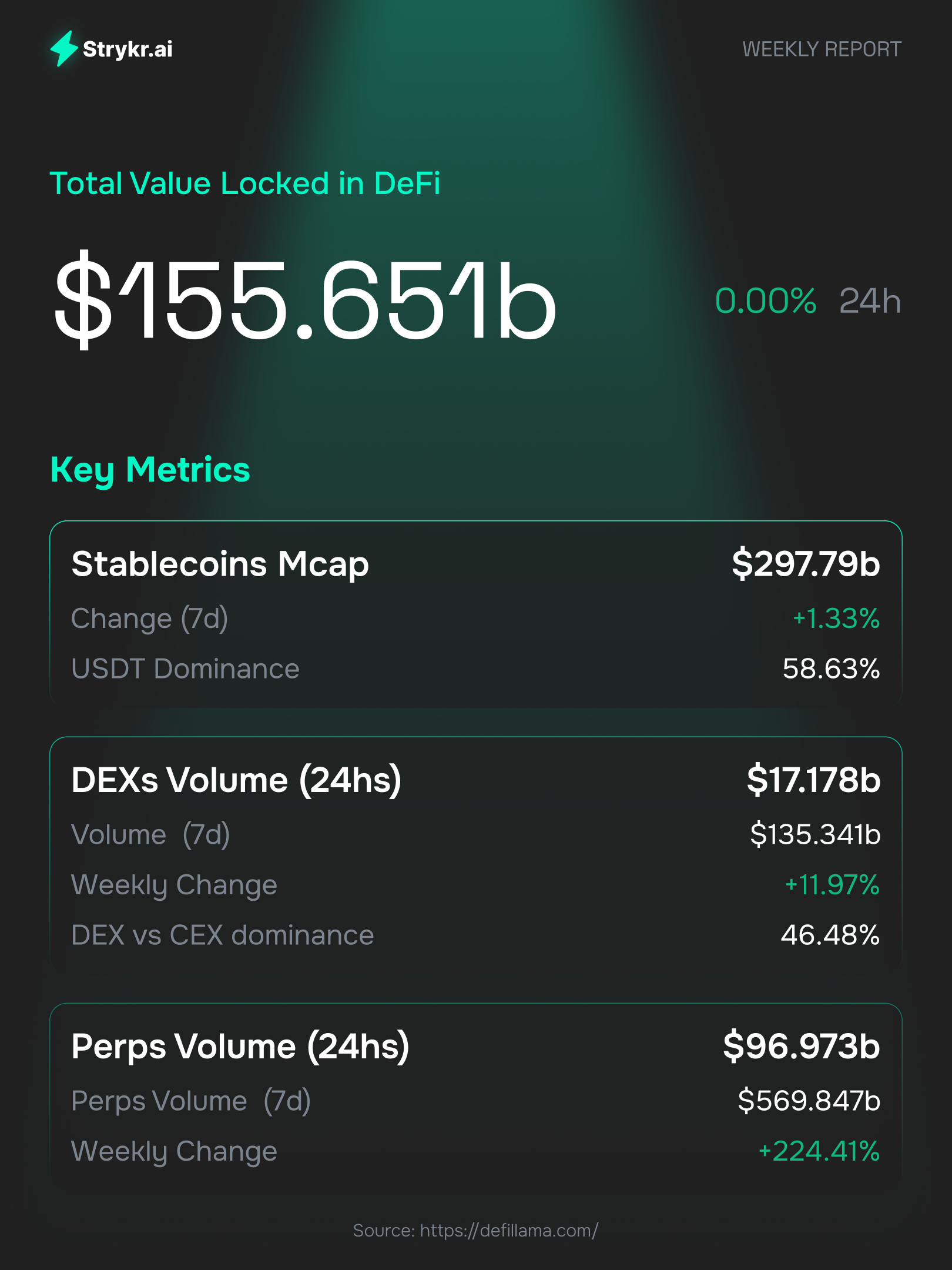

DeFi fundamentals stayed firm this week. Total value locked came in at $155.65B, showing stability after recent inflows. Stablecoin market cap climbed to $297.79B, up 1.33%, with USDT dominance steady near 58.6%. DEX volumes reached $17.18B daily, an 11.97% weekly increase, while perps volume surged to $96.97B, up 224.41% week over week.

The takeaway is clear: DeFi remains sticky. Activity continues to rise even as broader market momentum cools, signaling consistent participation and improving liquidity depth. For protocols, this means core revenue flows are intact, and for traders it means the decentralized landscape is holding firm as a reliable venue for risk and rotation.

Strykr AI View

Last week delivered a split narrative: majors lost some footing, the dollar held its ground, and macro risk returned to the forefront. Yet beneath the surface, altcoins continued their quiet rotation, DeFi activity stayed strong, and speculative leaders kept liquidity flowing across key chains.

Execution outlook: ETH remains the foundation for conviction plays, Aster continues to lead as the technical breakout, OpenX carries the L2 momentum, BNKR fuels speculative flow, and PENGU holds its role as a reliable cross chain mover. Macro is still the wild card. Softer inflation data and a cooling dollar could reignite altcoin rotation, while firmer readings likely keep price action range bound with capital crowding around high momentum names.

That concludes Edition No. 5. Next week’s focus will be on US CPI, central bank updates from the UK and Japan, and whether altcoin strength can carry into the final stretch of September. Thank you for reading Strykr.ai Weekly.