Market Pulse

Markets are starting the week with steady footing, showing renewed resilience after last week’s consolidation. Bitcoin is trading around $114,670 (+0.40%), stabilizing as buyers absorb supply near support. Ethereum has climbed to $4,169 (+1.59%), outperforming broader alt markets and maintaining consistent dip demand. The Dollar Index (DXY) sits at $99.23 (+0.3%), keeping modest pressure on risk assets but not reversing sentiment.

The tone is constructive and patient. BTC’s recent defense of the 114K level has established a short-term base, giving bulls a clear line to build from. ETH continues to act as a leader for capital rotation, supported by strong spot flow and sustained participation in high liquidity pairs. The market’s pace remains measured, with leverage low and positioning still supportive of gradual upside.

Altcoin activity is broadening as traders re-engage across sectors. Mid-cap names are starting to see consistent turnover, and liquidity is rotating evenly after several weeks of uneven participation. Sentiment has shifted from reactive to opportunistic, showing that traders are again looking for momentum rather than shelter.

Macro remains the underlying force. The dollar’s strength is steady but slowing, allowing risk assets to extend without direct headwinds. This week’s economic releases, including inflation and employment data, will shape whether this early October push evolves into a sustained trend or meets resistance.

The takeaway: the market is regaining traction. BTC and ETH are leading confidently, rotation is picking up, and macro data will determine if this new momentum carries into mid-month or settles into another consolidation phase.

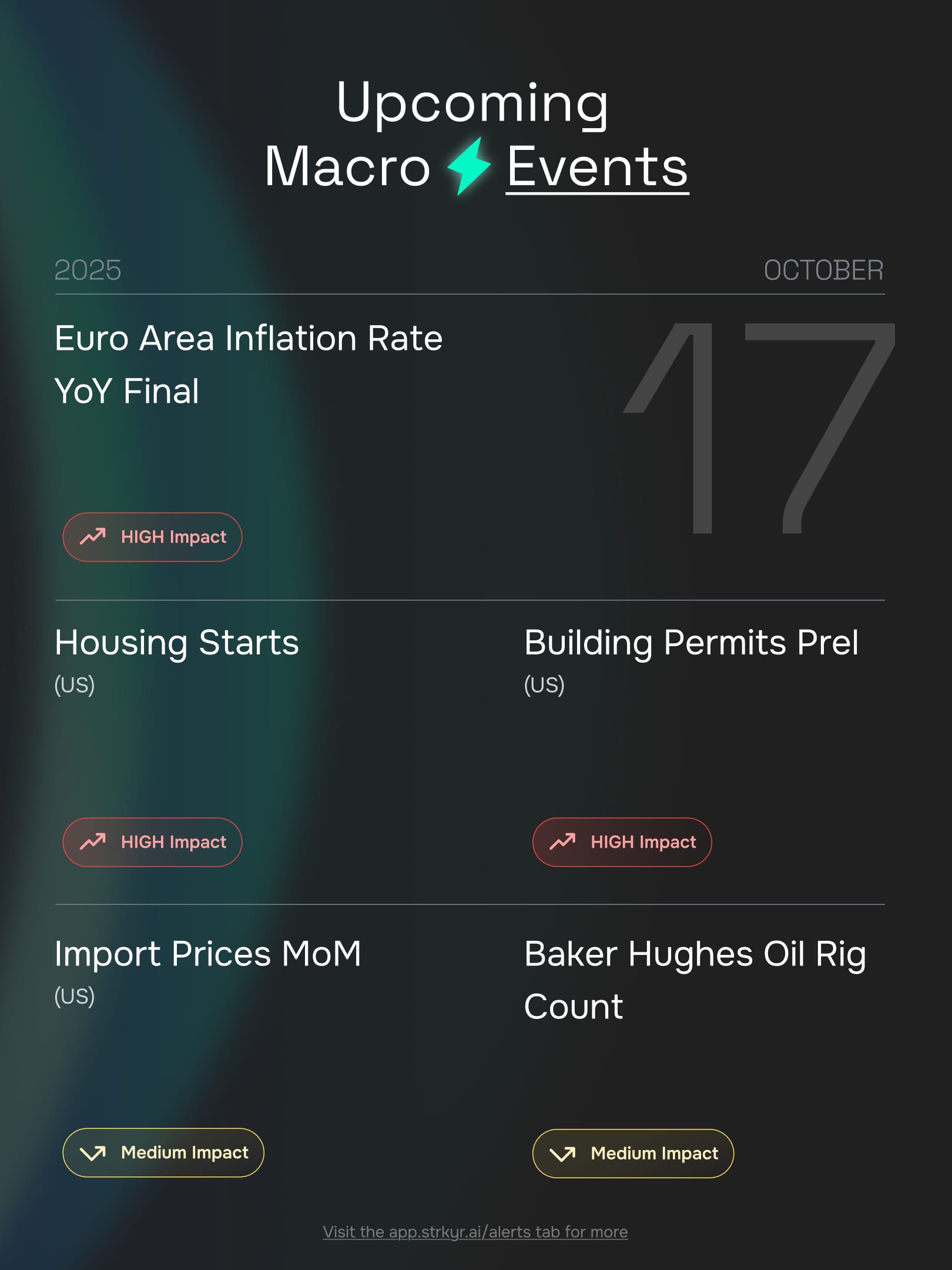

Macro Events

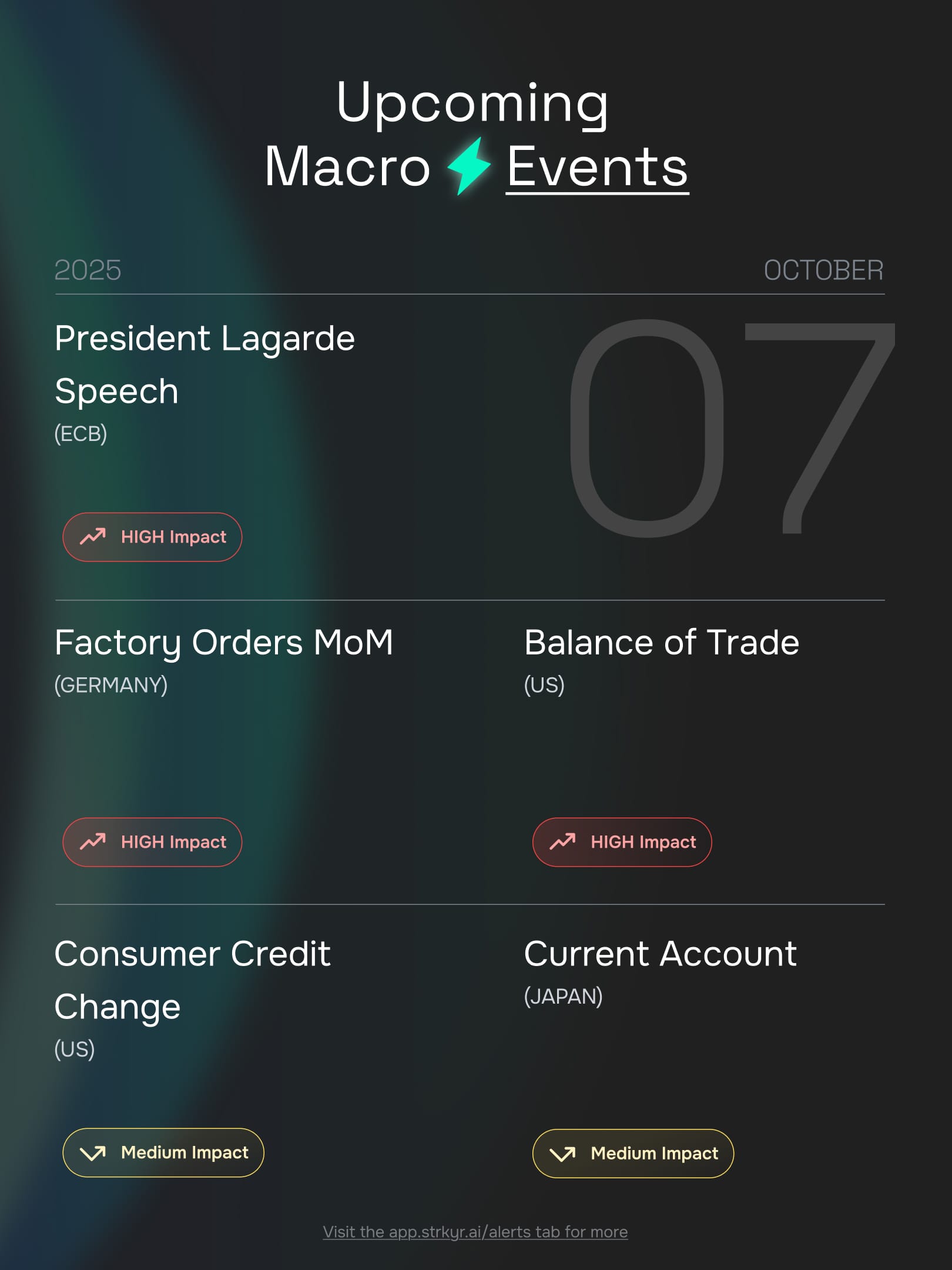

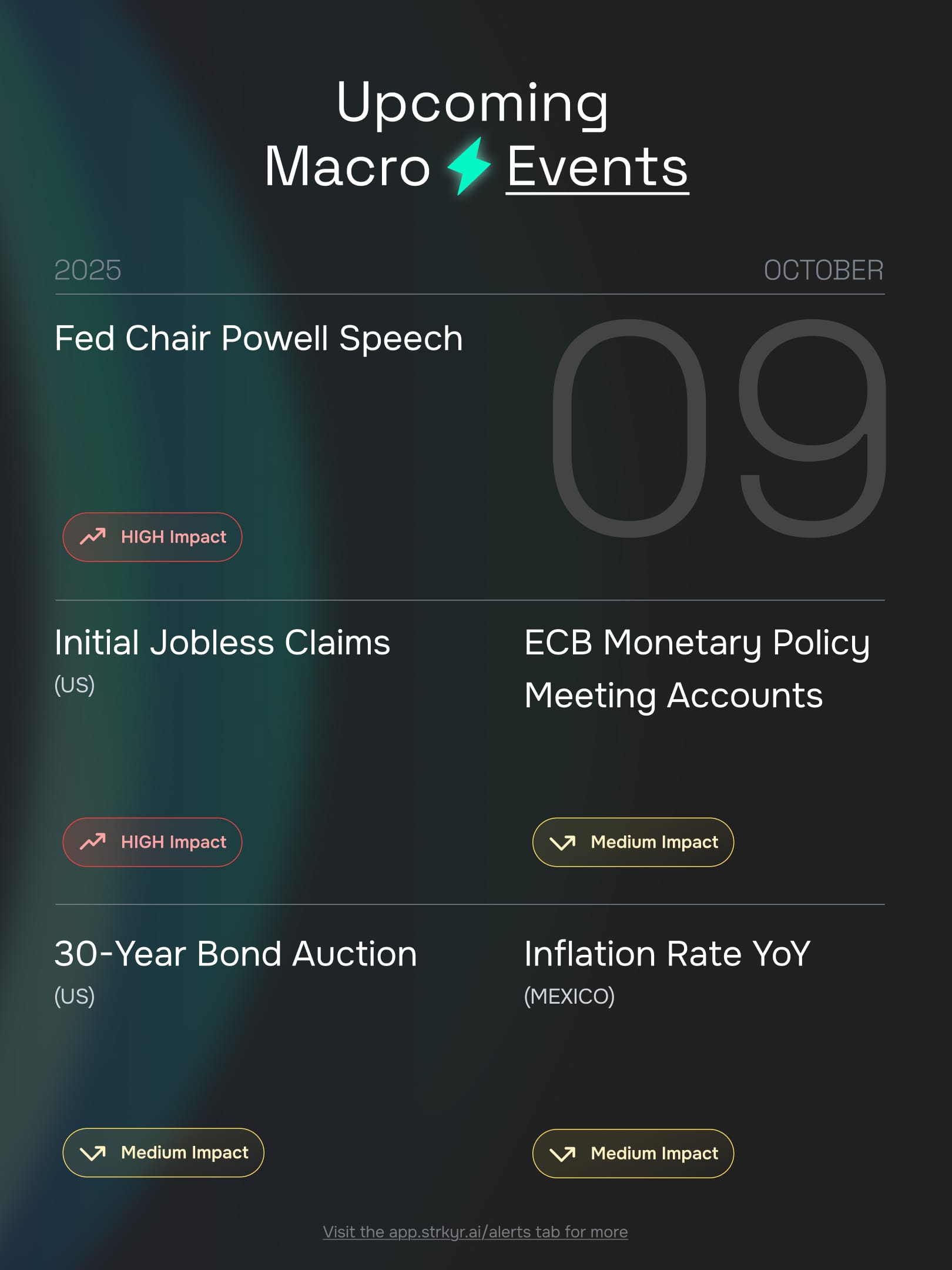

The week ahead carries heavy macro weight, with inflation data and central bank communication set to shape risk sentiment across global markets.

Monday (Oct 13): Focus centers on India’s inflation rate, Singapore’s GDP growth, and the OPEC monthly report. Together, these will gauge regional demand trends and set the tone for commodities and emerging market flows.

Tuesday (Oct 14): The spotlight turns to inflation from China and Germany alongside the UK unemployment rate. Fed Chair Powell’s remarks will be pivotal for global positioning, as traders parse tone for signs of policy direction heading into year-end.

Wednesday (Oct 15): The FOMC Minutes headline the session, providing clarity on the Fed’s internal rate debate. Australia’s unemployment print and Europe’s industrial production data round out a day rich in global labor and manufacturing signals.

Thursday (Oct 16): US retail sales and producer price data take center stage, offering fresh insight into domestic demand and inflation pressure. Lagarde’s comments from the ECB will be key in confirming whether Europe follows a similar path of policy caution.

Friday (Oct 17): The Euro Area’s final inflation reading closes the week, accompanied by US housing and import data. Together they offer the last key inputs before markets reassess risk appetite heading into the second half of October.

Takeaway: Macro remains the deciding force. A soft inflation tone from China or Europe could lift sentiment across risk assets, while any sign of stickiness or hawkish rhetoric may reassert dollar strength and tighten conditions for crypto and equities alike.

And this is not even half of what is on deck. You can find the full calendar of upcoming macro events directly inside our app.

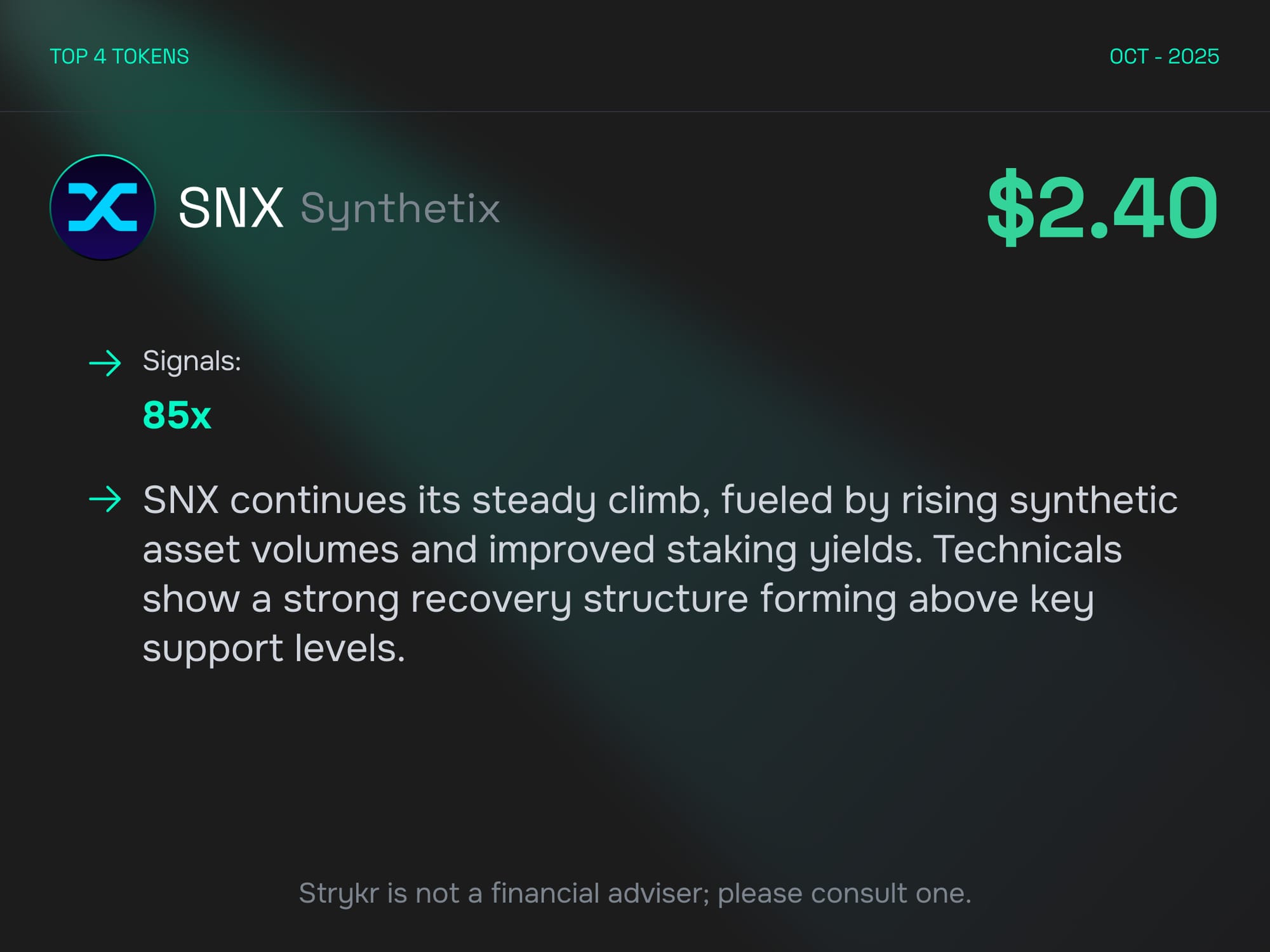

Coin Spotlight

SNX continues to command attention as one of the few DeFi tokens maintaining consistent strength through recent market swings. Trading near $2.40, it has held steady following weeks of sector rotation, confirming that buyers remain active even as liquidity shifts. Volume and staking activity have remained firm, showing that participation in the Synthetix ecosystem is driven by sustained engagement rather than short-term speculation.

What sets SNX apart is its structural resilience. While many DeFi tokens have struggled to hold key levels, SNX’s consolidation has been controlled and well-supported, signaling conviction from long-term holders. Its synthetic asset volumes and staking yields continue to trend higher, reinforcing its position as one of the more established and liquid names within decentralized finance.

Narrative strength also supports its climb. Renewed interest in synthetic exposure and derivatives trading has positioned SNX at the center of DeFi’s utility-driven recovery. Integrations across networks and consistent developer activity have kept it visible within the broader conversation. With price reclaiming critical support and signal activity holding steady, SNX remains a model of technical and structural stability.

The takeaway: SNX has matured beyond a cyclical DeFi token into a core pillar of the on-chain derivatives landscape. Its liquidity depth, staking growth, and consistent trading participation make it a leading indicator of confidence across the broader DeFi sector.

Last Week Today

Diving into what happened the previous week.

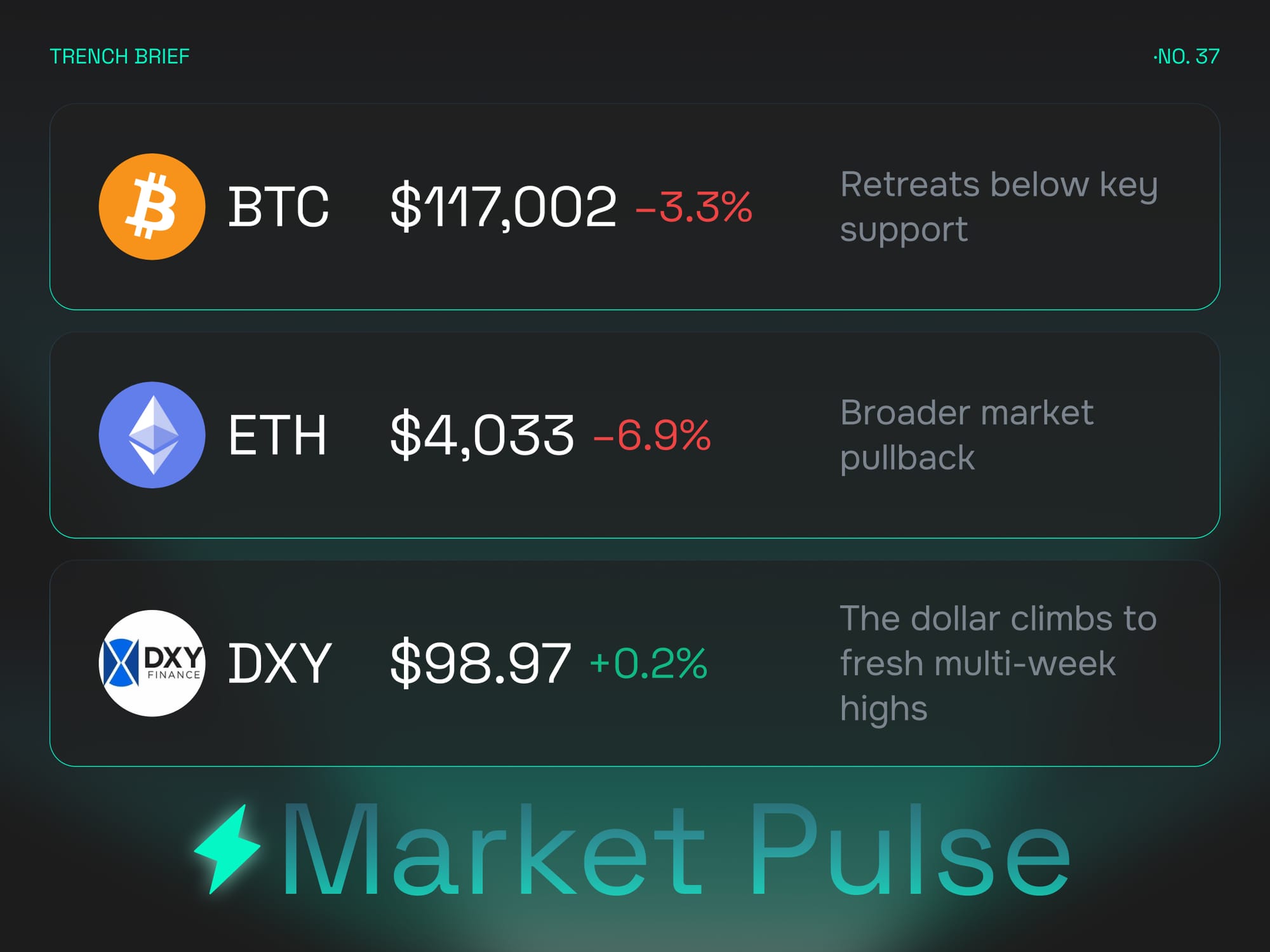

Market Pulse

The second week of October turned defensive, with BTC slipping 3.3% to $117,002 after failing to hold support near 120K. ETH led the pullback, sliding 6.9% to $4,033 as profit-taking hit key liquidity zones. Meanwhile, the Dollar Index (DXY) climbed modestly to 98.97 (+0.2%), pressing to multi-week highs and keeping pressure on broader risk sentiment.

The tone across markets was corrective but contained. BTC’s rejection near resistance marked a pause in momentum rather than a full breakdown, while ETH’s sharper drop reflected positioning unwinds rather than panic. Dollar strength was the main headwind, with traders rotating capital defensively while waiting for macro clarity.

Altcoins saw fragmented participation. Mid-cap names that outperformed in early October cooled, while high-volatility tokens remained active as speculative flows shifted to short-duration trades. Signal flow across majors thinned slightly, consistent with a risk reset after a multi-week climb.

In short, last week was a recalibration. Momentum cooled, liquidity condensed, and markets transitioned from expansion to digestion. With key inflation and employment data ahead, traders are watching closely to see if the recent dip evolves into deeper consolidation or sets the stage for a fresh rebound.

Top 4 Tokens

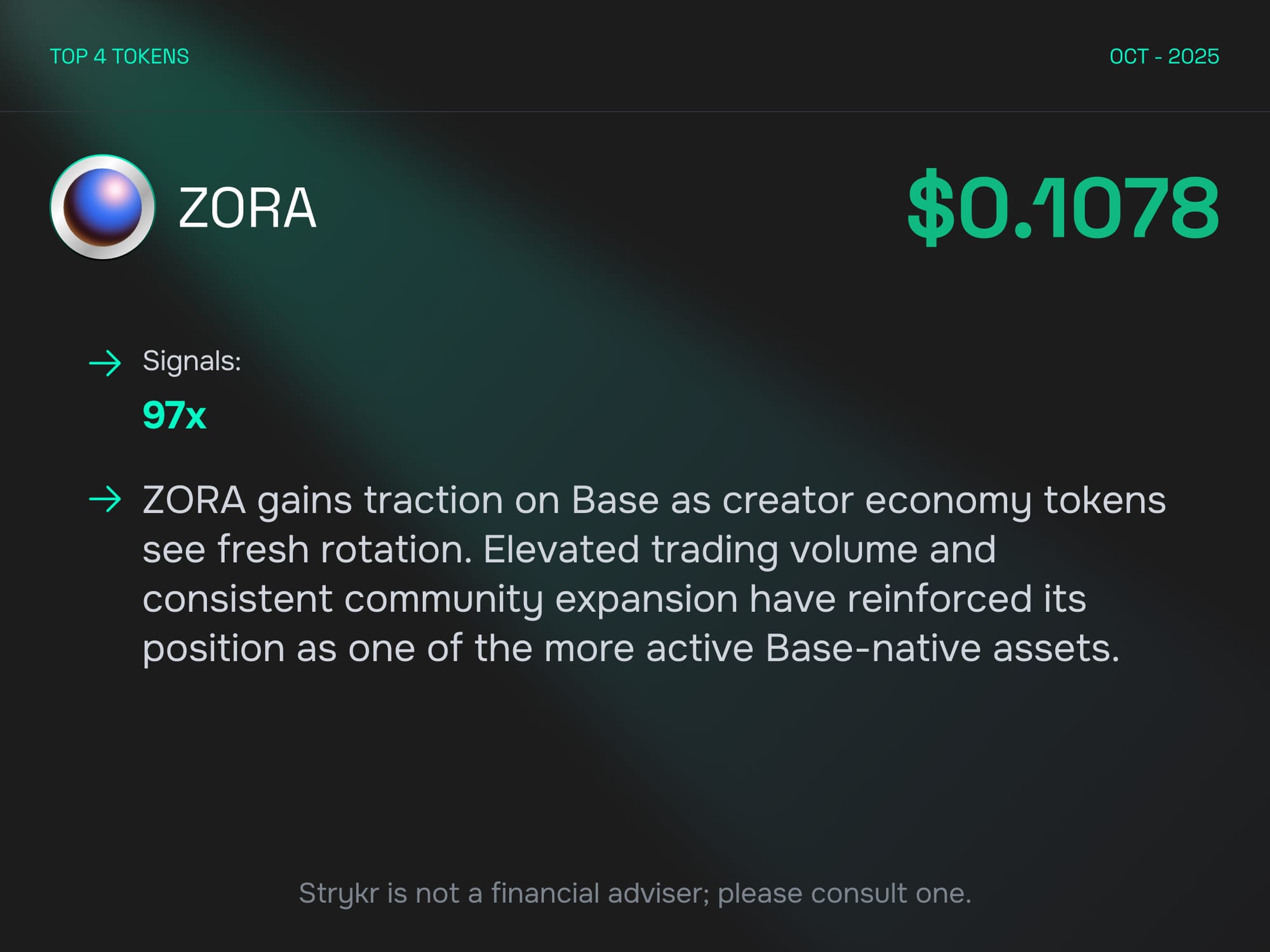

ZORA

ZORA gained strong traction last week as activity around Base-native creator economy tokens accelerated. Elevated trading volumes and consistent signal flow reflected growing engagement from both builders and collectors. Liquidity held steady across decentralized venues, underscoring that participation is expanding beyond short bursts of speculation. With its blend of cultural and technical utility, ZORA continues to position itself as one of the more enduring projects in the Base ecosystem.

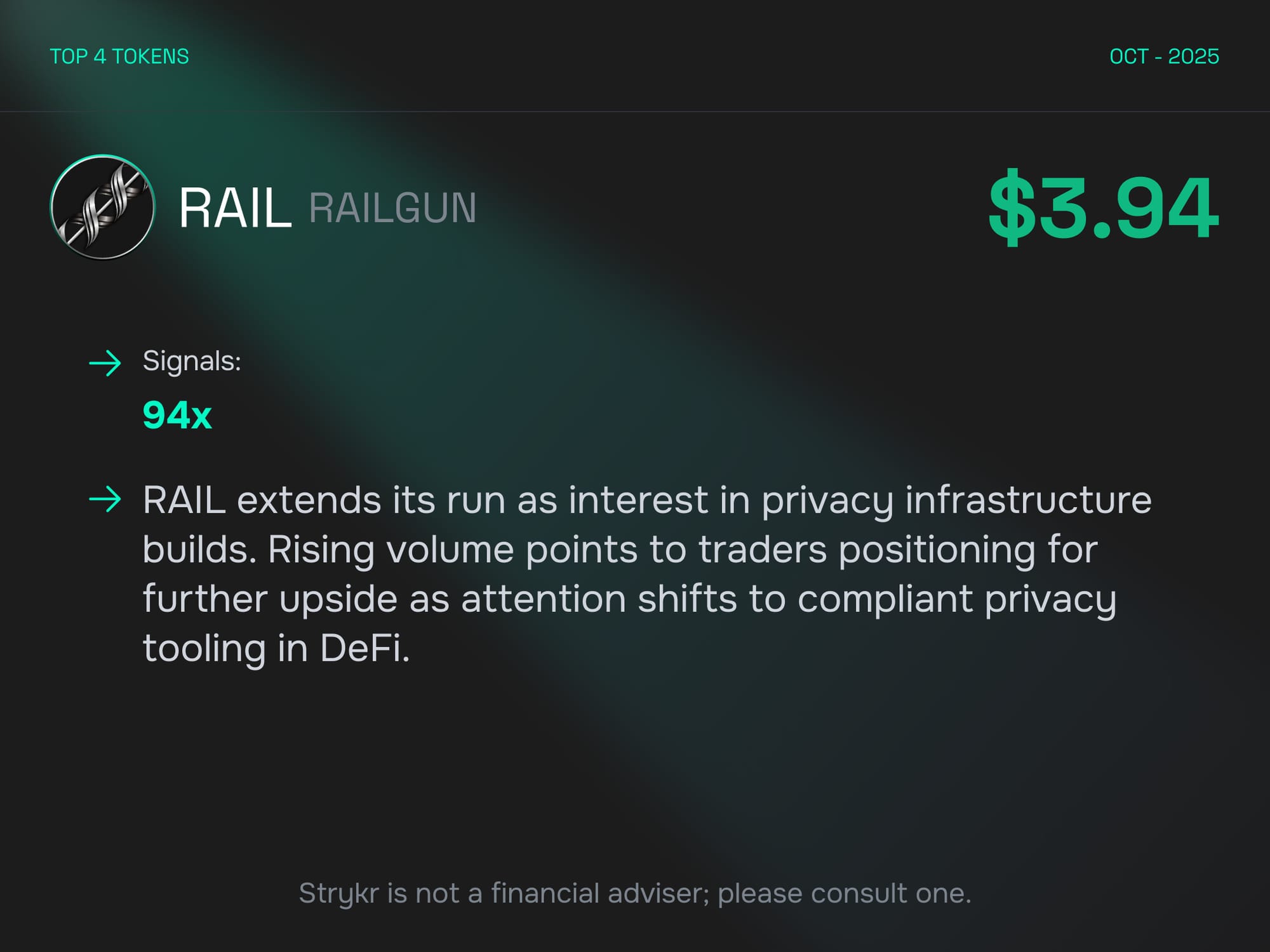

RAIL

RAIL extended its move higher as traders continued to accumulate exposure to privacy infrastructure plays. Signal activity stayed elevated, highlighting consistent positioning among both discretionary and algorithmic participants. Despite broader market consolidation, RAIL’s structure remained clean, supported by rising volume and tightening spreads. The sustained flow points to an ongoing revaluation of privacy protocols as regulatory clarity and compliance-focused development gain momentum.

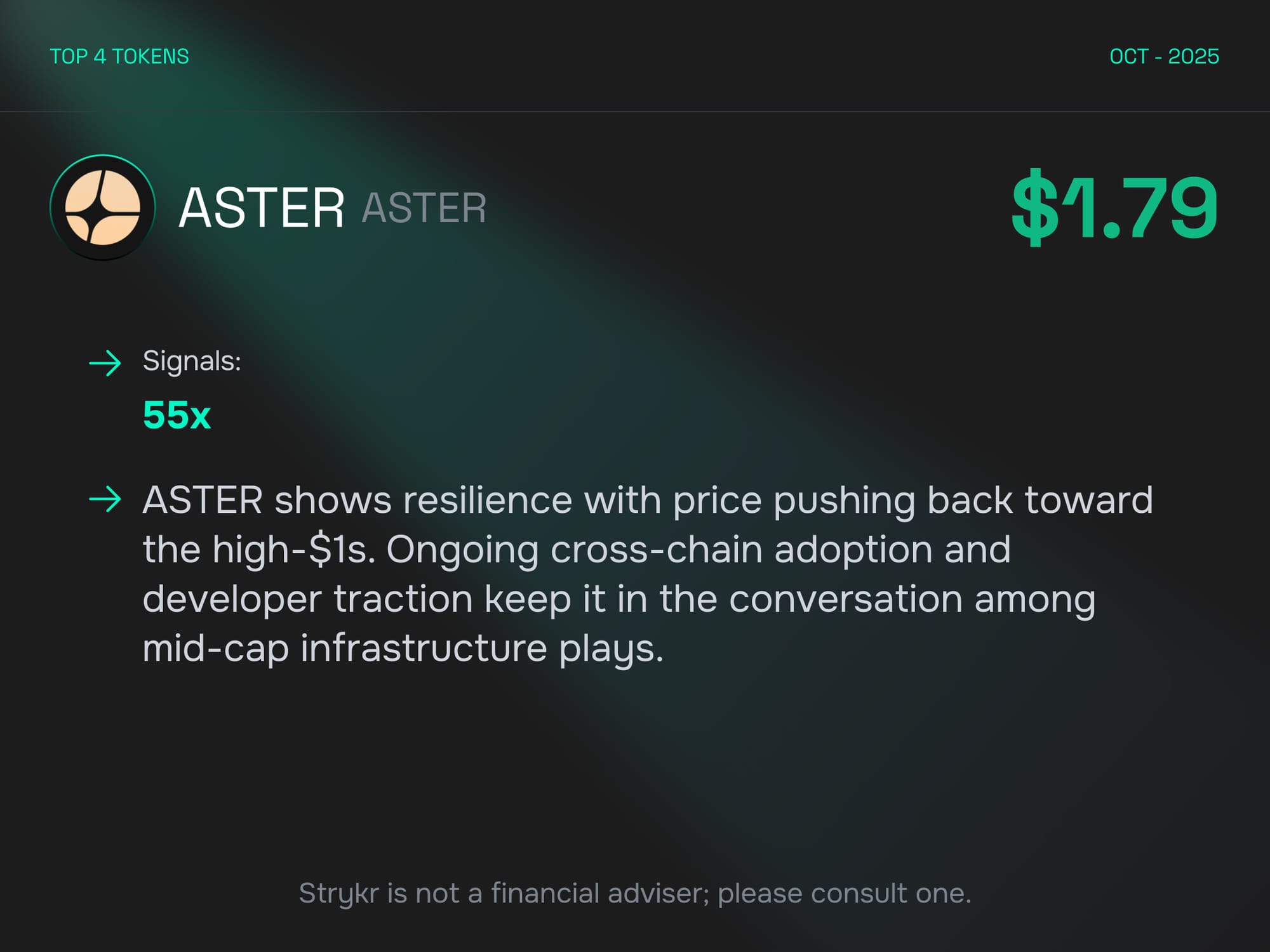

ASTER

ASTER maintained its reputation for resilience, holding firm through rotation and renewed volatility across mid-caps. Signal intensity reflected steady demand, and price structure continued to tighten near recent highs. Liquidity across exchanges remained stable, with cross-chain integrations and developer traction supporting a broader narrative of structural strength. As capital searches for quality within the mid-cap range, ASTER remains a reference point for consistency and execution.

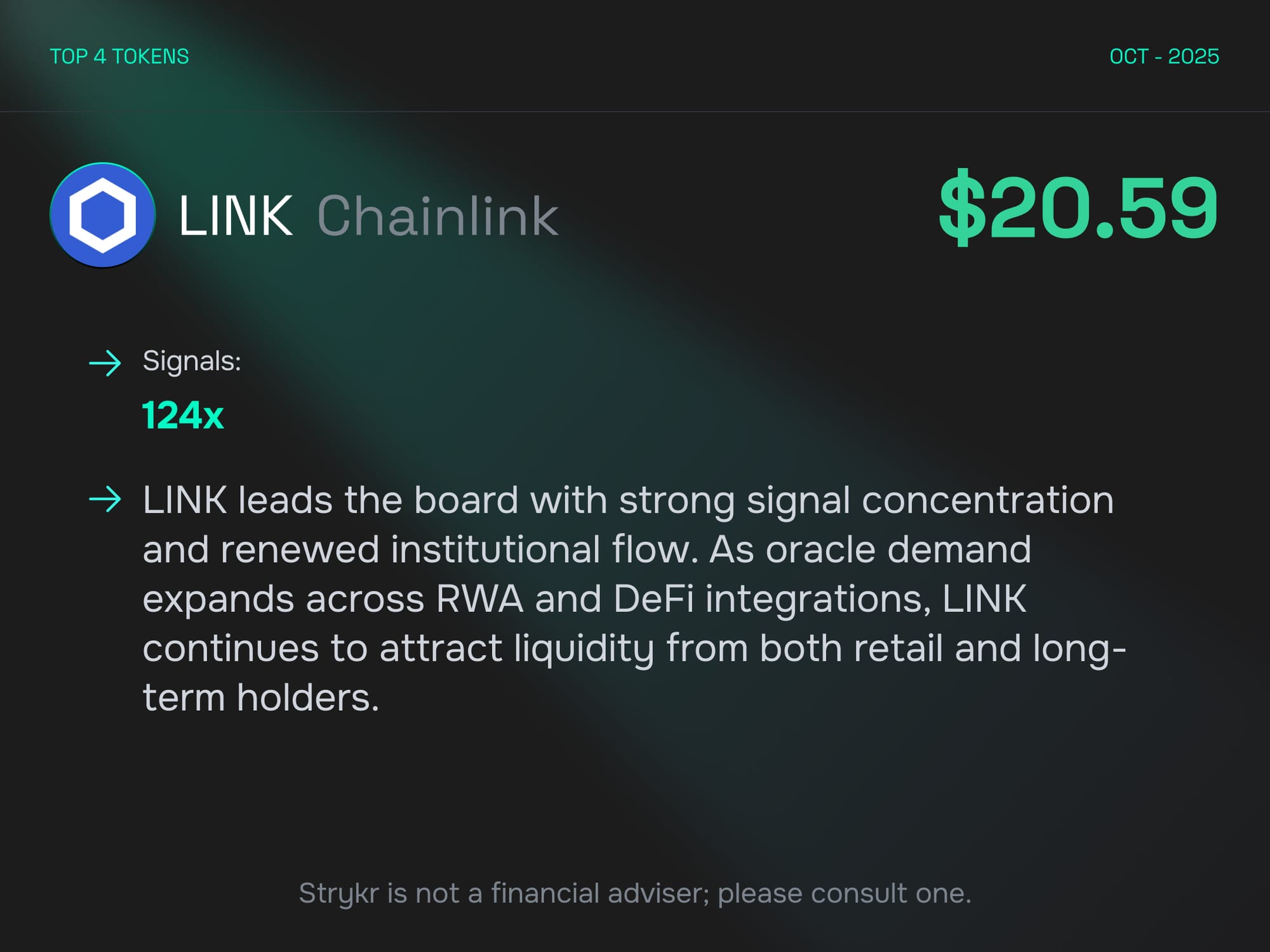

LINK

LINK once again led the board, cementing its position as the anchor for institutional and DeFi-related flows. Signal concentration rose meaningfully as traders re-engaged with oracle infrastructure following renewed real-world asset discussions. Liquidity remained deep across both centralized and decentralized venues, allowing LINK to sustain its leadership without excess volatility. The token’s strong bid presence highlights its continued role as a liquidity benchmark for higher-cap assets.

Macro Events: October 6 - 10

The macro slate last week carried a cautious tone as global policymakers returned to the spotlight. A series of central bank speeches and mid-tier data points kept volatility in check but left traders searching for clarity on policy direction. The focus was less on fresh surprises and more on confirmation that the disinflation trend remains uneven and growth momentum continues to flatten across major economies.

The week opened with remarks from ECB President Lagarde and BoE Governor Bailey, setting an early tone of guarded optimism in Europe. Eurozone retail data and Spanish industrial output came in soft, while UK figures hinted at modest consumer stability. Across Asia, India’s services PMI edged higher, reflecting steady demand despite global slowdown concerns.

By midweek, attention turned to the United States. Factory orders and trade balance data pointed to a cooling goods sector, while the FOMC Minutes underscored the Fed’s wait-and-see stance, signaling comfort with holding rates as inflation gradually moderates. German industrial production also softened, adding to evidence of a sluggish manufacturing recovery across Europe.

Thursday’s Powell speech and jobless claims kept markets grounded. Powell avoided new guidance but reinforced the theme of policy patience, while labor data showed only mild cracks in employment conditions. The ECB’s meeting accounts echoed a similar stance, showing that inflation remains a concern but overt tightening risks are fading.

Friday closed with a broad look at sentiment and inflation. US consumer sentiment dipped slightly, Canada’s jobless rate ticked up, and inflation readings from Russia and Mexico suggested that global price pressures remain sticky. The dollar ended the week firm at 98.9, while crypto markets stayed resilient. BTC and ETH continued to consolidate as traders weighed macro signals over short-term catalysts.

The takeaway: last week’s data reinforced a steady equilibrium. Inflation is slowing but uneven, central banks are cautious but not cutting, and risk assets are adapting to a world where policy inertia, not panic, is setting the tone for October.

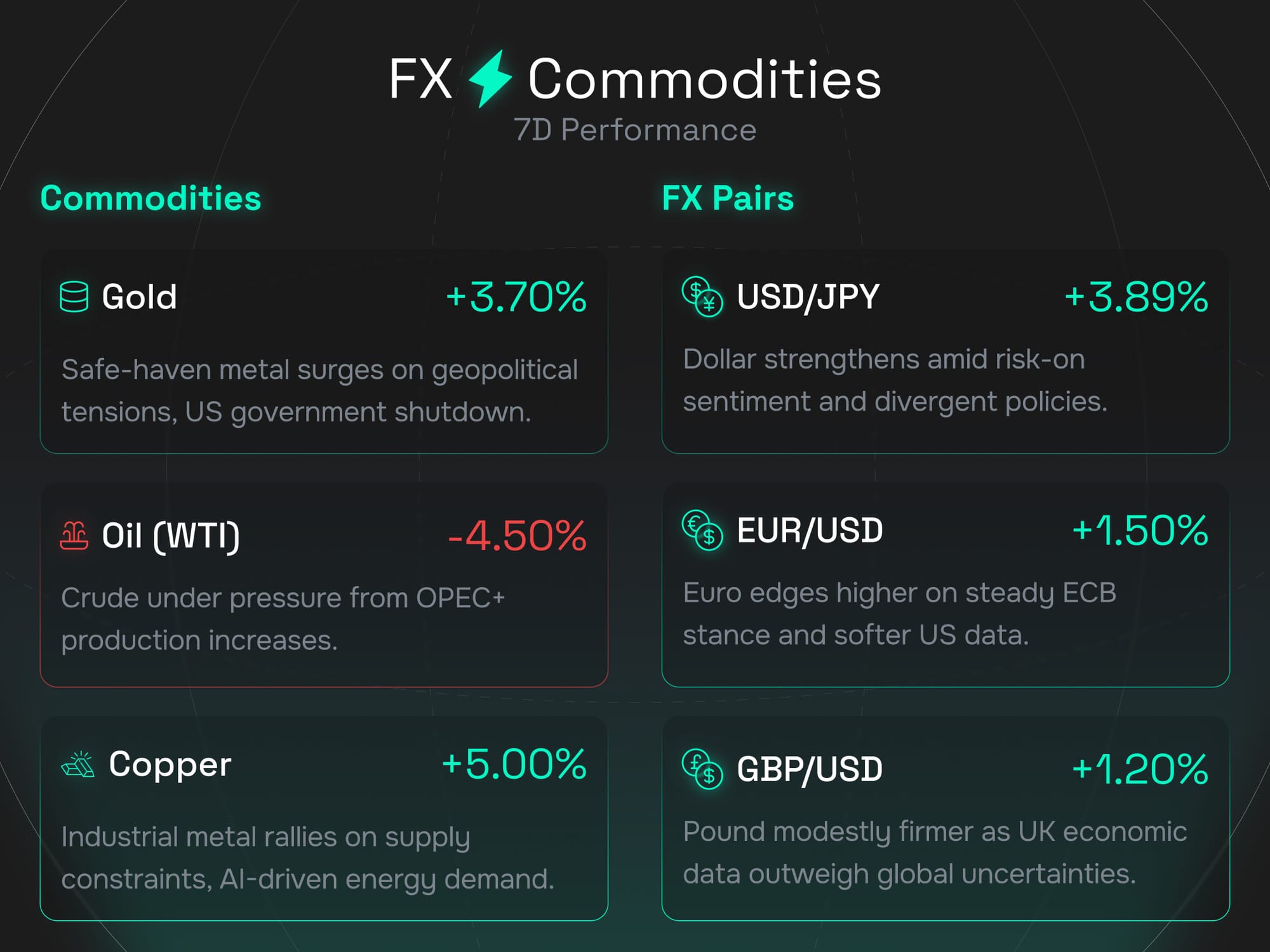

FX & Commodities

Cross-asset flows last week reflected cautious positioning as traders balanced geopolitical risks with shifting rate expectations. Gold surged 3.7%, benefiting from safe-haven demand tied to global tensions and renewed concerns over a potential US government shutdown. Oil (WTI) fell 4.5% as OPEC+ supply signals pressured sentiment and offset seasonal demand optimism. Copper gained 5.0%, rallying on tightening supply and AI-linked industrial energy demand.

In FX, the dollar extended its strength, supported by divergent monetary policies and a measured risk-on tone. USD/JPY climbed 3.89% as yen weakness persisted under sustained policy gaps. EUR/USD advanced 1.50% after stable ECB communication and softer US data, while GBP/USD rose 1.20% as domestic data in the UK slightly outperformed expectations.

The takeaway: rotation across commodities and FX favored defensiveness over speculation. The dollar remains firm, gold continues to attract capital on uncertainty, and energy softness highlights how supply headlines still drive near-term direction.

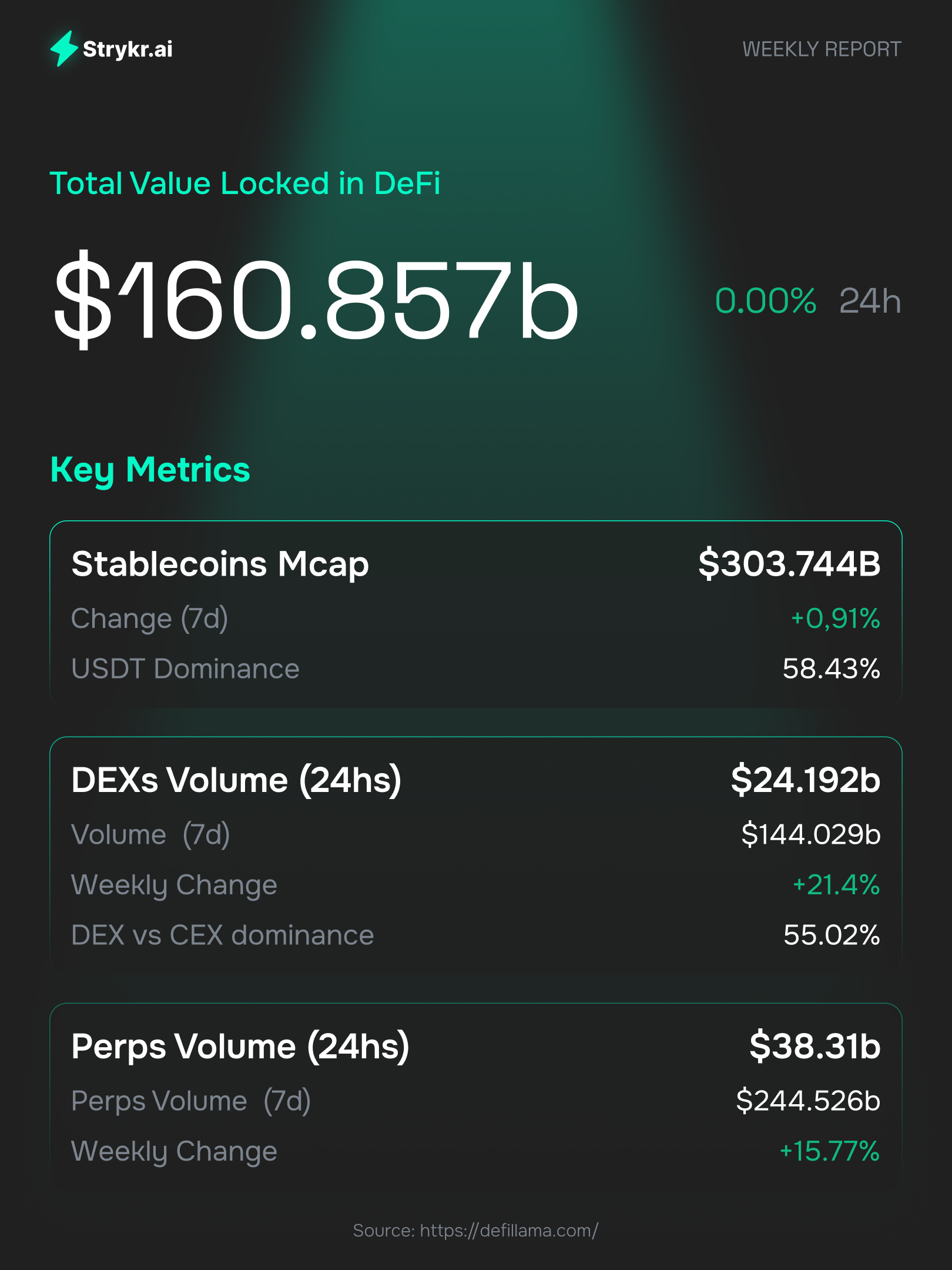

DeFi Metrics

DeFi metrics held steady last week as liquidity and participation remained resilient. Total value locked came in at $160.86B, marking a stable reading after recent inflows across key ecosystems. The stablecoin market cap rose to $303.74B, up 0.91%, with USDT holding dominance near 58.43%.

Activity in decentralized exchanges showed renewed momentum, with DEX volume at $24.19B daily, reflecting a 21.4% weekly gain and a growing share of total trading activity. Perpetuals volume followed with a strong advance to $38.31B, up 15.77% week over week, signaling continued interest in leverage and directional positioning.

The takeaway: DeFi continues to prove its staying power. Even as volatility cycles through majors, on-chain participation remains firm, liquidity depth is improving, and decentralized markets are reinforcing their position as the backbone of crypto trading infrastructure.

Strykr AI View

Last week reflected a steady but cautious tone across the market. Bitcoin and Ethereum both consolidated near key support levels, while the dollar stayed firm ahead of another heavy macro lineup. Volatility remained contained, yet under the surface, rotation continued to define the week. DeFi volumes climbed, mid-cap infrastructure tokens showed resilience, and speculative pockets on Base and Solana chains kept turnover alive.

Execution outlook: ETH remains the cornerstone for structured positioning, while Aster continues to lead mid-cap strength. SNX is emerging as a quiet outperformer as synthetic asset demand rebounds, Zora sustains traction through Base ecosystem growth, and Rail remains the privacy infrastructure play with steady accumulation. Macro remains the key variable. Should inflation readings soften and risk sentiment hold, altcoin breadth could expand again. If not, expect the current consolidation to persist with selective strength in high conviction names.

That wraps up Edition No. 6: The week ahead brings US CPI, Eurozone inflation revisions, and Fed commentary that will set the tone for risk sentiment into late October. Thank you for reading Strykr.ai Weekly.